Award-Winning. Data-Driven.

Crypto Investing Expertise.

Our Multi-Strategy Fund is designed to capitalize on the growth of the crypto asset industry over the next couple decades while simultaneously minimizing the volatility inherent in an emerging asset class. We are financial veterans with extensive experience in portfolio management, risk mitigation, and compliance.

Our team has invested through multiple crypto market cycles – giving us experience, insight, and perspective that few crypto fund managers can match.

CONTACT USHarnessing artificial intelligence, machine learning, and large scale computing expertise to process vast datasets and make informed trading and risk management decisions.

Systematic risk management to minimize downside volatility and maximize risk adjusted returns.

Our interdisciplinary team has a diverse skill set spanning traditional wall street finance, crypto and DeFi experience, complex derivative trading, PHDs, and venture capital.

About Us

Members of the Blockforce team first started investing in cryptoassets dating as far back as 2014.

After developing robust investment strategies through data science, backtesting, and live trading Blockforce began taking in outside capital starting in March of 2019. Since then, the Fund has won numerous awards for exceptional performance in the digital asset market, most recently “Best Sustained Performance over 36 months” by Hedgeweek.

OUR INVESTMENT PHILOSOPHY

#1 Multi-Strategy Hedge Fund Under $250m AUM

Ranked by 2021 Net Returns

2021 Best Digital Asset Fund

AUM less than $25m

Top 10 Crypto Hedge Fund in 2021

Ranked by Net Return

Top 10 Crypto Hedge Fund in 2020

Ranked by Net Return

Our Philosophy

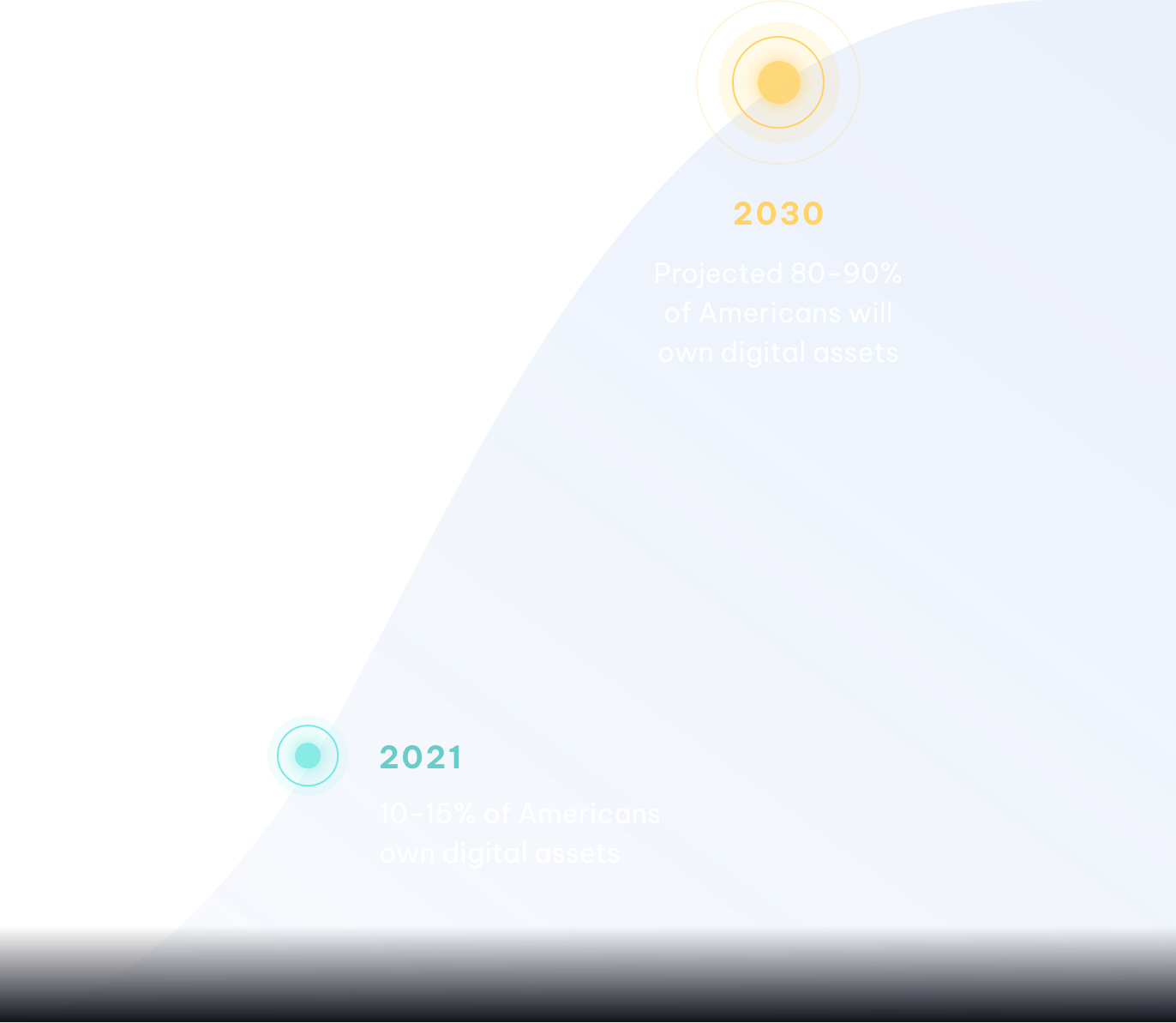

We fundamentally believe we are in the early innings of a technological and financial transformation – resulting in the crypto industry outperforming every other asset class over the next couple decades.

Blockforce’s investment strategy is to best position ourselves to capture the gains we believe the crypto asset class is likely to generate while minimizing downside volatility and compounding that growth over the long term.

Our Fund

Multi-Strategy Fund

Team

Eric Ervin / Founder & Chief Investment Officer

The investment team is overseen by Eric Ervin, Chief Executive Officer, and he is responsible for the fund’s investment strategy oversight and supervision of the funds operational and trading personnel. Eric has significant experience building strategies and managing capital with nearly 20 years at Morgan Stanley and Citi Smith Barney, then an additional 8 years of experience as the founder and CEO of Reality Shares, where he was the portfolio manager and index creator of numerous top performing publicly traded Exchange Traded Funds.

Brett Munster

Portfolio Manager

Kasey Price, MBA, SHRM-CP

Chief Compliance Officer

Insights

The Node Ahead 109: ETFs hold strong

READThe Node Ahead 108: When gold leads and bitcoin lags

READMonthly Manager Commentary: January 2026

READNode Ahead 107: Demographics trends are bullish for bitcoin

READBlockforce Capital’s Investment Strategy

Sign up to Receive Our Biweekly Newsletter

Request More Info

"*" indicates required fields