Good Morning!

In case you missed it, 60 minutes recently aired a great piece on “Bitcoin Beach” in El Salvador. Long before El Salvador officially made bitcoin legal tender, the coastal city of El Zonte started incorporating bitcoin into its economy. Today, numerous businesses in El Zonte accept bitcoin as payment, tourism is up 30%, and the country is saving hundreds of millions of dollars per year in remittance fees.

On Chain Analysis

Bitcoin continues to trade within the price range that we have been discussing for the past several newsletters. In fact, once again we saw bitcoin’s price push up against the short-term holder cost basis of $47k which has been providing an upper bound resistance level for bitcoin. And once again we saw increased sell pressure from short term holders which resulted in bitcoin’s price bouncing back down to $40k, right in the middle of the range it’s been stuck in since the start of the year. As a result, bitcoin and the larger crypto markets continue to trade sideways as more and more coins are being transferred from short term market participants to long term holders.

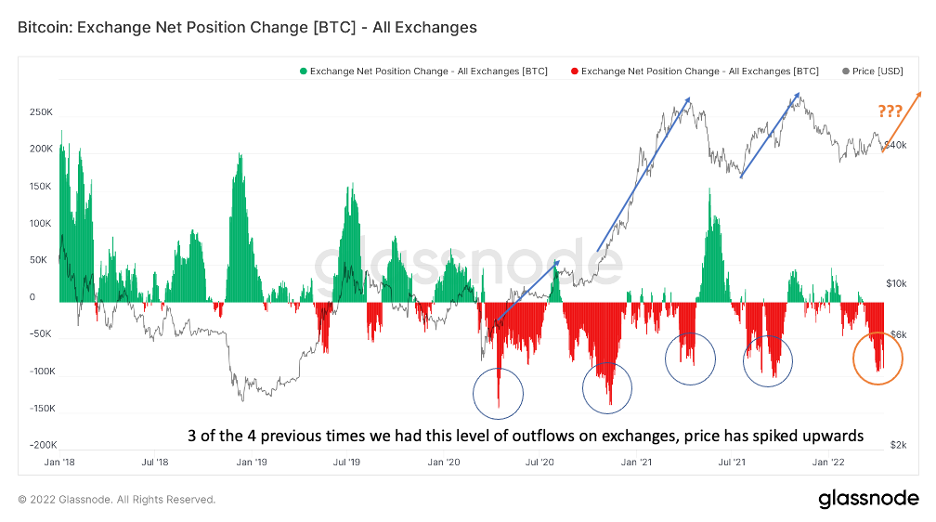

One way we know that this supply is being transferred to long term-oriented holders is the fact that a massive amount of bitcoin has been coming off exchanges in recent months. When bitcoin is taken off exchanges, it’s taken offline and put in cold storage, meaning it’s not available to be traded. This is only done by individuals who expect to hold onto their coins for the foreseeable future. In fact, we have only seen this level of outflow from exchanges four previous times since the start of 2018. Three of those instances correlated with a sharp upward movement in price not too long after.

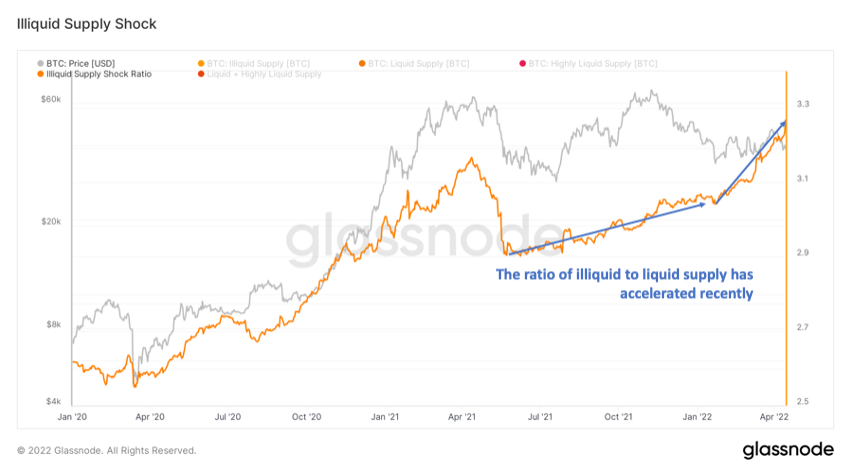

As a result, the supply squeeze that we have been discussing for the past several weeks continues to build. Last newsletter we showcased the Illiquid Supply Shock Ratio which had crossed above 3 (meaning there was 3x the number of bitcoin held in cold storage vs the number available to be traded). Two weeks later and that number has now climbed to almost 3.3 meaning the number of illiquid coins is not only growing, but the rate at which it is growing is accelerating.

As always, the on-chain data is provided by Glassnode. If you would like to have access to the data yourself, you can sign up here:

Bitcoin 2022

In recent years, the annual bitcoin conference has become the largest crypto conference in the world. This year’s event, which was held on April 6-9 in Miami, attracted over 25,000 attendees, more than double last year’s attendance. It also showcased some of the biggest names in the industry. Senator Cynthia Lummis outlined her forthcoming bi-partisan bitcoin bill, Peter Thiel discussed what he sees as the future of bitcoin, Cathie Wood of ARK Invest and Michael Saylor of Microstrategy had a fireside chat, Serena Williams, Odell Beckham Jr and Aaron Rodgers explained why they choose to be paid in bitcoin, Kevin O’Leary from Shark Tank took the main stage to discuss the forthcoming flood of investment into the space, and Jan Van Eck of Van Eck ETFs described why blockchain will revolutionize Wall Street.

The bitcoin conference has also become the premiere destination for new announcements. It was at Bitcoin 2021 that Jack Mallers and Nayib Bukele announced that El Salvador would become the first country to adopt bitcoin as legal tender. This year had no shortage of big announcements as well. Here were some of the most notable.

Jack Mallers, founder and CEO of Strike, once again made headlines when he unveiled the company’s integrations with Shopify to allow for payments across the Bitcoin Lightning network for any merchant who wants to opt in. Strike’s integration enables Shopify merchants to accept payment in any currency, bypass the credit card fees, and choose the currency in which they want to be paid. The merchant has the option to keep the payment in bitcoin or instantly convert to dollars if the merchant prefers. Jack also announced that Strike is partnering with the world’s largest point-of-sale supplier, NCR, and payments firm Blackhawk. These two payment processors serve approximately 85% of all retail merchants including some of the biggest names such as McDonalds, WalMart, WholeFoods and more. By using the Lightning Network, these retailers can avoid credit card fees meaning they will pay almost nothing on every transaction (compared to the 2-3% most credit cards charge) and get near instant settlement rather than waiting days. If you are an executive at Visa, Mastercard or American Express right now, you are staring down the barrel of the Innovators Dilemma.

But Strike wasn’t the only company making waves at Bitcoin 2022. Robinhood revealed that customers can now send and receive crypto and said it will add support for bitcoin transactions on the Lightning Network. Block (formerly Square) announced three new bitcoin services for Cash App. They include automatic conversion of paychecks into bitcoin, automatic investment of the change from debit transactions into bitcoin, stocks, or ETFs, and a unified QR code enabling users to send and receive bitcoin on both the Lightning Network and the base layer.

The conference also had legislators from around the world announcing their plans to support the adoption of bitcoin in their own country. Indira Kempis, a senator in Mexico, announced that she plans to propose regulation in her country to recognize bitcoin as legal tender. Also, the president of an economic development hub in Honduras, announced that bitcoin acts as legal tender there and Miguel Filipe Machado de Albuquerque, the president of Portugal’s Madeira region, announced that bitcoin investors will pay no personal income taxes.

Finally, Blockstream CEO Adam Back announced that his company, in partnership with Jack Dorsey’s Block, is developing a solar-powered bitcoin mining facility that will be powered by Tesla’s battery and energy technology. The solar-powered site relies on excess daylight to power bitcoin mining operations located in West Texas with a goal to achieve zero-emission energy during the mining process. “We’re interested to prove out our thesis that bitcoin mining can help fund green power infrastructure” Back said in an interview. Not to be outdone, North Dakota announced its plans to invest another $3B to accelerate its greener crypto mining operations with a promise to create the “cleanest crypto on the planet.” More proof that bitcoin mining is spurring investment in clean energy.

Is Yuga Labs becoming the Web3 version of Disney?

On March 11, the most important deal in NFT history to date was finalized. Yuga Labs, the creator of Bored Ape Yacht Club (BAYC), announced it had acquired the rights to the CryptoPunks and Meebits collection from creator Larva Labs. Bored Apes and CryptoPunks are the two most valuable NFT collections by market cap and hold a combined worth of over $5.8 billion at the time of writing this. Yuga Labs now “owns” (we will dive into what it means to own an NFT collection in just a bit) the three most valuable NFT franchises in the world (BAYC, CryptoPunks, and bored ape spinoff Mutant Ape Yacht Club) and 4 of the top 8 collections if you include Meebits. However, before we get into what this means, it’s important to understand the history of these two iconic collections.

CryptoPunks were launched on June 23, 2017, and though they weren’t the first NFT collection ever created, they were the first to reach widespread recognition and quickly grew to become the most valuable NFT franchise by a wide margin. In addition to being early, what made the Punks unique was their counterculture vibe, both in terms of the aesthetics of the images as well as the community that formed around them. That vibe resonated with many of the original Punk owners who were early to the web3 movement and tended to be very crypto savvy.

The structure of the collection also made the project wildly successful and has since set the standard that many NFT collections would later emulate. There are a total of 10,000 Punks, each with their own distinct characteristics. Furthermore, there is a hierarchy of traits with some being rarer and more valuable and the traits are randomly generated so that no two Punks are exactly alike. Many of the most popular traits such as hoodies were later copied by other NFT projects as either homage to the Punks or simply because it was known the market liked certain traits and it increased that collection’s chance of success.

For years CryptoPunks was the undisputed king of all NFT collections by all measures. Individual Punks held the record for being the most valuable with the rarest Punks selling upwards of nearly $24 million for a single NFT. No other NFT collection was more influential on the NFT market nor was there a collection anywhere close to as valuable as the Punks. Well, that was until April 2021 when the apes hit the market.

Like the CryptoPunks, Bored Ape Yacht Club pushed the industry forward in several important ways. Prior to BAYC, most collections focused mainly on selling at the highest price or creating escalating prices during the minting process. In contrast, the Apes had a relatively low minting price of 0.08 ETH that was the same among every mint which resulted in a much fairer launch process and a much healthier ecosystem. Second, the Bored Apes had a very different aesthetic to them that had a more mass-market appeal. This distinctive look resonated with the market in a way prior collections had not and thus, attracted a whole new set of market participants (there is roughly only 9% overlap between Ape and Punk holders).

However, the most important contribution BAYC made to the NFT market had to do with the IP. In the traditional model, not just NFT collections but the traditional art and media world as well, when someone buys a piece of art or a collectible, the buyer owns that individual piece but not the IP on which that piece is based. For example, if I buy a limited-edition poster of Mickey Mouse, I own a cool and potentially valuable poster, but I do not own the rights to Mickey Mouse. Disney retains the IP to that character.

Ironically, this is how the IP ownership for the Punks was designed. Despite the counterculture narrative, the rights structure of the Punks was that each Punk owner owned their individual Punk, but the IP of the franchise was owned by the creator, Larva Labs. Even though the core values held by Punk owners were very much in line with decentralization and the web3 ethos, the ownership structure around those rights were very corporate in nature.

BAYC flipped this on its head. Yuga Labs, the creators of BAYC, gave full commercial rights to each individual owner. Rather than keeping sole control of the IP, Yuga Labs allowed any owner to do with their ape whatever they like. They could start a coffee business or microbrew and use their ape as their logo because unlike the Punks, the individual owned the right to the IP of that unique ape. In return, Yuga Labs receives a 2.5 percent royalty on each BAYC sale on the aftermarket, which resulted in $127 million in net revenue in 2021 and the creators are forecasting $455 million in 2022. Despite being more “mass market”, BAYC designed their collection much more in line with the ethos of web3 then any NFT collection before them, including the Punks. This gave the BAYC community a very different vibe and culture than any other NFT project. As a result, BAYC became the fastest growing NFT collection in history and the collection is now more valuable than the Punks. Today, Bored Apes and Punks are the clear blue chip NFT collections to own.

Building on top of what the Punks had initially established, BAYC evolved the NFT market and created the new gold standard for how NFT projects are designed. In this way, BAYC changed the industry forever and its highly unlikely we will ever see a future NFT collection issued in which the community does not have any rights to the IP.

Which brings us back to the acquisition by Yuga Labs. There was (and to some degree still is) a fear among Punk holders that Yuga Labs might ruin what made the Punks so great in the first place given the vastly different cultures. However, after acquiring the rights to the CryptoPunks, Yuga Labs transitioned the rights agreement for the Punks to the same rights agreement as the Apes. Now Punk holders own the right to the IP of their unique Punk in a way they never had before. Most would agree that this is a substantive improvement in the structure of the collection and decentralization of the Punks.

What really makes this acquisition interesting however, is where it goes from here. Like Disney holds the rights to Marvel, Star Wars and Pixar in addition to classic Disney IP, Yuga Labs has positioned itself as steward of the most valuable NFT franchises. Amy Wu, the head of FTX Ventures (a $2 billion fund that recently invested in Yuga Labs) believes that the goal for Yuga Labs is to become the web3 version of Disney. “They see themselves as holding valuable IP that they want to build, essentially, a media entertainment empire with” Wu said in a recent interview.

Yuga Labs is already in development of a metaverse gaming project called Otherside that would incorporate all the NFT collections under their umbrella. Reportedly, the in-game economy will run on their recently released token, ApeCoin. So, it’s obvious Yuga Labs has plans to foster the growth of the collections but what might be even more powerful is what gets created outside of Yuga Labs.

Facebook doesn’t create its own content, its users do. YouTube doesn’t create its own content, its users do. The beauty of Yuga Labs giving the IP to the individual holders is that it gives owners the creative license and incentives for them to create whatever they like. It might be businesses, or games or ideas we haven’t even thought of yet. But having thousands of individuals experiment with their IP drastically increases the odds of the next big thing emerging within Yuga Lab’s umbrella then if they tried to do it all themselves. Not only is Yuga Lab’s acquisition important because of the consolidation of the top franchises under one parent organization, its important because Yuga Labs is clearly willing to experiment with a new business model that is web3 native in a way no other organization has ever done. It’s an ambitious plan and who knows if Yuga Labs will be successful, but Yuga Labs is running the perfect playbook on how to disrupt traditional media and entertainment.

In Other News

The U.S. Senate Republican Policy Committee (RPC), has issued a policy paper on crypto titled “Cryptocurrency Goes Mainstream,” signaling they are beginning to see crypto as a voting block.

Many states, eager to attract the jobs they think the industry will bring, are rushing to grant the legislative wishes of the crypto companies.

Lightning Labs announced Tuesday that it is launching the Taro protocol, a technology that will route fiat-pegged stablecoins and other digital assets through the bitcoin monetary network.

Oklahoma joins growing group of US states mulling tax incentives for bitcoin miners.

The Biden Administration and Capitol Hill policymakers appear to be focusing on stablecoins with regards to regulations.

Intel (INTC) has launched its second-generation bitcoin mining chip which is supposedly one of the most “efficient” chips on the market.

Citibank is losing a number of its top executives to crypto.

Luna Foundation Guard buys another $231 million of bitcoin. Then bought another $100 million more.

Cash App now lets users automatically convert paychecks to bitcoin as it expands its Lightning network support.

Ethereum Layer 2 networks hit “critical mass” as the merge approaches.

Following weeks of speculation, Ethereum core developer Tim Beiko confirmed that the Ethereum network’s transition to proof-of-stake (PoS) will not be in June but “likely in the few months after.”

Terra’s new stablecoin pool makes waves in DeFi.

Tennessee Titans become the first NFL team to accept bitcoin.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS