Myth: Bitcoin ownership is highly concentrated.

Truth: The data shows that bitcoin ownership continues to become more distributed. Even most of the “whales” today consist of exchanges and custodians that hold BTC on behalf of thousands, if not millions, of individuals. Furthermore, the number of “whale” accounts is decreasing while the number of smaller accounts who own any amount of bitcoin is increasing.

——————————

One of the greatest characteristics of public blockchains is that all transactional data is freely accessible to anyone. This allows for transparency and analysis on the bitcoin network that is not possible in traditional finance. However, this also makes it easier to scrutinize and critique bitcoin. One such criticism is that bitcoin is highly concentrated among a small number of holders.

Before we unpack this myth, lets first examine why concentrated ownership of bitcoin is potentially a problem. Bitcoin was designed as an alternative financial system, one that is supposed to be more open, inclusive, and less susceptible to outsized influence by any one entity. If bitcoin ownership were to become too highly concentrated, it could lead to a situation where most of the gains from further adoption would likely fall disproportionately to a small number of holders.

Hence, it’s with good reason that we should closely examine bitcoin’s ownership distribution. Unfortunately, many attempts to do so have analyzed the distribution of BTC based solely on network addresses which has led to the proliferation of this myth. For example, according to CoinMetrics, “18.7M of 18.9M total bitcoins are held by the top 10% of bitcoin addresses while 17.3M are held by the top 1% of addresses.” Stats such as this are superficial, misleading and result in false narratives about bitcoin’s ownership. Let’s examine why.

The main problem with analyzing addresses on the bitcoin network is that one user can control multiple addresses and one address can hold the funds for multiple users. For example, an address that belongs to a large crypto exchange is likely to hold a large number of bitcoin. However, this single address holds BTC on behalf of all its users and thus should be categorized very differently in terms of distribution on the network compared to an individual’s self-custodied address. In fact, many of the largest addresses are entities holding bitcoin on behalf of thousands, if not millions, of individuals. Most reports fail to make this distinction and thus make inaccurate conclusions.

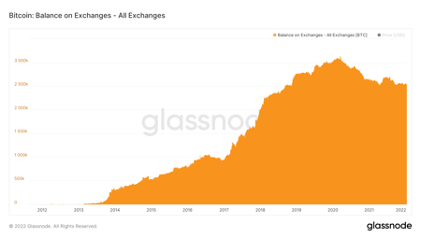

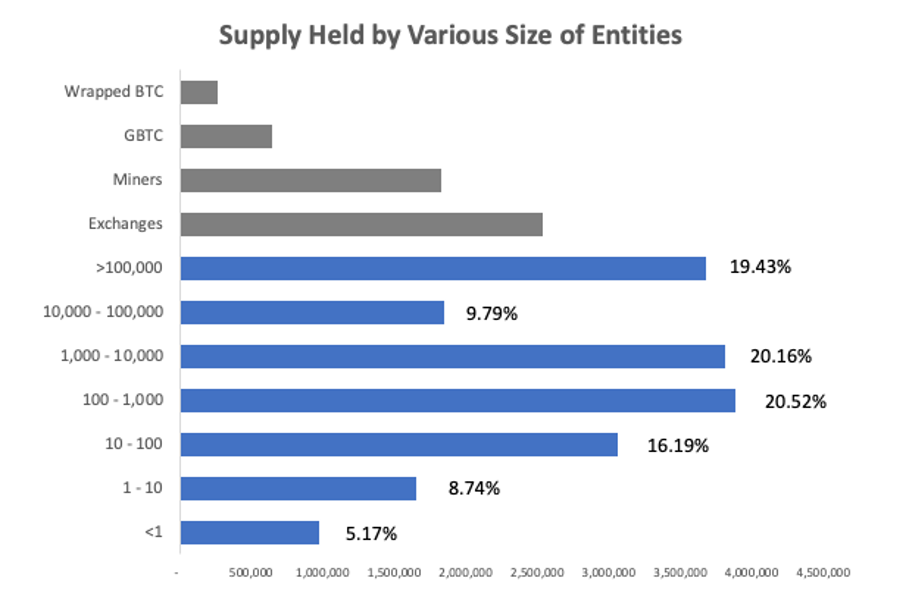

Exchanges – Centralized exchanges such as Binance, Coinbase or Gemini hold bitcoin to facilitate trading, and custody bitcoin on behalf of their users. According to data from Glassnode, exchanges hold over 2.5m bitcoin at the time of writing this, which equates to roughly 13.5% of all BTC in circulation. These exchanges make up some of the largest addresses on the network, but the bitcoin held in these addresses belongs to their users which may be in the thousands or millions. Thus, it would be disingenuous to include any of these exchange owned addresses as part of the small number of addresses that own a large amount of bitcoin.

ETFs and Publicly Traded Trusts – Exchanges aren’t the only large entities that hold bitcoin on behalf of others. ETFs and publicly traded trusts are funds that hold and manage BTC on behalf of other investors. The largest of this group is Grayscale Bitcoin Trust (GBTC) which as of October 2021, held roughly 3.4% of the world’s supply of bitcoin. While these 642,000 bitcoins are held by GBTC, that trust and the bitcoin held therein, is technically owned by a much larger number of individuals.

- Wrapped BTC (WBTC) – Wrapping cryptoassets is a process that allows one cryptoasset to be used on a blockchain that it is not native to. For example, bitcoin and ether run on different blockchains and thus, normally bitcoin cannot be transacted on in Ethereum and vice versa. However, creating a tokenized version of the cryptoasset on a different blockchain and pegging it 1:1 allows that asset to be used on various blockchains. At the time of writing this, there were 266,880 wrapped bitcoin on the Ethereum network. However, the vast majority of these WBTC are held in custody by a small number of addresses. What initially looks like a few large whales is in fact a small number of addresses storing BTC for 42,974 users (as of writing this).

Thus, as we can see, it’s not as simple as looking at the addresses holding large amounts of BTC and concluding that the network is highly concentrated. A number of these large addresses are holding bitcoin on behalf of a much larger number of market participants. Simply counting these “whale” addresses drastically skews the true distribution of bitcoin.

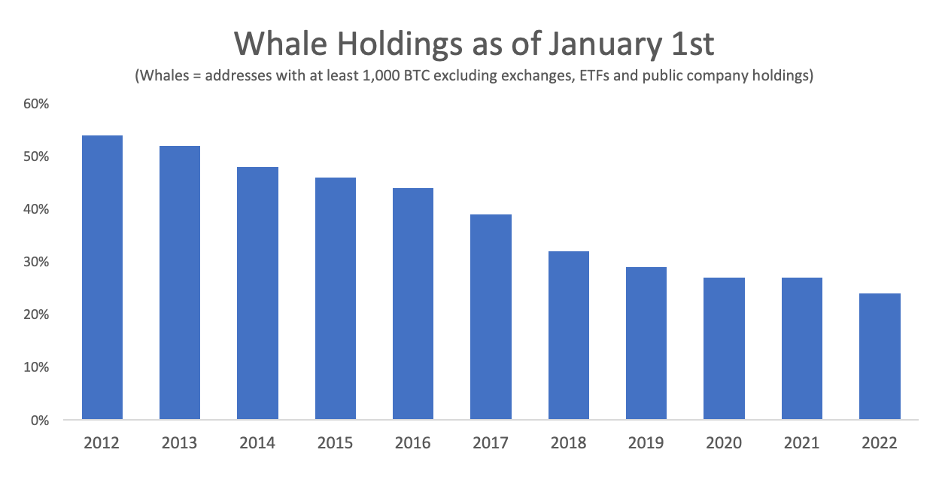

But not all addresses with a large number of bitcoin hold assets on behalf of others, there are addresses that possess a lot of BTC for individuals. However, this number has been decreasing over time. A recent analysis by on-chain analyst Willy Woo showed that if we exclude exchanges, ETFs and public company holdings, the percent of total supply held by single entities with at least 1,000 BTC has decreased over time. In 2012, these “whale” accounts held 54% of the total supply and as of January 1, 2022, these accounts now only hold 24%. That’s right, over time, whales are holding less of the overall supply of BTC.

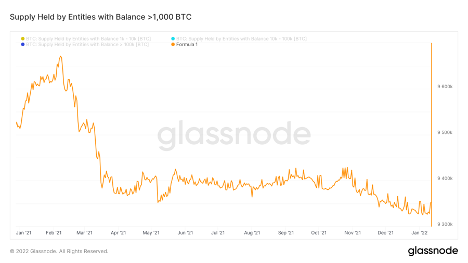

It’s not just the percent of the total supply, it’s also the total number of large entities. Before we dive into the data, it’s worth pointing out that for the sake of this report, we use “entities” not “addresses.” Remember that addresses can be problematic because one user can control multiple addresses and one address can hold the funds for multiple users. To account for this, on-chain data provider Glassnode developed entity-adjusted metrics through a combination of industry–standard heuristics, proprietary clustering algorithms, and advanced data science methods which helps obtain a more precise estimate of the actual number of users in the Bitcoin network.

Using this more precise entity metric rather than the simple total addresses, we can see that the largest holders, those with at least 1,000 BTC peaked in February 2021 and has been on a steady decline ever since.

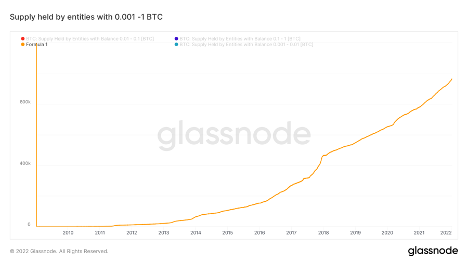

If the percent supply owned by whales is decreasing and the total number of whales is decreasing, who is holding the remaining supply of bitcoin? The answer is that a greater number of entities with a small amount of bitcoin continue to make up a larger percent of the network. Bitcoin entities with 0.001 – 1 bitcoin in their balance have continued to hit all-time highs. Today, there has never been more bitcoin entities on-chain in the 13-year history that hold these smaller amounts of bitcoin. This indicates that a larger number of people around the world are holding bitcoin and the total supply held by these smaller entities is increasing. In other words, bitcoin ownership is becoming less concentrated over time.

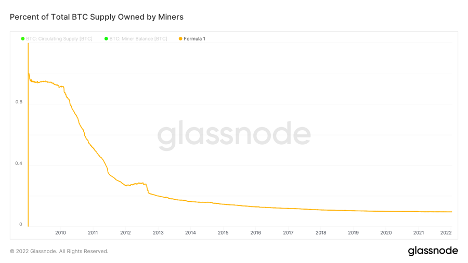

Lastly, we can’t fully analyze bitcoin’s distribution without discussing miners. Miners play an important role in the bitcoin network as they provide the computational power to validate transactions and secure the network. In exchange, miners are rewarded with newly issued bitcoin. It’s through miners that bitcoin comes onto the network and gets distributed to everyone else. Mining bitcoin has real world costs in the form of equipment, maintenance, and most importantly electricity. Thus, miners have operational costs they need to fund to stay in business. Historically, the primary way miners have funded this cost is through the selling of bitcoin onto the market. This incentive to sell to other market participants has led to a natural distribution of tokens across the network which we can see by analyzing the on-chain data. Miners originally owned 100% of all bitcoin in existence when bitcoin was first launched as this was the only way to acquire bitcoin initially. As the market has matured over the last 13 years, the total supply owned by miners is now less than 10%.

The on-chain data shows that bitcoin ownership continues to become more distributed over time. At the time of writing this, almost a third of all bitcoin is held by participants who own less than 100 BTC and that number continues to rise. Furthermore, as we discussed previously, most of those larger entities actually hold BTC on behalf of a large number of other individuals.

This increase in distributed ownership means that the economic gains are being accrued by more people globally. As bitcoin is adopted by more people around the world, the historical trend would suggest that it will continue to evolve into a true egalitarian store of value that can’t be debased, censored, or manipulated.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS