Prologue

Out of breath. Panting. Trying to stay quiet at all costs. Rain slowly drips from the gutter as lightning cracks across the northern sky. In a few seconds the thunder will come, but in that moment a stealth shape takes form — something lurking around the corner and above the roof. Crouched and hiding between the concrete wall and rusting fence, there’s no escape. Before the rolling thunder even arrives, everything suddenly snaps to black. The hunt is over. The Alpha Predator strikes again.

Don’t be alarmed, it was only a backtest. As the simulation fades and the console terminal comes clearer into focus, we see the Alpha Predator’s true form take shape. Lines of Python code provide a silhouette to the phantasmagorical beast lurking within. Hello World — meet Alpha Predator.

Introduction

We didn’t mean to, but here at Blockforce Capital (formerly Reality Shares, Inc.) we created a monster. However, unlike most predators our Alpha Predator is in fact a benevolent beast, seeking to extract order from the current chaos surrounding digital asset investing; Alpha Predator doesn’t “prey” on people, it prey’s on market inefficiencies. Philosophically, we want this newly emergent asset class to thrive and believe it has the potential to be a vehicle of change, improving quality of life around the world. Human life is built up from interactions, and blockchain technology has the ability to radically improve those interactions. To accelerate the adoption of blockchain technology and associated cryptocurrencies, we believe institutions need adequate onramps to enable the investments necessary for innovation. However, being a nascent asset class still in its developing stages, the current market is fraught with operational risks, informational asymmetries, and other challenges inhibiting mainstream investment. In order to foster the emergence of mainstream investing in blockchain related products, we first need to de-risk as much of this asset class as possible.

To help make our philosophy a reality, we’ve been hard at work crafting a two-fold solution that comes from both the institutional side and the consumer side to find a natural state of equilibrium. From the institutional end, our soon-to-be-launching hedge fund, the Blockforce Multi-Strategy Fund*, will be utilizing the Alpha Predator model — hunting market inefficiencies, leading to better price discovery for all market participants. Additionally, our cryptocurrency portfolio investment platform and mobile app, Onramp, will provide institutional and individual investors an end-to-end solution for investing in portfolios of cryptocurrencies and digital assets within a simple integrated platform**. Unlike traditional markets, where alpha is a zero-sum game, we believe this asset class has the potential to deliver returns far in excess of traditional stock and bond markets, even with just a buy and hold strategy. Just as predators are necessary for keeping equilibrium in nature; the interaction of competitive quantitative models from competing firms will bring about a natural selection of transparency, efficiency, and liquidity necessary for investors of all types to flourish.

A Predator Emerges

The impetus behind the creation of Alpha Predator was our attempt to answer the question: how do we adjust our quantitative models based on the ever-changing tides of market participants, trends, volatility, and risk? Crafting a corresponding model applicable to traditional asset classes like equities or fixed income is hard enough, but trying to apply this methodology to a nascent asset class that is only now starting to garner institutional support is a continual challenge.

Throughout our experience in finance we have seen many models, both quantitative and qualitative, work until they don’t anymore. Many quantitative models that pre-dated the financial crisis subsequently ceased working because the majority of investor participation shifted from active management philosophies to passive investments via exchange traded funds (“ETFs”). That shift changed the underlying market structure, dynamics, and behavior; which in turn diminished the efficiency of traditional quantitative models. Even fundamental models had difficulty adjusting to new market dynamics due to the buy-everything-in-a-basket mentality that ETFs created, certain sectors trading together more than usual, and the increasing difficulty of generating alpha via stock selection.

For the past few years, we here at Blockforce Capital have thought deeply about how to address this lingering issue. Ideally, a quantitative model should be able to understand the underlying market structure and have the ability to adapt and change like a living, breathing organism. We don’t mean adapting to changes in trends or volume, but instead, adapting to how the actual market is interacting with its participants, and how participants are interacting with the market. Analogous to general relativity — just as matter tells spacetime how to warp, spacetime tells matter how to move. We believe financial markets are merely a microcosm of the underlying physics upon which the markets are built.

Over the past few months we have been hard at work tailoring these thoughts and trials into a new model. Our efforts have paid off in the emergence of our Alpha Predator model, focused on capitalizing on inefficiencies in current digital asset markets to generate alpha, but also shifting and adjusting as the markets continue to transform and develop. We recognize that market participants are changing every day, so we wanted to create a model that has the ability to understand the market (using what we call diagnostics), that seeks to correctly allocate and adjust risk exposure so the appropriate risk-reward ratio can be optimized. Our international and interdisciplinary team has roots in traditional finance and risk management, theoretical physics, statistics, and computational astrophysics. Using our various strengths and experiences to sharpen our edges, we have collectively put our best foot forward while creating this interactive and dynamical model. Over the coming months we will be peeling back the curtain a little bit to show how certain parts of our model work, but in the meantime we would like to give a general idea of how the Alpha Predator hunts.

A Deeper Dive

Since Alpha Predator needs to adapt to many different market conditions, it needs multiple sub-models to rely upon. Additionally, machine learning is used to optimize for unexpected conditions that might not have been initially present. Since we are managing digital assets, there is limited history for us to base our methodology on. We view this as an opportunity to stand out. With our firm’s history and reputation as an innovative ETF manager, known for the creation of unique quantitative ETF products, we are harnessing our traditional market experience and ideologies maximized for opportunity while minimizing risk, and applying them to the digital asset world. When combined with appropriate risk management and time series analysis, we can test and develop trends in long, historical periods, regardless of the data limitation for cryptocurrencies. This, coupled with modeling a large set of data, allows Alpha Predator to adjust to current market conditions on the fly based on a variety of factors, including but not limited to assumptions from other asset classes, behavioral finance, statistics, and data science***.

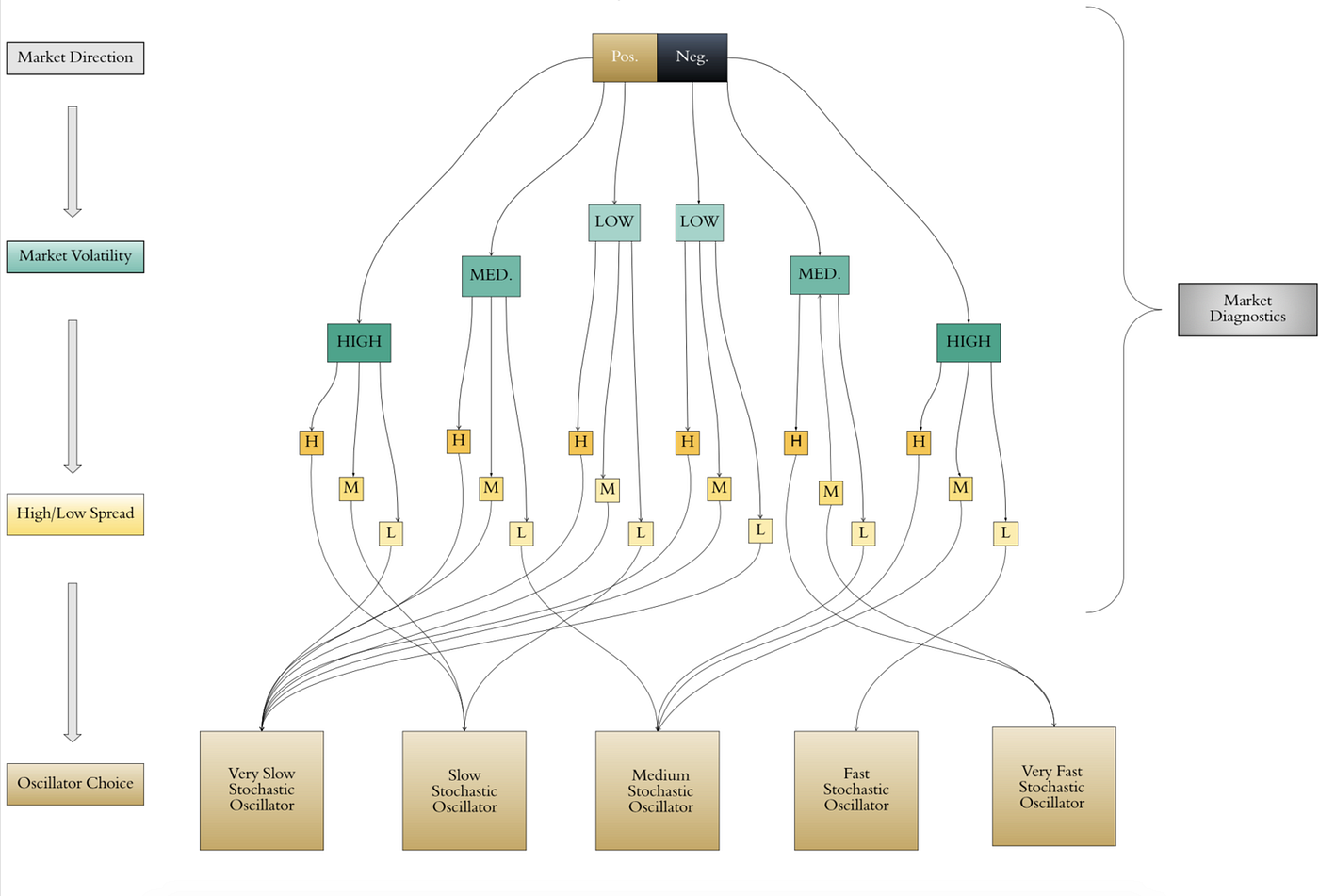

In its current form (version 1.0), Alpha Predator measures the underlying market conditions based on three main factors: (1) the overall market trend direction, (2) market volatility, and (3) market spread. It measures each of these on a minute-by-minute basis, 24 hours a day, 7 days a week, from multiple exchanges around the world. Alpha Predator then uses this data to continually optimize itself. The general premise of Alpha Predator is to measure these values and assign the current market fundamentals to a category using a decision tree (see Figure 1.). Each categorical assignment has a number of algorithms that have been designed to “prey” on the inefficiencies underlying the current market condition. For example, if the market is taking a random walk but has high volatility and spreads, the system has algorithmic baskets ready to deploy that could capitalize on this market condition. Just as any good natural predator knows, it needs to get in and out quickly, with as little disruption to the environment as possible. When a trend forms with directional volatility, we can let our algorithmic baskets breathe and give them a bit more room to ebb and flow with the general market trends. We currently have 18 market diagnostic baskets with optimized algorithmic overlays ready to deploy for each condition. To be clear, many of these baskets have not yet been utilized in our backtests, but they have been created in preparation for future market cycles and behavior that we have not seen thus far within digital asset markets.

Algorithmic Overlays

Due to the difficulty in diversifying our market risk within the still nascent digital asset space, we are attempting to diversify and minimize our exposure risk algorithmically. For each of our diagnostic baskets, we have a number of systematic algorithms that interact in a complementary manner. Ideally, we are looking for a signal generated from a subset of algorithms that have similar trade counts, drawdowns, and average performance. To diversify our exposure we look to the complementary algorithms with those characteristics, but that enter and exit the market at different times, rather than trading in tandem. This helps our model gradually add exposure over time as the market cycle changes, rather than jumping in fully invested. Within the Alpha Predator algorithmic framework, we may have up to 100 optimized algorithms ready to deploy based on the underlying non-linear market dynamics. This algorithmic diversification helps manage our downside risk, at the expense of giving up potential upside alpha. This is in alignment with our fundamental market philosophy — there is plenty of alpha waiting to be captured in cryptocurrencies and digital assets, but the risk profile remains too great for a long only, buy and hold strategy.

Optimizing for Sortino and Drawdown

Many other hedge funds investing within the digital asset space are focused solely on the upside return. Traditional hedge fund managers are rewarded to take those associated risks because they get paid for performance, but have little to no personal consequences for any downside volatility created by taking this additional upside risk. Conversely, at Blockforce Capital, we fundamentally believe that returns are only as great as the risk taken, and just posting a great topline performance number doesn’t show the true full picture. Sure, during parabolic bull markets (such as Bitcoin during 2017) those managers were rewarded with both assets and performance, but most, if not all, are now on track to complete the year down around 50% — 60%****. In the traditional asset world, a drawdown of more than 35% within a hedge fund means the “hedge” in hedge fund isn’t being utilized appropriately, and investors often see this one-third drawdown as a signal to exit for the hills. At Blockforce Capital, we believe that managing downside risk is just as important as the total return metrics, which is why we are seeking to optimize our algorithms for the Sortino ratio and drawdown alongside total returns.

Conclusion

As a phantasmagorical beast, the Alpha Predator is ever-changing and continually evolving as markets change and new data is analyzed. We will unleash the Alpha Predator as an allocation within our Multi-Strategy Fund, as a tool in our toolbox that helps us adjust for exposure. In time we would like to bring Alpha Predator to the people, by providing proprietary programming solutions the public can learn from to start building their own models. Just as it’s the nature of chaos to tend toward order (i.e., life will find a way), we hope our Alpha Predator model will help make that path a little bit clearer for everyday investors — either by programming their own type of “Alpha Predator,” or by using our investment solution, Onramp. In the meantime, your village has nothing to fear, that is unless your village is a cryptocurrency market trying to hide alpha from the Alpha Predator.

*This material does not constitute an offer to buy any security and may not be relied upon in connection with the purchase or sale of any security, nor shall any securities be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. Any such offer would only be made by means of formal offering documents, the terms of which would govern in all respects.

**Represents a future product. Onramp is planned to launch in Q4 2018 or Q1 2019.

***The Alpha Predator trading model (both algorithmic and arbitrage) is continually updated in an ongoing effort to optimize and improve its performance. However, there is no guarantee that updates will improve the model’s performance, updates may decrease the model’s return.

****Source: www.hedgefundresearch.com/family-indices/hfr-blockchain

Blockforce Capital does not recommend that the information presented herein serve as the basis of any investment decision. The information is given in summary form and does not purport to be complete. The sole purpose of this material is to inform, and in no way is intended to be an offer or solicitation to purchase or sell any security, other investment or services, or to attract any funds or deposits, nor shall any securities be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase, or sale would be unlawful under the laws of such jurisdiction. This information does not constitute general or personal investment advice or take into account the individual financial circumstances or investment objectives, or financial conditions of the individuals who read it. You are cautioned against using this information as the basis for making a decision to purchase any security.

This material is presented for information purposes only, and does not constitute investment advice or an offer to sell securities.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS