By Brett Munster

Crypto’s Recent Pullback

By the first week of October, bitcoin had climbed to a new all-time high of $126,000, driven by renewed conviction in the “debasement trade” narrative (see next section for more on this topic). But that rally ran headlong into geopolitics on Friday, October 10 when President Trump announced a 100% tariff on Chinese technology imports alongside new restrictions on U.S. exports of “critical software.” The move was a direct response to Beijing’s decision to curb exports of rare-earth materials, vital components in advanced manufacturing and electronics.

When Trump’s tariff announcement landed late Friday, equity markets were already closed for the weekend—leaving investors with no conventional outlet for the sudden wave of macro anxiety. Crypto, trading around the clock, became the de facto pressure valve. Within hours of the announcement, bitcoin plunged roughly 12%, Ethereum and Solana fell 26%, and smaller altcoins shed more than half their value.

Once bitcoin broke through key technical support levels, the decline took on a life of its own. Leveraged long positions were automatically liquidated, triggering a self-reinforcing feedback loop: each wave of forced selling pushed prices lower, prompting further liquidations and accelerating the downward spiral. The effect was magnified by thin weekend liquidity in both spot and derivatives markets, particularly outside of major tokens like BTC, ETH, and SOL. As order books thinned, a safeguard known as auto-deleveraging—used by platforms like Binance to protect the exchange when too many positions are being liquidated—kicked in, setting off a chain reaction across exchanges that drained even more liquidity and deepened the sell-off.

When it was all said and done, an estimated 1.6 million traders were liquidated, wiping out nearly $19 billion in leveraged positions in one of the largest single-day liquidations in crypto’s history. The total crypto market capitalization collapsed by about $1 trillion—a 25% drawdown in less than 24 hours.

Crucially, the crash was not the result of a breakdown in fundamentals. Instead, this was a purely technical event—a rapid unwinding of excessive leverage and crowded long positioning. Over 90% of liquidations were from traders betting on further upside, underscoring just how bullish sentiment had become across digital assets.

We’ve written about this before, but it bears repeating: tariffs have no direct bearing on decentralized digital assets. There are no import duties on bitcoin transactions and no customs checkpoints in decentralized finance. The sell-off was not a reflection of crypto’s intrinsic value, but a rapid repositioning by short-term traders bracing for broader macro volatility. What it did reveal, however, were persistent structural weaknesses in parts of the market—especially among centralized exchanges such as Binance. These platforms, reliant on opaque and proprietary risk engines, amplified the downward pressure as automated liquidations cascaded through their systems. By contrast, decentralized finance (DeFi) infrastructure functioned precisely as intended. Protocols governed by transparent liquidation rules and supported by oracles like Chainlink absorbed the shock with minimal disruption. The contrast was striking: decentralized systems remained resilient even as segments of the centralized ecosystem faltered.

This contrast underscores a deeper point about what bitcoin and the broader crypto industry represents. Many of the investors who sold during the panic—whether involuntarily or out of fear—overlooked what they actually owned. Bitcoin was built to be independent of nation-state risk, a store of value immune to government policy. Historically, such moments of geopolitical stress have validated that thesis, not contradicted it.

History also suggests that sharp, mechanically driven drawdowns like this rarely last. The pattern resembles prior episodes such as the May 2021 flash crash, the yen carry-trade unwind in August 2024, and the tariff shock earlier this year. Each triggered steep but temporary liquidations that ultimately cleared speculative excess and reset leverage to healthier levels.

Post-crash data already point to normalization. Open interest has fallen sharply, funding rates have returned to neutral, and major tokens have recovered much of their initial losses. Markets appear to have flushed out excessive leverage, laying the groundwork for renewed stability—and potentially renewed upside. Historically, these conditions mark the end of the forced-selling phase and the beginning of a more sustainable accumulation period.

Structurally, bitcoin’s broader uptrend remains intact. More than 90% of bitcoin’s circulating supply is still in profit, suggesting this was not a broad capitulation event but rather a leverage-driven correction. Most realized losses came from those who bought near the recent highs. Even with record liquidations, the price behavior remains well within historical norms. A range between $100,000 and $105,000 aligns with prior correction lows from 2024 and earlier this year, making it a plausible support zone. The key level to watch, however, is $95,000—the price area that has seen the most trading activity over the past twelve months. On-chain data show that approximately 62% of all invested capital sits above that level, making it both a psychological and technical floor. A sustained break below $95,000 could trigger deeper losses, with limited historical support until roughly $75,000.

Still, perspective matters. I’ve been investing in crypto long enough to remember bitcoin’s crash to $200 in 2014, the gut-wrenching drop to $3,000 in 2018, and the painful slide to $16,000 in 2022. Even the tariff-induced plunge to $80,000 earlier this year caused panic in the market at the time. And yet, just six months later, we’re calling a dip to $105,000 a “crash.” The irony is that investors will likely react with the same panic when bitcoin “plummets” to $250,000 a few years from now.

Viewed through a longer-term lens, the October sell-off looks less like the start of a downturn and more like a healthy reset. None of the fundamental drivers of the ongoing bull market—increasing liquidity, institutional adoption, or global demand for non-sovereign assets—changed during the turmoil. What changed was positioning. Excess leverage has been purged and markets are regaining technical footing.

In that sense, the episode underscores how far the system has matured. Crypto remains the most reflexive, continuously traded expression of global macro sentiment, yet it is increasingly capable of absorbing shocks without systemic breakdowns. As macro uncertainty fades and liquidity stabilizes, digital assets appear well-positioned to recover from a stronger foundation.

Market resets like this are not the end of bull markets—they are often what allow them to continue. The October crash may ultimately be remembered not as a failure, but as a stress test that reinforced the system’s resilience. With speculative excess burned off, the path forward may now be clearer—and sturdier—than it was just weeks ago.

Trump’s Debt Spiral Comments Ignite Debasement Trade

President Trump’s recent statements on the national debt crystallized growing concern over America’s deteriorating fiscal outlook, propelling the so-called “debasement trade” to the forefront of Wall Street discourse. At its core, the debasement trade is a bet that fiat currencies will continue to lose real value over time and that assets with fixed or scarce supply will outperform. Bitcoiners have long championed this view, but Trump’s assertion that the only realistic way to address the U.S. debt burden is through economic stimulus has transformed what was once a fringe narrative into a mainstream investment thesis.

The newfound attention reflects a simple logic. The debasement trade is a hedge against governments’ inability—or unwillingness—to rein in spending. Nations running persistent structural deficits eventually turn to monetary expansion to manage their debt loads. That expansion dilutes the purchasing power of money, effectively debasing it. To preserve real wealth, investors increasingly favor assets that cannot be printed or easily increased in supply—traditionally gold, and now, increasingly, bitcoin.

The debasement trade is not a new idea. For decades, gold bugs and, more recently, crypto proponents have warned that central banks’ dependence on liquidity injections would one day undermine fiat credibility. If you’ve been reading this newsletter for a while (yes, all five of you), you’re likely rolling your eyes because I’ve beaten this topic to death over the years (here, here, and here just to name a few).

What’s new is the degree of institutional endorsement of this idea. Major banks, research desks, and asset allocators are no longer dismissing the argument; they are embracing it. The debasement trade has moved from the blogs of “sound money” enthusiasts to the boardrooms of Wall Street.

Why now? Because the U.S. fiscal trajectory is looking increasingly unsustainable. Without meaningful entitlement reform, the U.S. is structurally locked into deficit spending. Each year, Washington is forced to borrow more just to keep the lights on. The result is an accelerating debt spiral. For perspective, it took more than two centuries for America’s national debt to reach $1 trillion. Reports from August and September indicated the U.S. national debt increased by $1 trillion in approximately 48 days. Annual interest payments on the debt now exceed the defense budget and are second only to Medicare. Even if all discretionary spending—defense, education, infrastructure and more—were eliminated, mandatory spending and interest costs alone would still surpass federal revenues.

Against this backdrop, Trump’s October 4 declaration that the U.S. must “grow our way out” of its debt burden landed with force. On its surface, the statement was optimistic: faster economic growth would, in theory, make existing debt more manageable relative to GDP. But between the lines, it was a signal. The administration’s strategy for stimulating growth—more spending, lower rates, and looser money—implies an acceptance of higher inflation as the price of avoiding austerity.

The irony of trying to spend one’s way out of a spending problem was not lost on markets. Yet Trump’s comments made explicit what many already suspected: inflation is now a politically acceptable tool. To be clear, I am not making an argument about whether the administration’s approach is prudent or misguided, I am merely acknowledging the reality of the situation. The notion of tolerating higher prices to sustain growth has shifted from the whispers of policy circles to the podium of the presidency. With the Federal Reserve under pressure to ease and other central banks adopting a dovish stance, investors now see a coordinated tilt toward monetary accommodation. Wall Street, it seems, is taking the president at his word.

JPMorgan analysts have formally labeled gold and bitcoin “the debasement trade,” framing both as hedges against inflation, geopolitical instability, and the erosion of confidence in fiat systems. Their models suggest bitcoin could reach $165,000 by year-end on the strength of this thesis.

Morgan Stanley’s Global Investment Committee, which advises 16,000 financial advisors managing $2 trillion in assets, recently recommended a 2–4% crypto allocation for the first time, citing bitcoin’s scarcity and its role as “digital gold.”

Goldman Sachs has gone further, interpreting Trump’s rhetoric as shorthand for currency debasement and framing bitcoin as a “pressure valve” for global liquidity imbalances. The bank argues that bitcoin functions as a superior store of value—one investors increasingly are using to hedge against fiat depreciation and inflation risks.

Deutsche Bank recently released a report titled “Gold’s Reign, Bitcoin’s Rise,” forecasting that a strategic allocation to bitcoin is becoming a modern pillar of financial security—much like gold did in the 20th century. The report attributes this shift to the weakening dominance of the U.S. dollar and rising geopolitical risks, which are prompting central banks to diversify their reserves. It also highlights that increasing regulatory clarity, deeper market liquidity, and bitcoin’s fixed supply are enhancing its legitimacy as a store of value. As a result, bitcoin is evolving from a speculative asset into a structural component of the global financial system.

Wells Fargo has authorized advisors to allocate client capital into bitcoin ETFs, and both UBS and Merrill Lynch are expected to follow. Even the index world is adapting: Standard & Poor’s is reportedly developing a “Digital Markets 50” benchmark—essentially an S&P 500 for crypto—to track the sector’s growing relevance.

The message from Wall Street is unmistakable: digital assets are now an essential part of mainstream portfolio construction.

The rapid institutional shift into digital assets reinforces the dynamics behind the debasement trade. Bitcoin tends to rise when liquidity expands or when trust in governments and financial intermediaries wanes. It surged during the March 2023 regional banking crisis, amid the Canadian trucker standoff, during Cyprus’s banking collapse, and in the wake of currency depreciation in Turkey and Argentina. Each episode exposed vulnerabilities in the fiat system and drove capital toward assets outside it. The current environment—marked by a U.S. government shutdown, record debt growth, and open tolerance for inflation—fits that pattern perfectly. Bitcoin’s climb to a new all-time high above $125,000 this month reflects that convergence of structural fragility and monetary excess.

As we highlighted earlier, institutions are finally catching on. In the first week of October alone, crypto markets saw $6 billion of inflows—a record for a single week. The following Monday, bitcoin ETFs recorded their second-largest single-day net inflow on record, raking in $1.2B and setting them on track for all-time-high in quarterly inflows for Q4. The narrative is self-reinforcing: as policymakers signal tolerance for inflation, investors seek refuge in scarce assets, driving up their prices and further entrenching the very dynamics that prompted the move in the first place.

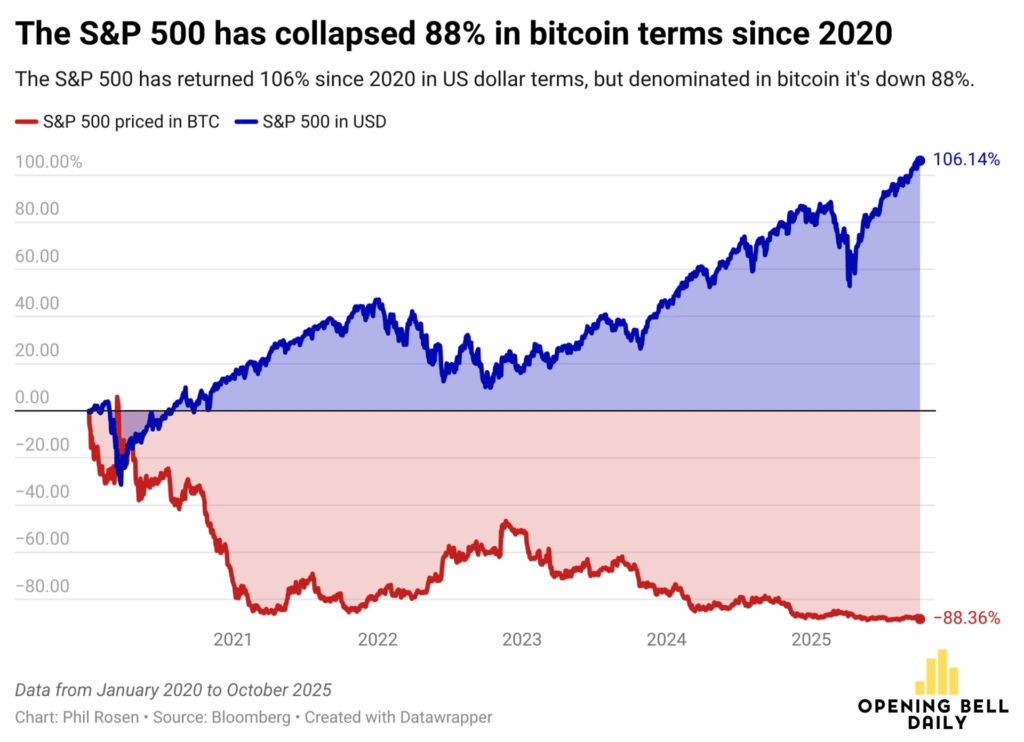

Recasting market performance in non-dollar terms reveals a very different picture of the post-2020 boom. The COVID stimulus of 2020 ignited an era of aggressive monetary expansion that fundamentally altered how asset prices should be understood. Since then, the S&P 500 has risen about 106% and U.S. home prices roughly 52% in dollar terms. Yet these apparent gains vanish when measured in bitcoin—a deflationary benchmark immune to monetary expansion—with equities down as much as 88% in BTC terms. This contrast illustrates the essence of the debasement trade: asset prices appear to rise not because their intrinsic value increases, but because the measuring stick—the dollar—is being diluted. Since the start of 2020, the dollar’s purchasing power has dropped more than 20%, while gold has risen 170% and bitcoin an astonishing 1,400%, a vivid illustration of how capital is migrating toward assets that resist debasement.

Source: Opening Bell Daily

In the original bitcoin whitepaper, Satoshi Nakamoto wrote: “The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.” Seventeen years later, that warning is resonating in global markets.

We now appear to be entering a regime where lower rates and explicit monetary expansion are not emergency measures but policy norms. Currency debasement is no longer a tail risk; it is a feature of the system. The institutional world—once skeptical—is now leaning in. Bitcoin ETFs are recording unprecedented inflows, M2 money supply is accelerating, and retail sentiment is aligned with the view that the fourth quarter will favor scarce assets.

Yes, risks remain. But this is no longer a speculative fringe idea. Gold and bitcoin—long dismissed as ideological bets—are increasingly recognized as the market’s counterbalance to monetary excess. They are doing what central banks have failed to do: preserve purchasing power. The “debasement trade” has gone mainstream, and this time, Wall Street is not fighting it—it’s leading it.

In Other News

The U.S. SEC and CFTC held a joint roundtable on September 30 to strengthen cooperation and “harmonization” on crypto policy.

BTC sets new all-time high as analysts expect “Tactically Bullish” October.

SEC aiming to formalize its “Innovation Exemption” by the end of the year.

Morgan Stanley to open crypto access to all client accounts, including retirement plans.

U.S. government bitcoin reserves surged to around 325,000 BTC ($36 billion) after announcing it had seized 127,271 BTC ($14 billion) — the largest forfeiture in DOJ history.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS