Multi-Strategy Fund Performance

The Fund finished 2023 on a high note as December was our best month of the year. Led by alt coins such as Solana, Optimism, and Chainlink, the Fund more than doubled bitcoin’s performance for the month while still maintaining a very similar level of volatility. While the alt coins led the growth, the stability in the Fund came from the algorithmic trading portion of our portfolio. A few months ago we introduced our new Quant Alpha machine learning strategy to the portfolio and in each of its first four months, the system has produced positive returns with near zero correlation with the overall crypto market. In December, the Quant Alpha System was up 7.2% and had a 86% win rate on its trades. It’s exciting to see the Quant Alpha System improving each month as we continue to add robustness and additional features. That algorithmic trading combined with our basket of category leading assets sets the Fund up well heading into 2024.

| Multi-Strategy Fund | Bitcoin | |

| December Gross Performance | 27.1% | 12.1% |

| December Daily Volatility | 2.5% | 2.3% |

Market Commentary

Bitcoin and the crypto markets have historically moved in four year cycles with largely similar trends playing out each time. However, each cycle does have its own nuances and thus far, this current cycle is no different.

Historically, bitcoin has been the first cryptoasset to recover following a crash. This was true in 2015 following the crash in 2014 as well as in 2019 following the crash in 2018. Intuitively, this makes sense as bitcoin has been around the longest, is the largest cryptoasset, and viewed by the market as the “safest” cryptoasset. As investors begin to re-enter the market, still a little weary from the recent crash, bitcoin overwhelmingly tends to be the cryptoasset the market begins to allocate to first.

2023 has largely followed this same pattern. Like all past cycles, for most of the year Bitcoin has led the recovery following the crash in 2022. Bitcoin is not only up roughly 150% on the year, but its share of the entire crypto market cap increased from 39% at the start of the year to 54% at its peak. This meant that bitcoin was worth more than every other cryptoasset combined at one point showing just how much bitcoin led the market recovery for most of the year.

Following bitcoin’s recovery, the historical tendency is for investors, flush with recent profits, to start to look to other opportunities within the crypto ecosystem for the next big winner. Capital eventually starts to rotate out of bitcoin and into Ethereum towards the middle of the cycle and then to more long tail assets at the end of the cycle.

However, this cycle has seen alt coins rally much earlier than in previous cycles. In Q4, alt coins saw a massive resurgence. While bitcoin was up 58% during the last 3 months of the year, Smart Contract Platforms were up 96% as a category, led by Solana (390%), Avalanche (330%) and Polkadot (105%). DeFi protocols increased 132% in the quarter led by decentralized exchanges such as Raydium (680%) and Orca (600%) on Solana and Uniswap (80%) on Ethereum. Layer 2 networks continue to grow with Optimism (175%) on Ethereum and Stacks (200%) on bitcoin leading the way. On Chain Infrastructure networks such as Chainlink (106%) and The Graph (120%) saw big gains as did decentralized physical infrastructure (DePIN) with Helium (360%) and Render (200%).

Two things about this unusual Q4. This huge movement in alt coins has come much earlier in the cycle than past cycles. It’s likely the gains from bitcoin have led to many crypto native people to try and get out in front of the alt coin wave and began rotating capital into more long tail assets sooner than in previous cycles.

Also, we mostly skipped Ethereum’s big move. Historically, ETH tends to see a big move up after BTC so it’s no surprise that ETH lagged behind for this year. In fact, that was to be expected. What was surprising was that the capital rotation skipped right over ETH and went straight to alt coins in Q4.

However, do not sleep on ETH just yet. Ethereum is still by far the largest smart contract platform with the largest developer base in all of crypto. That network effect doesn’t go away overnight. Second, Ethereum will be rolling out their next big upgrade called “Dencun” in 2024 which should drastically increase throughput and scalability within the ecosystem. Third, as activity starts to pick up, ETH’s burning mechanism will likely make ETH’s total supply net deflationary throughout the year. Lastly, there is potential that an ETH ETF gets passed which would remove any and all regulatory risks from the asset and open ETH up to a whole new set of institutional investors.

It’s very possible that alt coins as a whole cool off (maybe even pull back) to start next year as focus returns to bitcoin with the ETF approval likely in January. Institutions are likely to start funneling capital in BTC first half of 2024 which could see BTC regain the narrative. We also expect the narrative and focus on Ethereum to pick up in 2024 and expect ETH to have a stronger year than it did this past year. However, it is possible alt coins could continue to rise throughout 2024 which would be a significant deviation from previous cycles.

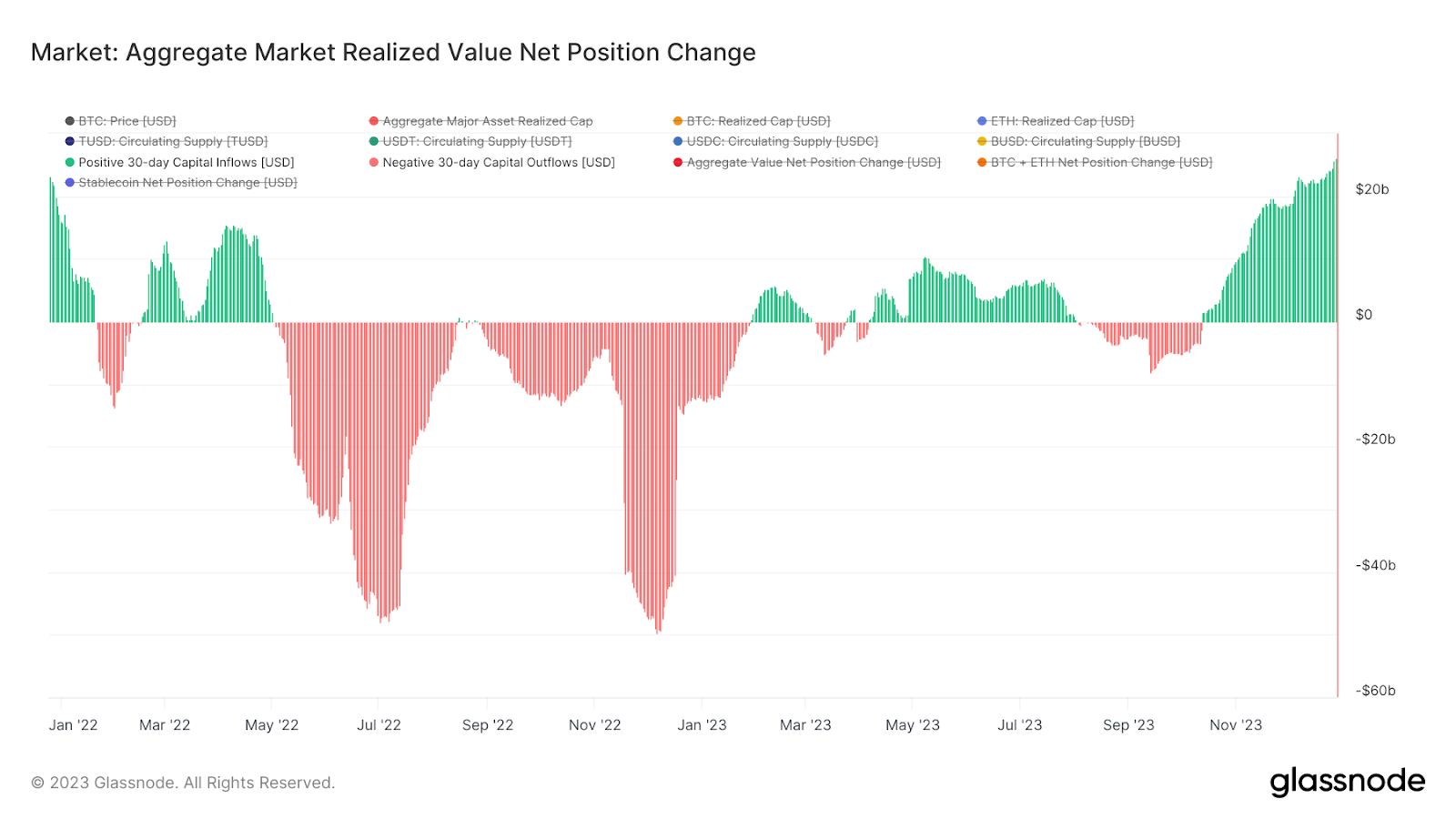

The one thing we know for sure is that money is beginning to flow into the ecosystem in a big way. December saw the largest 30-day capital inflow into the crypto ecosystem since January 2022. Demand is growing again. Trading volume on-chain is on the rise as are Google searches. All of this indicates that the crypto market is very likely to increase significantly in the first half of 2024, it’s just a matter of which parts of the market experience the biggest gain.

Regardless of which scenario plays out, Blockforce has positioned its portfolio to take advantage of all of them. We have positions in many of the emerging subsectors and will benefit regardless if BTC, ETH or alt coins have big years in 2024.

The Blockforce Team

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS