By Brett Munster

The Treasury confirms what we have known all along

There is a common myth that cryptoassets are used by criminals to fund illicit activity. Upon examining the data, however, it becomes clear that on both an absolute and percent basis, far more illegal activity is financed with cash and fiat systems than cryptoassets. That makes sense when you think about it because every transaction is immutably recorded on the blockchain and publicly available for anyone to view. The last thing you want as a criminal is to have your illegal transactions out in the open for everyone to see until the end of time. Ask any law enforcement agent and they will tell you they would much rather criminals use cryptoassets than cash because they can track the flow of the assets much easier. Last year we published a research piece highlighting the data and showing examples that dispel the myth that crypto is the preferred financing tool of criminals.

Which brings us to the US Treasury Department because on April 6th, they dropped a 42-page report on Decentralized Finance, aka DeFi, and the risks of financing illegal activity with it. Can you guess the conclusion they (reluctantly) came to? According to the US Treasury Department, although there has been some illegal activity that has occurred in DeFi, it still pales in comparison to the amount happening in fiat currency and traditional assets.

From the US Treasury’s own conclusion:

“This risk assessment finds that criminals use DeFi services to profit from illicit activity, in particular ransomware, theft, scams, drug trafficking, and proliferation finance. This report recognizes, however, that illicit activity is a subset of overall activity within the DeFi space and, at present, the DeFi space remains a minor portion of the overall virtual asset ecosystem. Moreover, money laundering, proliferation financing, and terrorist financing most commonly occur using fiat currency or other traditional assets as opposed to virtual assets.”

The report fairly points out that criminals, ransomware attackers, and scammers have used DeFi to launder stolen funds (hi North Korea 👋) and that DeFi services don’t follow anti-money laundering (AML) or countering financing of terrorism (CFT) laws because the protocols aren’t governed by any central authority. Despite these concerns, the US Treasury acknowledged that DeFi isn’t going away and seems cautiously optimistic that the industry can help address illicit finance issues through innovative solutions.

The report suggests that the US government should “seek to further promote the responsible innovation of compliance tools for the industry, an avenue many in the private sector are already pursuing.” In other words, the Treasury is advocating for Congress to pass new regulation aimed at DeFi. Sure enough, a few days after the report, the SEC reopened the comment period for the public to weigh in on proposed amendments to the definition of exchange which could have direct implications for Decentralized Exchanges. Although there aren’t any new policies going into effect right now, it’s a signal that DeFi could become a focus for regulators in the future.

The update formerly known as Shanghai goes live

In our Feb 14th edition, we covered in depth the “Shanghai” hard fork that was coming to Ethereum. Since then, two things have happened with the update. First, the name got changed. The developers decided to combine the execution layer update known as Shanghai with a consensus layer update known as Capella. It’s not worth getting into the details of execution vs consensus layer for the purpose of this post. All you really need to know is that the update still accomplishes the same thing, both layers were upgraded at the same time, and the name of the upgrade became known as “Shapella” (a smashing together of both names like tabloids do for celebrity couples such as Bennifer or Brangelina).

Second thing that happened is that the upgrade went live on April 12th and was successfully instituted without a hitch. As you recall from our previous newsletter covering the update, validators on the Ethereum network have to deposit ETH (aka “stake”) so there is an economic incentive to validate transactions properly. In exchange for locking up their ETH on the network, stakers are eligible to earn rewards in the form of more ETH. However, since 2020, validators were only able to deposit ETH but were never able to withdraw those assets. With the recent Shapella upgrade, validators on the Ethereum blockchain are now able to withdraw (aka un-stake) their ETH.

First off, it’s worth taking the time to congratulate the Ethereum developers and community for once again pulling off another technically complex upgrade to the Ethereum ecosystem. Much like the Merge, it’s hard to overstate how truly impressive of a feat this upgrade is given it went live on a chain that secures hundreds of billions of dollars without any security or operational issues. No hiccups, no downtime. The Shapella update demonstrates that Ethereum developers are continuing to build out the network infrastructure and thus continue to lay the groundwork that will enable more innovation to be built on top of the Ethereum blockchain.

So, what has been the impact of Shapella on Ethereum and ETH? Well, I’m glad you asked.

Prior to the upgrade, there was more than 18 million ETH staked on Ethereum (roughly 15% of the total supply) that was worth more than $36 billion at today’s prices. Some of those deposits have been staked since November 2020, when ETH traded for around $500. The consensus heading into the Shapella upgrade was that once people had the ability to withdraw and cash out, that would lead to massive sell pressure and a drop in price in ETH.

However, we argued the opposite would happen. If you remember our predictions from the start of the year and our newsletter in February, we made the case for why the Shapella upgrade (called Shanghai back then) lowered the risk of staking which we believed would increase the amount ETH staked which in turn would result in a decrease the amount of ETH available to trade. This, we theorized, would put upward pressure on ETH’s price over the long run. Contrary to popular opinion, we predicted the Shapella upgrade would lead to an increase in price of ETH, not a sell off.

Following the upgrade, ETH climbed above $2,000 for the first time in eight months. But it wasn’t just ETH, the entire ecosystem seemed to rally. Liquid staking services Lido (LDO) and Rocket Pool (RPL) surged as much as 17% and 37% in the days following the upgrade. Ethereum Layer 2 tokens have also spiked immediately following the upgrade, with Arbitrum (ARB), and Optimism (OP) rallying as high as 52% and 26%. Though it’s too early to claim anything definitive, early indications seem to be very positive.

Price is one indicator but what is happening on-chain is far more interesting and indicative of Ethereum’s longer-term outlook. Of the 18 million staked prior to the update, just over 1.3 million ETH has been withdrawn since Shapella went live. With only 7.5% of pre-Shapella staked ETH being withdrawn, it seems most stakers have decided to hold onto their coins. But if you dig into the numbers a little deeper, it gets even more encouraging for three reasons.

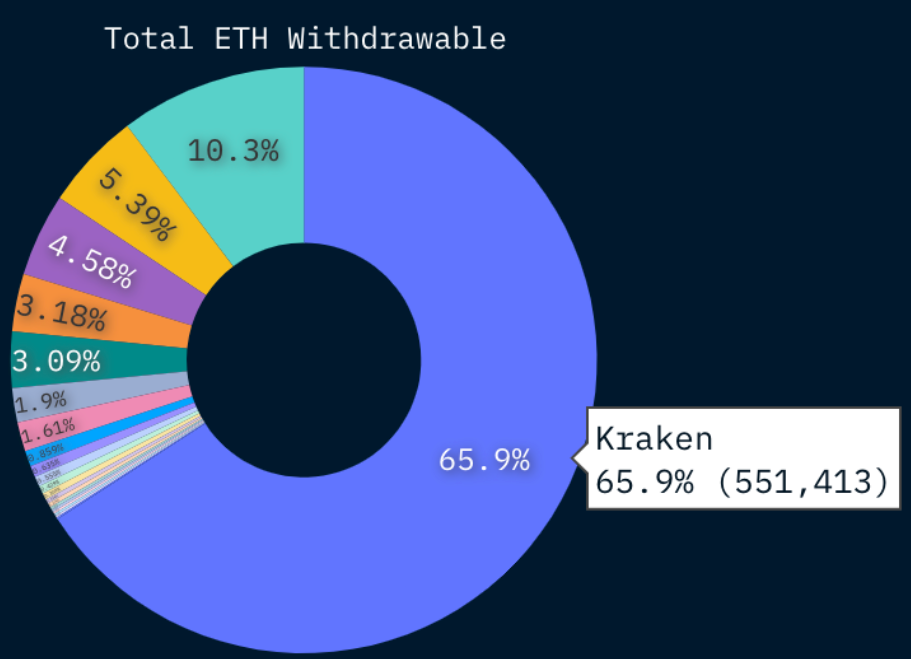

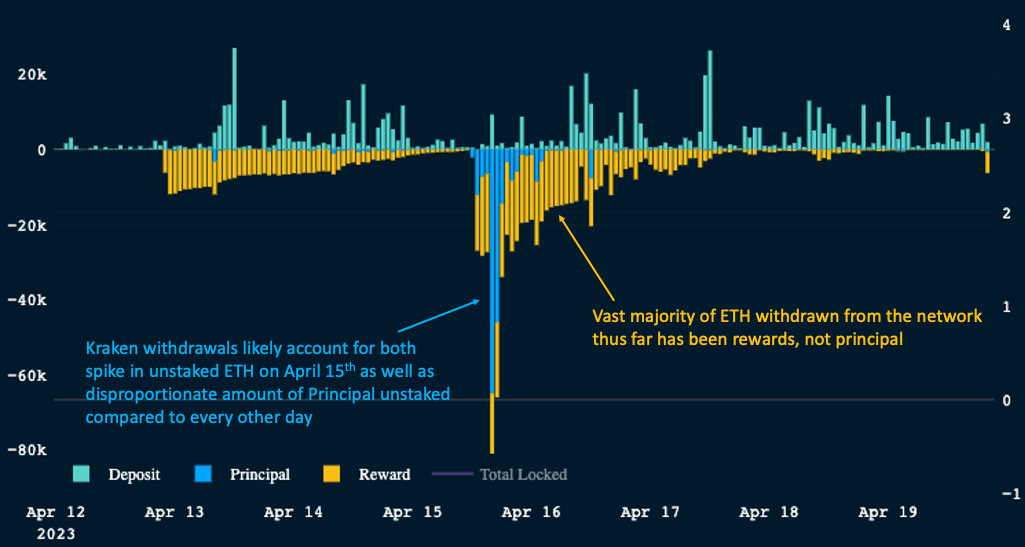

First, as Ben Giove and Jack Inabinet pointed out in a recent Bankless article, 65% of all ETH that was un-staked in the first few days after Shapella went live came from Kraken. As we covered in our March 1st issue, Kraken was forced to shut down their staking service as part of a settlement with the SEC. Thus, it makes sense that all the ETH staked through Kraken would be withdrawn the moment it was feasible to do so. But this forced de-staking by Kraken is a one-time event and is not indicative of a long-term trend. This means that a significantly smaller portion of the ETH withdrawn in the days after Shapella went live, which was already pretty low to begin with, was done so voluntarily. Furthermore, it’s likely some portion (maybe even a majority) of the ETH un-staked by Kraken, which was returned to users, might be re-staked by Kraken customers using other services.

Source: Nansen, April 14, 2023

Second, the vast majority of withdrawals other than Kraken, were only partial withdrawals. There are two types of withdrawals, full and partial. A full withdrawal means a user takes out all their ETH and is no longer a validator on the network. A partial withdrawal means a user takes out only a portion of the rewards earned, leaves at least the minimum 32 ETH staked on the network, and continues on as a validator. This is a long-term bullish signal for Ethereum as even among those who did withdrawal, the vast majority only withdrew a partial amount but still remain as validators on the network. Thus, the base number of validators are clearly committed to remaining validators which lends further evidence to our belief that stakers are long-term believers of the Ethereum network.

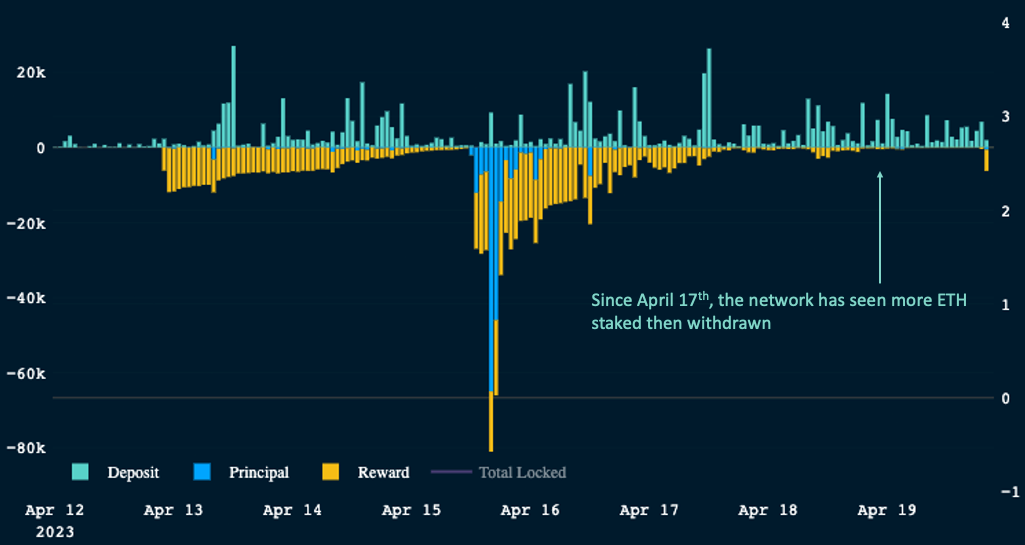

Source: Nansen

Third, deposits are growing. In the first few days following the Shapella upgrade, more ETH was un-staked than staked. This was expected as it was the first time in nearly three years that some stakers finally had access to liquidity. Also, as we covered previously, it was the first time Kraken had an opportunity to un-stake and return that ETH back to its customers. So, we knew there would be an initial drop in the total amount staked on the network. The question always was, how much and how long would that trend of un-staking surpass new staked ETH? The answer as it turns out, was less than initially thought and for much shorter than what most of the market anticipated. In fact, less than a week after Shapella went live, deposits started outpacing withdrawals. Furthermore, we are seeing the amount of ETH staked grow faster than anytime in ETH’s history and in total, more ETH has been staked than withdrawn over the last seven days. These are very bullish signals for the long-term health of the Ethereum network.

Source: Nansen

Just as we theorized at the start of the year, now that it’s possible to reclaim staked ETH, it makes the risk of staking much lower. Hence, users and investors are now more comfortable (and likely will continue becoming ever more comfortable) with staking. This will likely increase the amount of ETH staked on the Ethereum network over time. Today, less than 15% of the total supply of ETH is staked which is far lower than other Proof-of-Stake networks which typically range around 50-80%. Should the amount of ETH staked increase significantly, that would lower the circulating supply available to be traded. We have an idea what we believe this means for the long-term price of ETH, but we will let you make that determination for yourself.

Why the US should embrace Stablecoins

Stablecoins are blockchain based digital assets that are designed to maintain a constant price. Stablecoins have several of the same advantages of other cryptoassets such as being open, global, and accessible to anyone on the internet without the need for a bank account. For most people, fast processing and low transaction fees make stablecoins a good choice for sending money across borders without having to pay exchange fees. For ecommerce, stablecoins offer the ability for merchants to accept payments without paying the 3% fee that credit card companies charge on every transaction. And for people living in countries experiencing hyperinflation, stablecoins can preserve their wealth and provide better property rights protection through self-custody. As a result, stablecoins have become an integral component of the digital asset space in recent years, acting as a primary rail through which fiat enters and exits the market.

The two biggest stablecoins in the market today are USDC which is issued by American based Circle (hence the “C” at the end) and Tether (USDT) which is managed by Hong Kong based iFinex. Why someone would use USDC vs USDT is a matter of availability, liquidity, and perceived trust. Without getting into details, let’s just say Tether has a checkered history and is not necessarily known for its transparency regarding the collateralization of USDT. On average, USDT is more popular in Asia, while USDC is more popular in North America.

The most common way for stablecoins to remain stable in price is to be backed by collateral and the most common collateral used is the dollar. Both USDT and USDC are backed by dollars (hence the “USD” in both names). When someone converts fiat to stablecoins, dollars are deposited into a bank, after which the stablecoin is issued with a 1:1 ratio against those dollars. When a person wants to convert their stablecoin back to dollars, that stablecoin is destroyed and USD is issued back to that user.

From a global strategic point of view, it would benefit the US to embrace dollar backed stablecoins. As we just mentioned, all the largest stablecoins are denominated in USD meaning stablecoin issuers hold their reserves in dollars and short-term U.S. Treasuries (more on this in a minute). Most of the collateral in smart contracts and DeFi is now dollar based stablecoins and as a result, there is more value settled in stablecoins than bitcoin or ether. Crypto essentially gives anyone in the world access to dollar based financial services through the use of stablecoins even if they can’t access dollars through their local financial system. Places with the highest inflation are precisely the regions that benefit the most from a stable currency which is why we see adoption of crypto and stablecoins the highest in emerging markets. The bottom line is crypto is a vector for proliferating the use of the dollar globally. This both increases demand for USD and makes dollars more accessible to buyers across the globe. The adoption of dollar based stablecoins around the world gives the U.S. an opportunity to further entrench the dollar as the world reserve currency at precisely the time when other countries are actively exploring other currencies to transact in.

But it’s not just demand for dollars, stablecoins also increase the demand for US treasuries. The way stablecoin issuers make money is that they take in dollars, issue stablecoins, and then take a portion of those dollars and buy short term US treasuries. Those treasuries pay out an interest rate which the stablecoin issuer profits from. This is important because over the last 20 years, the amount of US treasuries that foreign nations hold has grown to nearly a quarter of all US debt. Stablecoins, which purchase US treasuries as a portion of the collateral they hold, could help diversify that ownership of US debt (ideally to more US based companies such as Circle or US banks). Furthermore, embracing stablecoins would also allow the US to set requirements around USD reserves and transparency thus mitigating consumer protection risks and national security risks at the same time.

Stablecoins could also solve some current problems for central banks. For one, the rise in interest rates by the Fed, which is causing problems for many banks’ balance sheets, should be good for stablecoins. When stablecoin issuers take in dollars and buy short term US treasuries, they keep all of the interest income themselves and pass none of it on to token holders. Hence, rising interest rates is pure profit for stablecoin issuers who do not have the same infrastructure costs that banks do. More importantly, due to deficit spending, the Treasury’s financing needs remain quite large. The Treasury finances its deficit spending by issuing debt but several of the largest buyers of US debt have been pulling back from investing in treasuries in recent years. The Federal Reserve, which is the largest owner of treasury bonds, has been reducing their portfolio through Quantitative Tightening. In short, Treasury bond liquidity is deteriorating. Stablecoin issuers could possibly provide the Treasury a brand new, persistent buyer of US Treasuries precisely when it is needed most.

The potential for stablecoins to really benefit the US economy and national security will only be realized if U.S. policymakers pass reasonable regulations that provide clarity to the market. The thing is, that bill already exists. Over a year ago, a bi-partisan stablecoin bill called “The Stablecoin Transparency Act” was introduced. The bill requires stablecoins to be fully backed by a combination of U.S. dollars and “government securities with maturities less than 12 months” (ie: short term US treasuries) as well as mandate that issuers of stablecoins regularly publish audited reports demonstrating their reserves. This bill seemed like a no-brainer and had support from both sides of the aisle as well as from the majority of the crypto community.

So why hasn’t this bill passed into law already? I’ll give you a hint, it rhymes with Harry Hensler.

Yup, the same agency that is supposed to be in charge of protecting consumers has actively lobbied against a bill that would promote the use of the dollar worldwide and increase the stabilization and transparency of stablecoins. According to reports, multiple people close to the negotiations say the SEC had constant objections and last-minute revision requests. “The stablecoins legislation was coming together over the summer, and the SEC was known to oppose it” said a former government official familiar with the matter.

Why would the SEC oppose the bill? Because it would undermine their power. As we have covered in past issues, the lack of federal regulations over the crypto industry has allowed the SEC to step in to fill that void. Gary Gensler doesn’t want those gaps filled because it would lessen his oversight capability. He has even reiterated to reporters that he doesn’t see the need for new laws to regulate the space. “I think the true aim was to stop any stablecoin legislation,” said a former official. “It tracked with their activities now, which is essentially claiming through enforcement action that these stablecoins are securities.” The blocking of sensible regulation is causing money to flow out of the US and into offshore based stablecoins as well as non-dollar backed stablecoins.

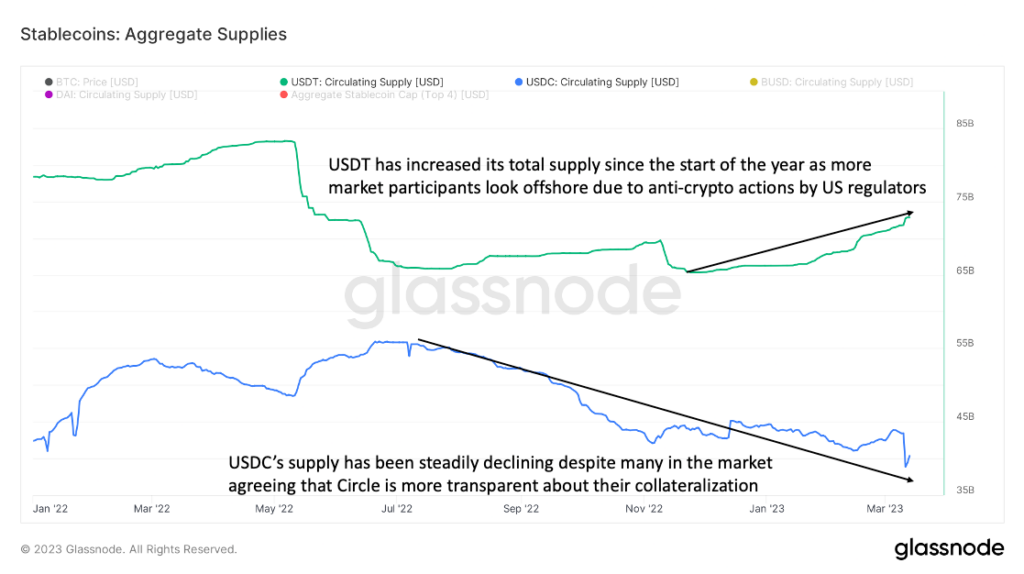

Despite Tether’s long history of clashes with regulators and concerns with its collateralization, several market participants have rotated out of US based USDC and into USDT in recent months. USDT supply has expanded back to $72.8 billion, now accounting for 57% of all stablecoins in the market. Meanwhile, the second largest stablecoin USDC has seen roughly $15 billion decrease (-27%) in total circulating supply since its peak in July of last year.

Source: Glassnode

Based on the data, it appears many market participants are more concerned about the US’s regulatory approach to crypto than Tether’s checkered history. That’s a shame because that means our regulatory agencies are driving business away from US based companies and into foreign competitors. It’s also not good for consumer protection as most people in the industry would agree that Circle is far more transparent about what assets back USDC than USDT. But the real kicker is that it’s also potentially bad for the dollar. Last year, Tether announced that for the first time, the company is buying government debt from countries outside the U.S. The vast majority of Tether is still backed by the dollar but the trend of diversifying away from the dollar is growing. Other foreign issuers have already launched stablecoins in other currencies, including the Euro and the Canadian dollar. Does the US really want the number one stablecoin in the world to be based outside the US and become less reliant on the dollar because that is exactly what US regulators are currently promoting.

In an interview with Fortune, David Mercer, the CEO of Mercer Group, noted that although banks have invested billions in blockchain tools and are keen to trade bitcoin and other major cryptoassets, the SEC is standing in the way. “It’s not banks saying no to crypto, it is U.S. regulators,” says Mercer. It’s time our regulators stop viewing stablecoins as a potential problem and realize them for what they are, an opportunity to bolster the US economy and national security. Between the SEC’s enforcement action on Paxos and Kraken, regulators public comments regarding Silvergate, and the FDIC forcefully shutting down Signature Bank, the US continues to incentivize people and businesses to move their money to offshore entities that are much more opaque, far less regulated and often times have less than a stellar track record. Just last week, Coinbase CEO Brian Armstrong came out and said he would consider moving the company out of the US if the regulatory environment for the industry does not become clearer.

The US House Committee recently published a draft of a new stablecoin bill in an effort to try to get a bill passed once again which reportedly still has bi-partisan support. It lays out a framework in which insured depository institutions (aka banks) seeking to issue stablecoins are supervised by an appropriate federal banking agency and non-bank issuers such as Circle and Tether are overseen by the Federal Reserve. Hopefully we will get some common sense, reasonable legislation passed in the near future as it would benefit consumers, the crypto industry, and the US as a whole.

DEXs

Usage of Decentralized Exchanges is growing amid regulatory pressure in the US. As a quick refresher, a decentralized exchange (DEX) is a peer-to-peer online service that allows direct cryptoasset transactions between two parties. It’s an exchange just like NYSE or Coinbase except there is no company or middlemen involved. DEXs create peer to peer markets directly on the blockchain, which allows traders to independently store and operate funds. Users of such exchanges can execute transactions with cryptoassets directly between each other without third party involvement. No intermediaries mean fewer costs which means they are often cheaper for users.

Unlike centralized exchanges, DeFi platforms are non-custodial meaning users retain full ownership and control of their assets when accessing these services. DEXs do not take customer deposits but instead provide a platform for users to execute trades in various liquidity pools. The assets in these liquidity pools are provided by other users and are governed by immutable smart contract logic that makes it impossible for DEXs to misappropriate funds. Unlike what we saw with FTX (a centralized entity), DEXs cannot lend your funds, nor can it leverage them for its own personal trading because it never has control or ownership of your funds in the first place.

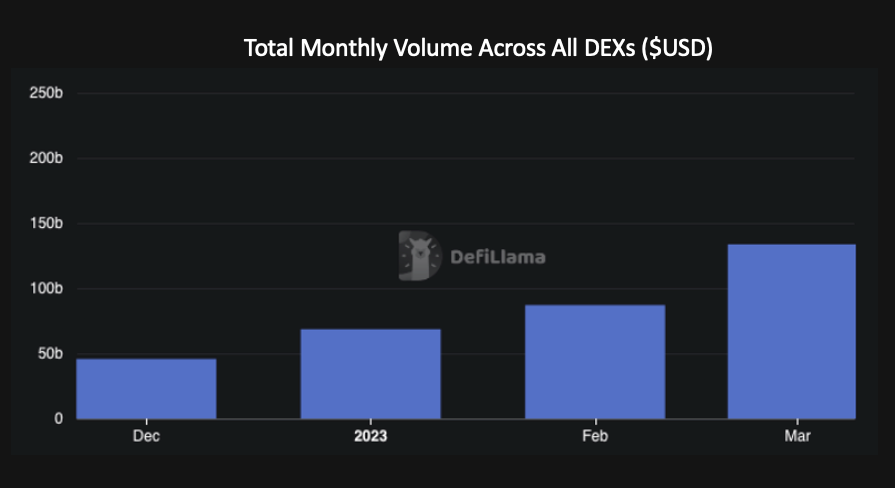

Trading volume across all DEXs has nearly tripled since December, reaching a total of $133B in March. The biggest winner has been the leading decentralized exchange, Uniswap which processed nearly $80 billion worth of volume on its exchange in March, the largest month in over a year. To put that in perspective, in the last two months Uniswap has seen more volume than Coinbase making Uniswap the second largest crypto exchange in the world over that period of time.

Source: https://defillama.com

The growth of the DEX market comes at a very interesting time. Since the start of the year, the SEC shut down Kraken’s staking service and fined it $30m, charged Gemini with selling unregistered securities with its Earn product, issued a Wells Notice to Coinbase accusing the company of violating securities law, and the CFTC filed a lawsuit against Binance for allegedly offering unregistered futures and options trading. As regulators in the US have cracked down on centralized exchanges, users and investors have started migrating more and more to decentralized exchanges and other DeFi products.

It turns out that US regulators might be the largest marketing organizations for DeFi even though I doubt they intended to be. What US regulators have still yet to realize is just how global and permissionless this industry truly is. The more US regulators try to assert heavy handed controls over the crypto market, the more they will drive capital and talent offshore or to decentralized solutions over which they have far less authority and influence. We have made the argument time and again, the crypto industry will continue to thrive globally regardless of what regulators do in the US. It’s just a matter of where the growth will happen, not if. And if our regulators continue down this path and our congress doesn’t pass laws to rein them in, all they are doing is hurting the US.

In Other News

Done under the guise of consumer protection, the attack on crypto is hindering innovation and denying Americans a path to new economic opportunities.

The original Bitcoin white paper is hidden within Apple’s Mac devices that run on a modern macOS version, according to a blog post from technologist Andy Baio.

Several crypto bills that never made it out of committee last session are making their second run at becoming law this year.

Fortune’s inaugural list of top 40 crypto firms.

Everyday people are getting their banks accounts closed with no warning or recourse because it’s a safer for a bank to kick someone out rather than deal with compliance.

Keeping Bitcoin mining in the U.S. helps the economy, national security and the environment.

Brazil’s Bitcoin Beach says Lightning Network works better than Visa.

The New York Times’ politically driven attack on Bitcoin mining is full of distortions an outright falsehoods.

Forbes article on why tokenization is the future of finance.

Bank of America believes the tokenization of real-world assets will be a key driver of digital asset adoption.

Andreessen Horowitz warns that the US is losing its edge in crypto due to regulatory environment.

FTX’s attorney Andy Dietderich revealed that the company recovered over $7.3B of liquid crypto assets and cash.

New research paper finds that bitcoin mining is sustainable and helps decarbonize energy grids.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS