Multi-Strategy Fund Performance

Blockforce saw greater than 25% gains for the second consecutive month as the Fund outperformed bitcoin in March. Solana (55%) was a big driver in the Fund’s monthly performance but a number of other networks saw big gains as well. Networks such as The Graph (22%) and Pyth (48%) continued to see their emergence as core pieces of on-chain infrastructure. Layer 2 networks on bitcoin such as Stacks (21%) also have seen a resurgence since the release of the BitVM whitepaper late last year and networks such as Render (38%) continue to ride the AI wave. The number of emerging narratives with real world traction within the crypto ecosystem is arguably greater than anytime in crypto’s history.

| Multi-Strategy Fund | Bitcoin | |

| March Gross Performance | 27.3% | 16.4% |

Market Commentary

As we covered in our Node Ahead newsletter on March 12, the bitcoin ETFs saw an acceleration of capital inflows which pushed bitcoin’s price to new all time highs of $73k by mid-month.

The following week, that trend reversed and the ETFs began seeing net outflows for the first time since late January. The primary catalyst was GBTC who recorded its biggest single daily outflow on Monday March 18th, with withdrawals totalling $643 million. The primary reason for the resurgence in outflow was the bankruptcy process of FTX. FTX was a major holder of GBTC and the bankruptcy estate reportedly offloaded the majority of its shares according to reporting from Bloomberg and CoinDesk.

Unsurprisingly, this renewed sell off from GBTC caused BTC’s price drop to as low as $60k during the third week of March. This appears to have been a short term phenomenon as bitcoin’s price rebounded back to $70k by the end of the month.

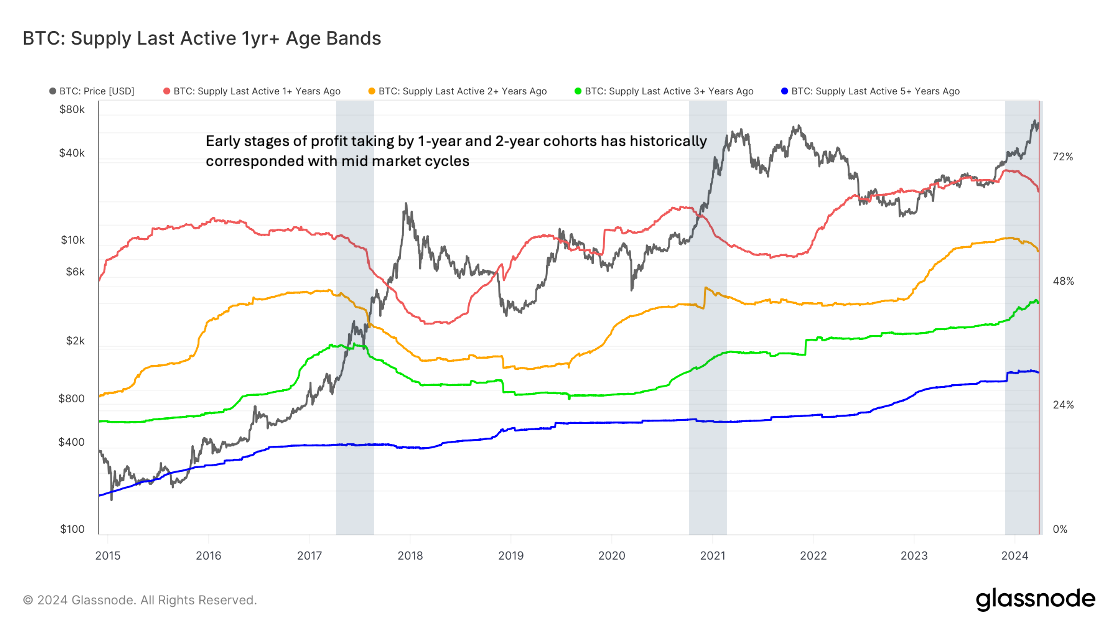

The rally to new all-time highs triggered another phenomenon we track closely, the amount of profit taking by long term holders. We have written extensively over the years about how when bitcoin that has sat dormant for a number of years comes back onto market, that has a very high correlation with market tops. Since 2022, we have seen a shift in market behavior towards accumulation of bitcoin for longer hold periods. As of January, we were at all time highs in terms of percent of bitcoin that had not moved in over 1 year, 2 years, 3 years and 5 years. This month, we saw the first reversal of that trend as the percentage of bitcoin held by the 1 and 2 year cohorts fell for the first time indicating that some investors who bought the top in the previous cycle are taking some of their chips off the table. In other words, we are just beginning to see some profit taking happen.

However, we have yet to see the 3 and 5 year cohorts sell in any meaningful amount. In fact, we are seeing a continued rise in both these older cohorts which indicates that we have yet to reach the late stage part of the cycle. In previous cycles, the 1 and 2 year cohorts tend to first begin selling into the largest bull market run up. It’s not until we see prolonged selling by this cohort in conjunction with older cohorts beginning to sell as well that we have historically reached market tops.

This is typical market behavior that aligns very closely with market patterns observed during all prior cycle all time high breakouts. Historical data would suggest that while we are no longer in the early stages of a bull market, we are squarely in the middle of the cycle with the largest price appreciation still ahead of us.

The Blockforce Team

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS