Myth: Bitcoin is too volatile to invest in.

Truth: While bitcoin does have a relatively high level of volatility compared to other assets held by retail investors, that volatility works to the benefit of long-term oriented investors and those who use bitcoin to diversify their portfolios.

——————————

Bitcoin has historically had a higher measure of volatility compared to other assets and as a result, a common argument made by bitcoin critics has been that bitcoin is too volatile to invest in. This myth stems from the fact that volatility is often used as a way of quantifying risk in traditional finance. Those who make the claim that bitcoin is too volatile are usually making the argument that bitcoin is too risky to include in a portfolio. However, bitcoin isn’t nearly as risky as this simplified argument may lead you to believe.

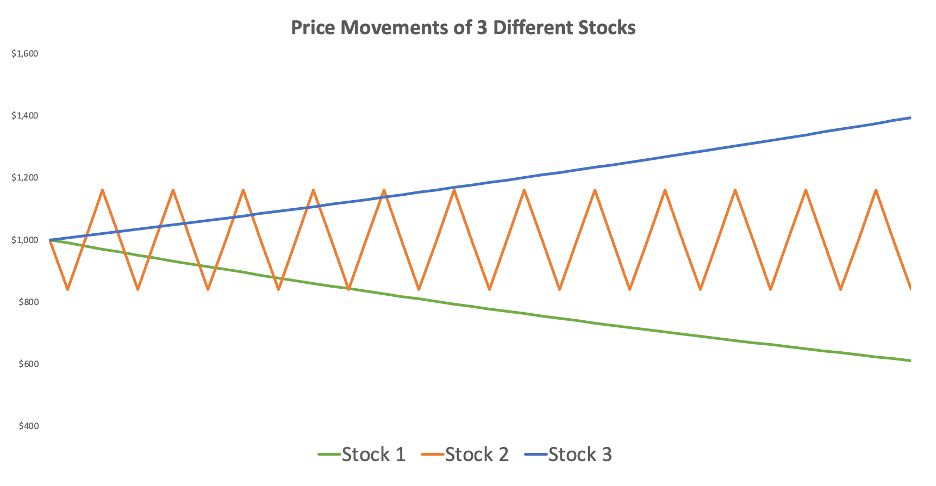

An asset’s volatility is measured by looking at how much its price moves over a given period. High volatility assets are characterized by large price movements. However, volatility does not capture the direction of those moves. For example, consider the price movement of the following three imaginary stocks:

Believe it or not, all three have the same volatility. However, all three produce very different returns. The moral of the story is volatility is not necessarily a bad thing. Stocks that have rapid price appreciation, by definition, are going to have higher volatility. Dismissing an investment based on volatility alone is a bad idea because if most of the volatility is to the upside, a volatile asset could prove to be a phenomenal investment opportunity. The quintessential example of this is Amazon.

Adjusting for the stock splits that have occurred throughout its history, Amazon went public on May 15, 1997, at $1.50. Twenty-five years later the stock is now worth roughly $3,230. However, Amazon has also been an extremely volatile stock. Below is a chart of Amazon’s drawdowns from all-time highs over its life as a public company. It includes a 94% drawdown in 2001, a 64% drawdown in 2008, crashes greater than 40% in 1998, 1999, 2000 and corrections greater than 20% in 1997, 2006, 2010, 2011, 2012, 2014, 2016, 2018, and 2022. There were also double-digit drawdowns in 2017, 2019, 2020, and 2021. In almost every year of Amazon’s existence as a public company, it has had at least one double digit decline in its price. Yet it would be foolish to make the argument that investing in Amazon and holding the stock for the past 25 years was a bad idea because of its volatility. Does it really make sense to forgo 2,152% returns over 25 years just because a stock was also volatile during that period?

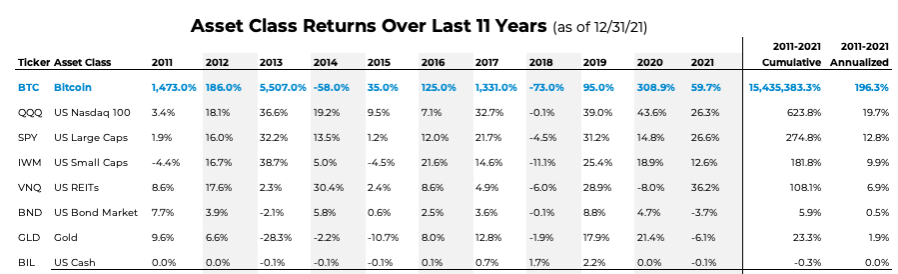

Which brings us to bitcoin. It has had numerous 50%+ corrections in its history. However, much like Amazon, bitcoin’s volatility has historically drastically skewed to the upside as evidenced by the 9,000% growth from 2012 to its peak in late 2013 and 2,800% growth from 2016 to the end of 2017. In fact, bitcoin has averaged nearly 200% annualized returns over the last eleven years. Even though bitcoin does experience significant price swings, most of the volatility has historically been to the benefit of those who have held onto their bitcoin.

When viewed over longer periods of time, bitcoin has historically appreciated in value more than almost any other asset. In addition to the annualized returns, it’s also true as of writing this that anyone who has invested in bitcoin and held for at least three years, has seen the value of that investment increase. It doesn’t matter what the purchase price was, so long as they held for at least three years, not a single person would have lost money on their bitcoin investment. Despite the short-term volatility, bitcoin has been a very reliable investment for those with longer time preferences.

So yes, bitcoin undoubtedly has a lot of volatility but so does the stock market. Both carry significant risks and yet, we’re comfortable putting stocks such as Amazon in portfolios even though there’s risk of significant principal loss at any given time. However, bitcoin has an advantage as an investable asset that no other stock does, it has a low correlation to the stock market.

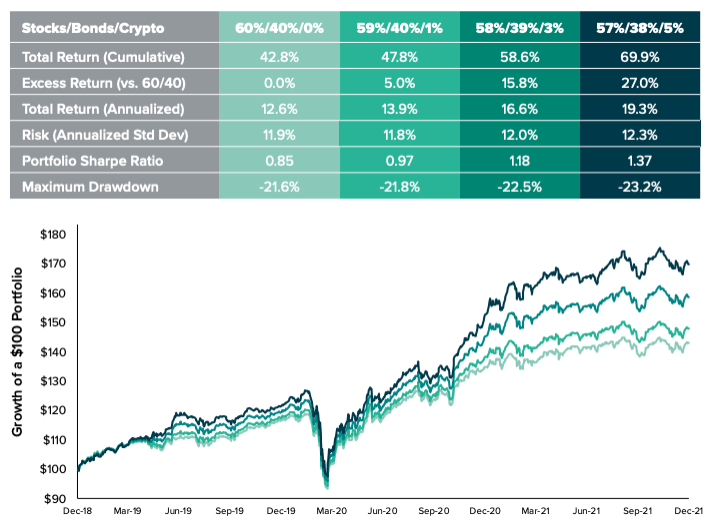

Because bitcoin has a very low correlation with every other asset class, adding bitcoin to a portfolio increases the diversification of that portfolio. This means that investors can achieve the same amount of return for less risk or achieve a higher rate of return for taking the same amount of risk. Numerous studies, including ones done by Fidelity, Yale economics professors, and Ark Invest, have shown the advantages of allocating a small percent of a diversified portfolio to bitcoin. In other words, even with bitcoin’s high volatility, it can be used to manage risk in a portfolio. Even for the most risk averse investors, bitcoin’s volatility should not be a deterrent.

There is no denying bitcoin does experience large price swings. However, when one begins to understand the volatility has historically been predominantly skewed to the upside, especially when viewed over longer time periods, the volatility of bitcoin is actually a benefit. Even for risk averse investors, adding a small amount of bitcoin to a portfolio can improve the risk-return profile of the portfolio. Hence, making the argument that the volatility of bitcoin means it’s a bad investment is inaccurate.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS