Blockforce Update

This month, Blockforce welcomed four new interns to the team for the summer. Cody, Ali, Svenn and Nijil all bring unique skill sets to the table which we have wasted no time putting to good use. All four are currently contributing to research across the organization, which is being applied to the development of our trading systems and risk management tools. The energy and fresh perspectives they have brought to the team in their short time at the Fund is already making an impact. The depth of knowledge younger generations have at such a young age and their exuberance for the crypto industry is a great reminder of just how strong demographic tailwinds are for the future of this industry.

Multi-Strategy Fund Performance

After a strong start to the year, May was the crypto market’s worst month thus far in 2023. Fortunately, our systematic strategies and new market neutral strategy (which posted its second consecutive month of 4%+ gains) performed as intended which limited both the volatility and downside for the Fund in May. However, the biggest bright spot in the portfolio was Lido (LDO) which saw a 14% increase during the month at a time when nearly every other cryptoasset was down. LDO is now up 125% on the year due to the increase in staking on Ethereum following the Shapella upgrade.

| Multi-Strategy Fund | Bitcoin | |

| May Gross Performance | -4.3% | -7.0% |

| May Daily Volatility | 1.2% | 1.8% |

Market Commentary

After an initial move up to start the year, bitcoin has traded within the $26k – $31k range since mid-March. Having recovered from the depths of the 2022 bear market, investors seemed to have found a new floor.

Source: Glassnode

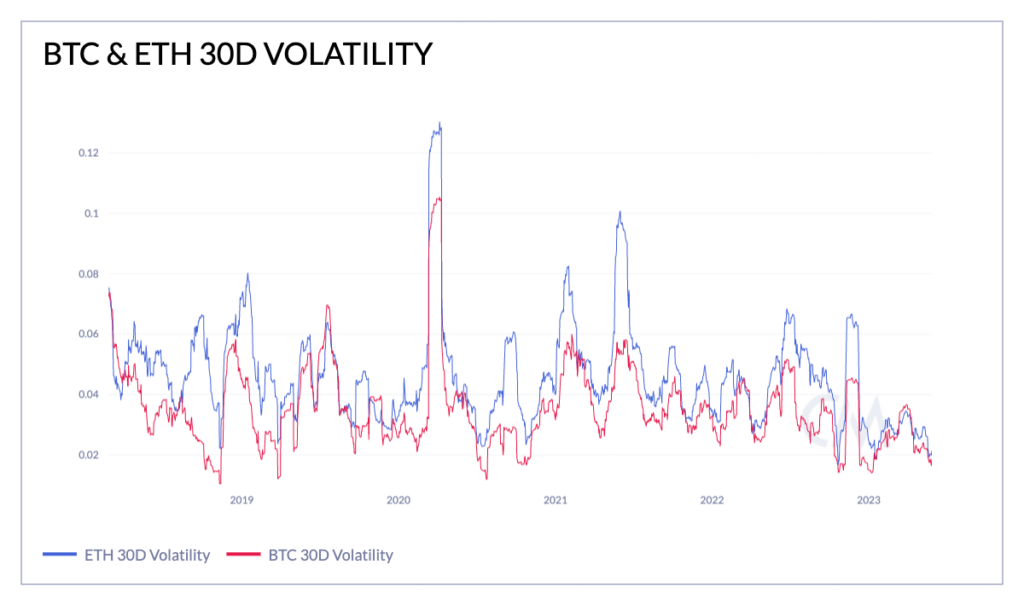

As momentum and trading activity on exchanges have slowed down, the Monthly Volatility has dropped significantly over the last couple months. The 30 day volatility for BTC and ETH is now at 0.016 and 0.019 respectively. According to a recent article by NYDIG, “Bitcoin’s volatility, as measured by the implied volatility of at-the-money options expiring in one month’s time, continues to fall, reaching levels rarely seen over the past few years.” Historically, such low-volatility regimes only account for 19.3% of market history, and therefore it is reasonable to expect volatility to pick up in the near future. Given the strong support at the bottom of range and what appears to be an exhausted marginal seller base, our best guess is bitcoin is likely to break to the upside though it’s difficult to know when that move is likely to happen.

Source: Coin Metrics

Furthermore, bitcoin’s correlation to traditional asset classes is falling back to historical levels as well. BTC’s 30-day price correlation with the NASDAQ fell to 0.26, its lowest level since December 2021. BTC’s correlation with the S&P 500 index also plummeted last month to levels not seen since late 2021. The elevated correlations we saw in 2022 are beginning to appear to be an exception while 2023 seems to be a return to historical norms. Bitcoin is providing non-correlated, outsized returns this year proving once again to be the ideal asset to add to any diversified portfolio.

The Blockforce Team

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS