By Brett Munster

The paradox that is 2025

We entered this year optimistic about bitcoin and the broader crypto landscape—not due to the four-year cycle narrative, but because the fundamental backdrop was exceptionally compelling. For the first time, the United States had both an administration and a legislative majority openly supportive of the industry, creating a real prospect for long-awaited regulatory reform. After several years of global quantitative tightening, the monetary environment was beginning to pivot toward easier policy and rising liquidity. And the launch and early success of spot Bitcoin ETFs, coupled with growing corporate and sovereign participation, signaled that institutions were beginning to adopt crypto in a meaningful way.

Fast-forward to today and 2025 has become something of a paradox because those tailwinds materialized. Regulatory progress has been substantial: executive orders from the president, bipartisan momentum behind stablecoin legislation, and a more market-oriented SEC under new leadership. Monetary conditions have clearly loosened: quantitative tightening is ending, the Fed has begun cutting rates, and global liquidity indicators are trending higher. Meanwhile, for most of the year, ETF flows, corporate treasury allocations, and sovereign interest continued to build in a way that looked, on paper, like a textbook bull-market backdrop.

And yet, as of writing this, bitcoin is down roughly 7% on the year, while the broader crypto market sits meaningfully lower. The question then becomes: if fundamentals are improving and tailwinds are real, why hasn’t the price followed? We believe the answer is not that the bull case was wrong, but that two powerful and unexpected headwinds have delayed the market’s ability to fully reflect these fundamentals.

The first is macro-driven deleveraging. Crypto entered 2025 with strong Q4 momentum and elevated leverage across derivatives markets. Then, in February, a surprise tariff announcement by President Donald Trump jolted global risk assets. The move had nothing to do with crypto’s fundamentals, yet it triggered liquidations across leveraged positions—ultimately producing a roughly 35% drawdown by the end of Q1. The market recovered over the following months, even reaching new all-time highs by early fall, setting the stage for what many hoped would be a seasonally strong Q4. But on October 10, a second tariff-related shock—again entirely exogenous to crypto—sparked the largest liquidation event in the sector’s history. In both episodes, the fundamental story did not break. Instead, macro surprises undermined risk appetite, forced leverage to unwind, and interrupted the momentum necessary for price to reflect otherwise constructive conditions.

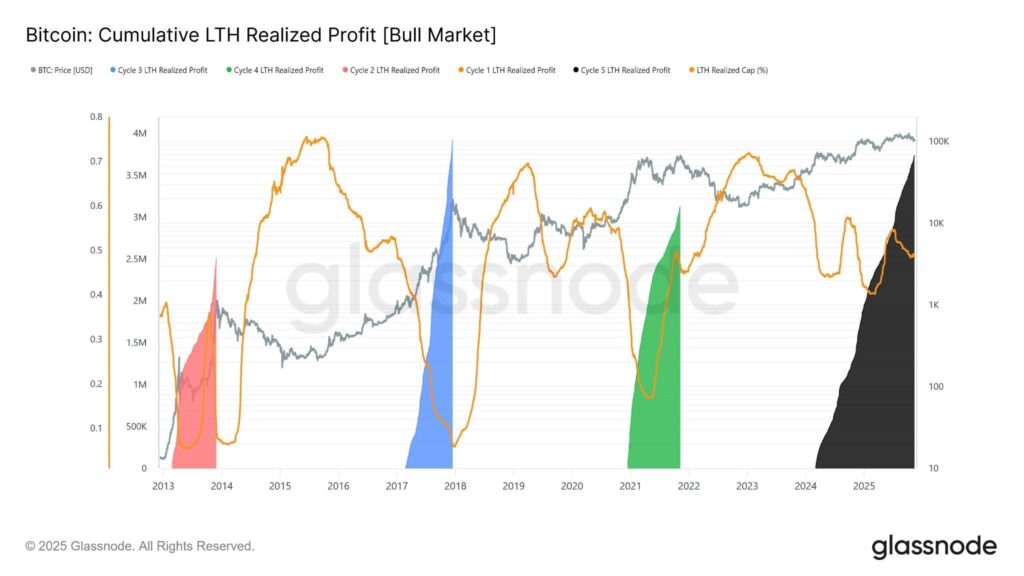

The second headwind has been structural: a steady stream of supply returning to the market from long-term bitcoin holders. Once bitcoin crossed $100,000, many early adopters—some holding for over a decade—began realizing significant profits. On-chain data shows that wallets holding coins for five years or more sold over $52 billion worth of bitcoin this year alone. A striking example came in July, when a Satoshi-era whale moved and sold roughly 80,000 BTC—about $9 billion at the time. As Jordi Visser calls it, bitcoin is experiencing its “IPO moment”: those who took enormous risks early in bitcoin’s lifecycle are methodically taking gains now that liquidity exists. This rational profit-taking isn’t driven by panic; it’s a natural outcome for investors sitting on 100x-plus gains. With roughly 15.75 million bitcoin mined or acquired below $1,000, it’s only logical that, after more than a decade of holding, some would sell to fund life changes, diversify their holdings, or plan their estates. This process simultaneously distributes ownership more widely, making bitcoin more stable, resilient, and primed for long-term institutional adoption.

Importantly, this behavior is not new. Long-term holders have realized profits in every prior cycle, and by late August the scale of realized gains from older wallets matched levels seen near historic peaks. The difference this cycle is that supply has been unusually steady and orderly, rather than episodic. It has been continuous background sell-pressure, not sharp capitulation. And throughout most of 2025, institutional, corporate, and sovereign demand absorbed nearly all of it—so much so that bitcoin still made new all-time highs in October despite enormous, realized gains by early holders.

Source: Glassnode

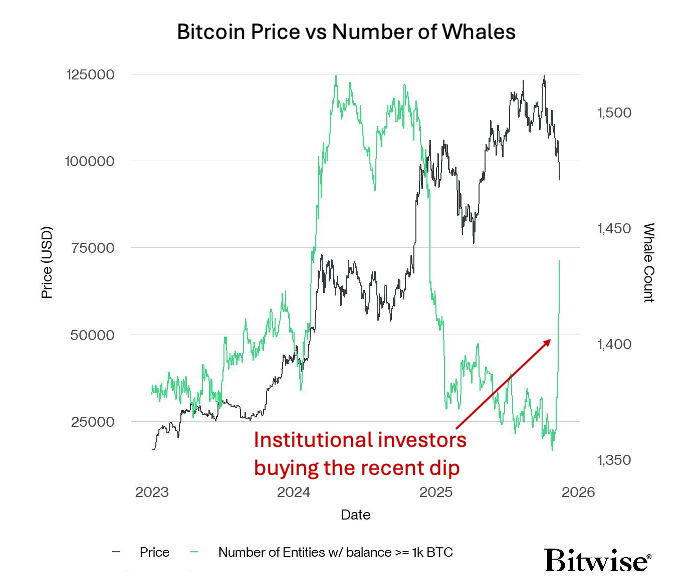

What has changed over the last month is the demand side: macro uncertainty from the tariff announcement temporarily paused institutional accumulation. Even so, the underlying trend is clear. Ownership is rotating from old whales to institutions with multiyear horizons. Data from Glassnode shows that wallets holding more than 1,000 BTC—typically institutional accounts—have spiked to a four-month high. Spot bitcoin ETFs now hold roughly 200,000 more BTC than earlier in the year, even as price has fallen to its lowest level since April. Their average cost basis, around $86,000, underscores the difference between the old and new investor bases. Early holders were sitting on 100x gains; ETF buyers are essentially break even on average and have no incentive to sell until materially higher prices. In effect, a higher structural price floor is forming in the market.

Source: Bitwise

These two forces—macro deleveraging and structural supply rotation—have offset the tailwinds that would otherwise have pushed prices higher this year. Prices have been flat not because fundamentals are weak, but because the market is digesting large supply shifts and intermittent macro shocks at the same time. Long-term capital is stepping in aggressively even as short-term sentiment is capitulating creating the foundation for the next leg higher.

Looking ahead to the remainder of 2025 and into 2026, the picture becomes considerably more constructive. Institutional adoption continues to deepen: Harvard’s endowment increased its bitcoin position by 257%, making it the largest publicly held asset in their portfolio; the XRP ETF (XRPC) and Solana ETF (BSOL) became the two largest ETF launches of the year and continue to attract inflows despite price softness; and sovereign entities—including the Abu Dhabi Investment Council, the Czech central bank, the government of El Salvador, and the Luxembourg Wealth Fund —have all expanded their bitcoin positions recently. Regulatory clarity is also progressing. The CLARITY Act appears positioned to pass early next year, providing a framework for market structure that the U.S. has lacked since bitcoin’s inception. SEC Chairman Paul Atkins recently outlined “Project Crypto,” which includes plans to classify token types, update the application of the Howey Test, and introduce tailored disclosure and exemption regimes for digital assets. And just last week, Congressman Warren Davidson introduced the “Bitcoin for America Act“, a bill that proposes enshrining the Strategic Bitcoin Reserve into law and allowing Americans to pay federal taxes in bitcoin without incurring capital gains tax. This is the most coherent regulatory agenda the sector has ever had.

The macro backdrop is equally supportive. Global M2 recently hit a record high of $142 trillion. Major economies, including China and Japan, are preparing substantial stimulus programs. The U.S. Treasury’s General Account, built up during the government shutdown, will need to be drawn down—injecting liquidity. Formal quantitative tightening ends December 1, and New York Fed President John Williams has said the Fed expects to return to asset purchases in the near future. With Powell set to be replaced in May, it’s very likely his successor will push for more aggressive interest rate cuts in 2026. For risk assets broadly—and crypto in particular—2026 is likely to be the most favorable liquidity environment since 2020.

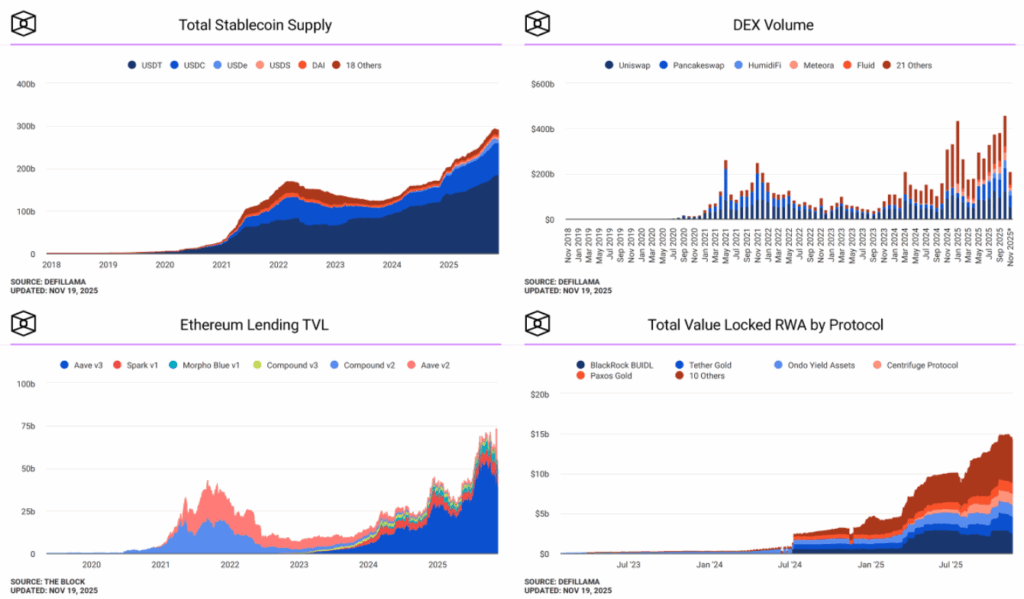

Finally, crypto’s real-economy fundamentals are strengthening in ways not reflected in price. Stablecoins surpassed $300 billion in supply this year, with transaction volume more than doubling. Tether alone is projected to earn $15 billion in profit for 2025. Crypto-native stablecoin platforms like Ethena (disclosure: Blockforce is an investor) have generated over $500 million in revenue so far this year. DeFi platforms are producing meaningful, organic revenue: Hyperliquid (disclosure: Blockforce is an investor) is on track for more than $1 billion in annualized revenue. Tokenization of real-world assets is accelerating as regulatory clarity improves, and early metrics show consistent month-over-month growth in volume and user participation. These indicators tell a very different story than spot price: they point to an ecosystem deepening, scaling, and institutionalizing.

Source: TheBlock

History helps contextualize the moment. During the 2016–2017 cycle, bitcoin experienced multiple 20–40% pullbacks—some of them violent—yet still delivered a 46x move from trough to peak. The 2020-2021 cycle had multiple 30% corrections but ultimately produced a 20x return from trough to peak. Those drawdowns felt painful in real time but were quickly forgotten once the cycle matured. This cycle has seen three 30% pullbacks over two years—well within the bounds of normal bull-market behavior. The structure of these corrections is remarkably similar to past cycles; the only difference is that we are living through one of them right now rather than looking back with hindsight.

In our view, the flatness and dips of 2025 do not represent a failed thesis. They represent a delayed one. The conditions for a powerful next leg—regulatory clarity, institutional adoption, supply rotation, and abundant global liquidity—are all falling into place. Many, including ourselves, expected 2025 to be explosively bullish. Instead, the evidence increasingly points to 2026 as the year when prices start to converge with the strong fundamentals now taking shape.

The bull market is not cancelled; it is simply running on a longer timeline.

In Other News

SoFi Bank becomes first nationally chartered bank to launch crypto trading for customers.

SEC Chair Paul Atkins unveils plan for ‘token taxonomy’ to redefine crypto regulation.

Bitcoin briefly dips below $90,000 before staging recovery.

OCC green lights banks holding crypto assets.

New Hampshire approves first-ever bitcoin-backed municipal bond.

US Senate banking chair eyes vote on crypto market bill next month.

Kraken confidentially files for IPO.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS