By Brett Munster

Good Morning!

It’s been another wild couple of weeks so let’s jump right into it.

Price may be down, but the fundamentals are up

It continues to be a turbulent year for the crypto markets with regards to price action. Bitcoin has fallen 57.5% YTD and 70.1% since its all-time high in November 2021 while the rest of the crypto markets have fared even worse during that time span. Like during the crashes in 2014 and 2018, the declarations that crypto is dead are resurfacing. For the record, bitcoin has been declared dead at least 455 times during its lifetime by various media publications. Not even one of those declarations were correct then and not a single one of them will be right this time around because although price might have fallen, the fundamental metrics of bitcoin are stronger than ever.

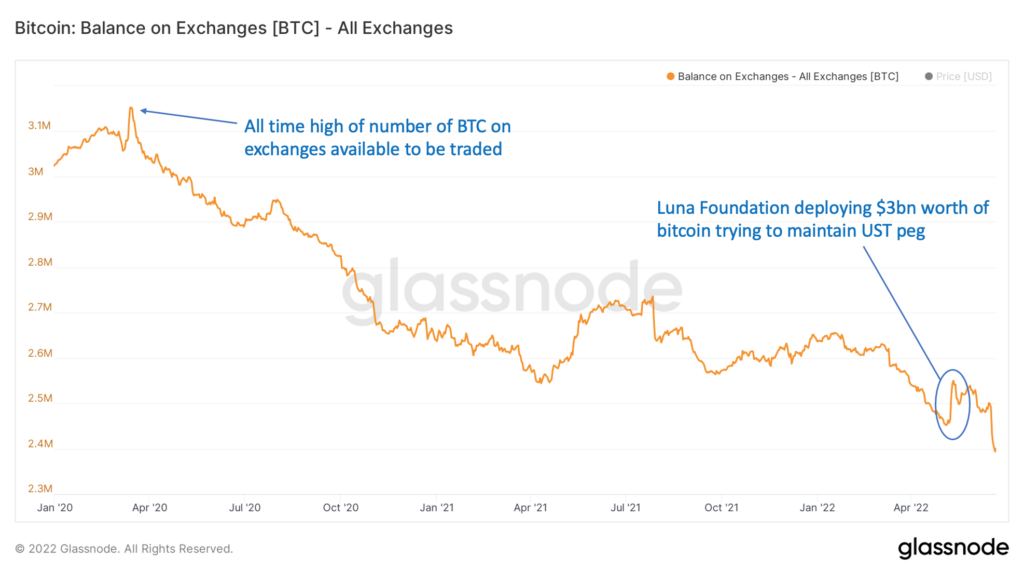

Let’s start with supply. As we have covered in past newsletters, ever since March 2020 there has been a steady trend of bitcoin coming off exchanges and put into cold storage. Typically, in a bear market where there is uncertainty, we would see coins being taken out of cold storage and deposited back onto exchanges indicating an intent to sell. However, this currently isn’t the case. Other than the ~80,000 coins that were dumped on the market by the Luna foundation in a failed attempt to defend the peg of UST, we have continued to see a steady flow of bitcoin out of exchanges and put away for long term accumulation.

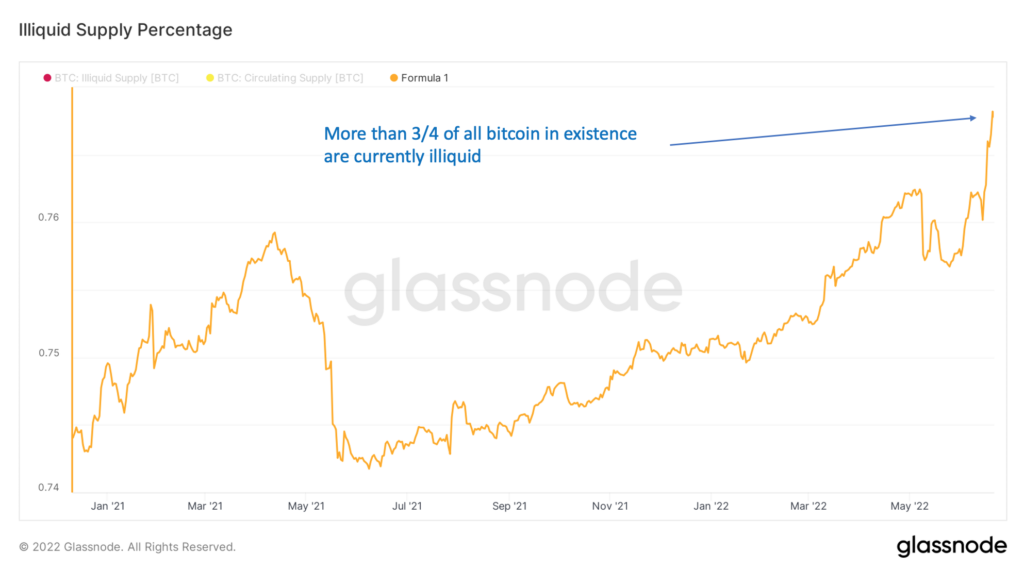

The result of this has been an increasing percentage of the total supply of bitcoin becoming illiquid. As of writing this, nearly 77% of total available supply is not available to be traded indicating there is a significant cohort of holders with long term conviction about this asset and is happily scooping up BTC at a severe discount.

Even more important for the long-term health of bitcoin than the supply squeeze that has been forming is the simple fact that bitcoin’s monetary policy remains unchanged. The total supply is still capped at 21 million. Furthermore, the network continues to issue the same amount of BTC with each new block and despite hash power on the network reaching new all-time highs (more on that below), the issuance rate remains constant just like it has for the past 13 years.

We do not have that same predictability or transparency with any other currency in the world, including the dollar. On June 15th, the Fed raised interest rates by 75 bps. I’m by no means a macro economist so I will leave it to people much smarter than me to determine what impact that will have on the economy. However, what strikes me as completely archaic is that the entire financial world waits on the edge of their seats for a small group of unelected officials to tell us what the price of money is going to be for everyone on the planet. And the decision by that small group of individuals behind closed doors has major ramifications for the entire global financial system. Everything including stocks, bonds, housing, and savings are impacted. Even worse, no one knows what the Fed will do in the future or when they might do it. Many have predictions, but no one actually knows. How strange is it that a mechanism in our financial system this important is so opaque that thousands of analysts waste countless hours analyzing and interpreting every word the Fed says (or doesn’t say) to ascertain some meaning and guessing what their next move will be?

Yet there is no guessing required with bitcoin’s supply. There is only one asset globally that has not changed its monetary policy over the last two years, let alone for the last ten. Only one with a monetary policy that is independent, predictable, and reliable. Bitcoin continues to produce block after block, uninterrupted and without a single fraudulent transaction or change in its supply issuance. In other words, nothing about the recent dip in price has altered the trust one can have in bitcoin’s system.

Nothing has changed with bitcoin’s supply dynamics in the last few weeks, but what about demand? Surely if price is falling, demand for the cryptoasset must be shrinking right? Nope.

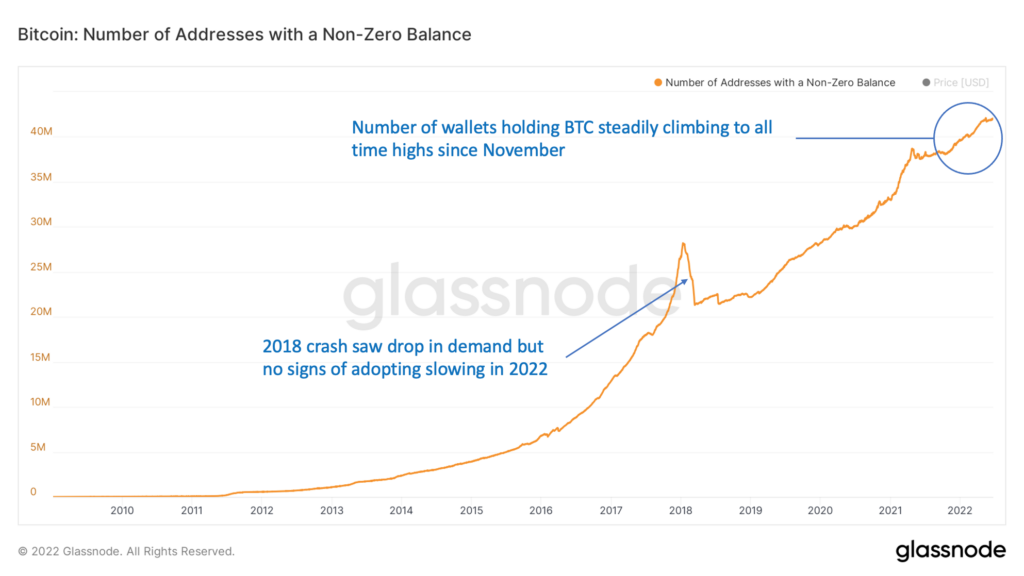

As we can see in the graph below, the number of wallets with a non-zero amount of bitcoin in them has been steadily growing since bitcoin hit its all-time high in price last November. In fact, we keep setting new all-time highs in the number of addresses holding bitcoin over the last year even as price has fallen. If we zoom out and look since bitcoin first launched, adoption very much looks like the beginning of an exponential curve. We also notice that unlike in 2018, when the demand for bitcoin did drop during that price crash, there are no signs of adoption slowing today.

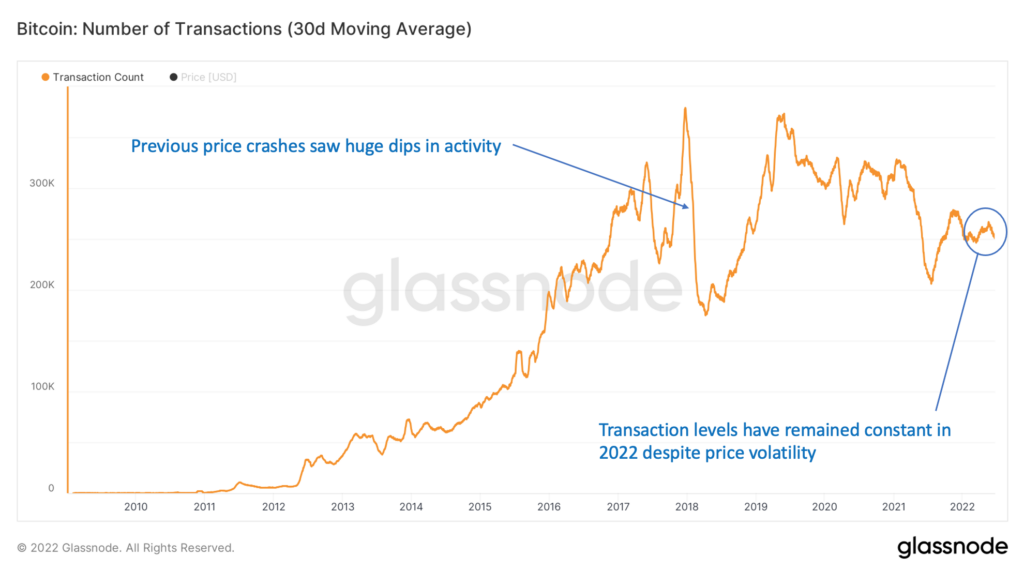

We can also look at the number of transactions processed by the bitcoin network. Unlike the last market cycle crash in 2018, transaction count has remained steady. As the graph below shows, we see active addresses and total successful transaction count remaining in line with their historical ranges.

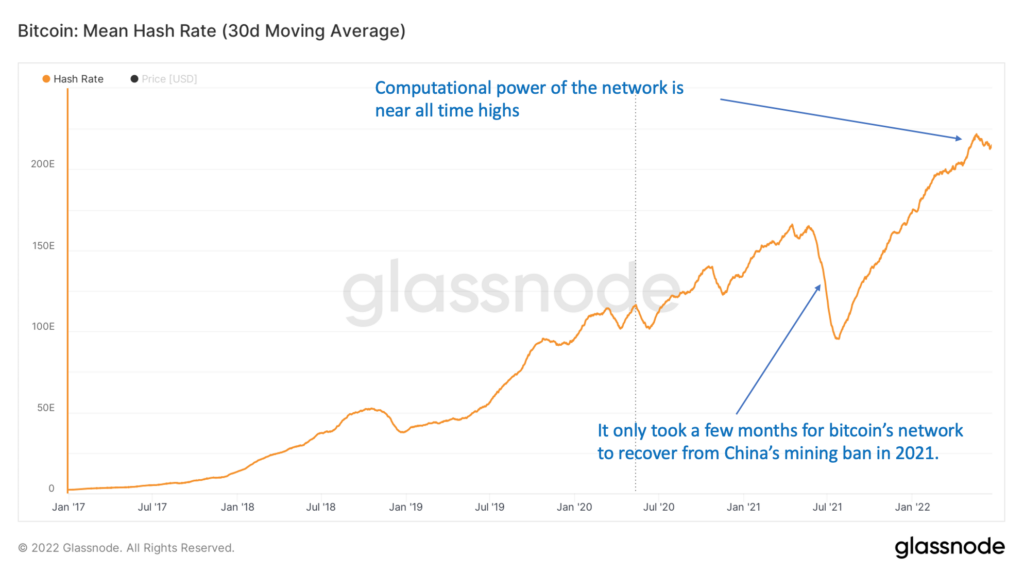

Or we can look at hash rate on the network. Hashrate is a measure of the computational power per second used when mining. When aggregated across all miners, it’s a measure of the computing power of the Bitcoin network. Hash rate is not only a good measure of the security of bitcoin but also the health of the network. Increasing hash rate means more miners are flocking to the network to participate. As we can see in the chart below, bitcoin’s hash rate has been setting new all-time highs throughout 2022.

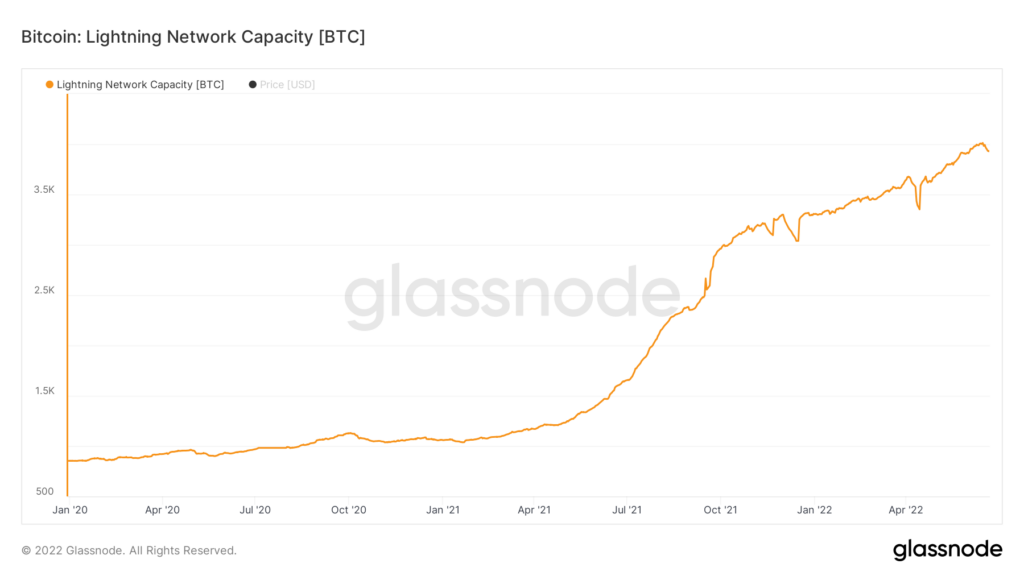

Finally, let’s look at the growth of the Lightning Network. The Lightning Network is a network of payment channels built on top of Bitcoin’s base layer blockchain that can handle thousands of transactions per second and settle them all on the Bitcoin blockchain as one transaction. Thus, the Lightning Network enables instant, secure, and nearly-free bitcoin denominated payments to anyone in the world. In the last year, the Lightning Network has grown 150% and as we can see in the chart below, the capacity of the Lightning Network is currently at all-time highs. More businesses such as CashApp and Robinhood as well as countries such as El Salvador that deal with bitcoin have started to implement it. This is a strong indication of the growing utility of bitcoin as a payment system, not merely as a store of value or speculative investment.

Despite the recent price crash, bitcoin’s fundamentals are arguably stronger now than any time in its history. The supply issuance remains unchanged since its launch in 2009 with HODLers scooping up bitcoin and taking them out of the circulating supply. At the same time adoption of bitcoin continues to grow throughout the world. Hence, the underlying value of the bitcoin network continues to increase.

And yet, value and price are not the same thing, nor do they always move in tandem. Increases in interest rates, coupled with quantitative tightening, have driven selloffs across all asset classes. We saw a similar market wide selloff in March 2020 when bitcoin fell from $10,400 to $4,500. Again, that period saw a dislocation in price compared to value as fears of the pandemic began to spread but the fundamentals of bitcoin remained unchanged. 13 months later, bitcoin reached $64,000.

Or we can look back at the three other major market crashes in bitcoin’s life. In 2011, bitcoin fell 93.5%. The run up in 2013 was subsequently followed by bitcoin’s price falling 85.1% in 2014. And in 2018, bitcoin’s price fell 83.6% from its peak in 2017. And yet, after each crash bitcoin has gone on to set new all-time highs in price within a couple years after crashing. Having invested through two of those crashes, I can tell you while the outlook in the media and social media was bleak, the thing that continued to give me conviction was the growth of the underlying metrics regardless of price action. Once again, I am seeing the same pattern repeat itself.

Market crashes are never fun, but the indicators of growth and adoption of the bitcoin network are telling a different story than what price alone might lead you to believe. Despite this drawdown, no other asset has better fundamentals than bitcoin. Bitcoin’s price has momentarily dislocated from its value and over a long enough time horizon, price and value will converge just like they have after every previous market crash. For this reason, as I argued in previous newsletters, I believe this current period of time is one of the best risk adjusted buying opportunities in bitcoin’s history.

As always, the on-chain data is provided by Glassnode. If you would like to have access to the data yourself, you can sign up here:

Zero Degrees Celsius

Other than price action, the biggest crypto news over the past couple of weeks is the possible insolvency of Celsius. Celsius is a crypto lending platform where users can deposit their cryptoassets or stablecoins and earn a yield in return. With over $11 billion in cryptoassets under custody, Celsius is one of the largest “crypto banks” along with BlockFi and Nexo. Celsius experienced tremendous growth the past couple of years by offering some of the highest yields of any service on the market. According to its website, Celsius offers up to 18.6% APY for various cryptoassets.

You can see why Celsius was so attractive to many people. Who wouldn’t want to earn 8-18% per year compared to the average rate of 0.07% for a traditional savings account. In addition, Celsius made it so simple. No need to learn all the complexities of investing in DeFi, just deposit your assets into Celsius, let them handle all the backend, and collect a very attractive yield every month. If this sounds too good to be true, your instincts are right.

So how does Celsius provide such high interest rates for its customers? Well apparently, the answer is that it engaged in some of the riskiest parts of the crypto market and operated more like a highly levered hedge fund rather than a bank.

First off, Celsius was deeply involved in Terra’s USDT stablecoin that collapsed last month. Blockchain analysis firm Nansen confirmed that Celsius was one of seven whale wallets that contributed to the UST depeg. According to some reports, Celsius, which promised high rates on stablecoins, held upwards of $500 million of customer funds in UST that has since fallen in value by 99%. The company also lost $54 million when the high yield protocol BadgerDAO was hacked.

Then there was the large position of “Staked ETH” which also fell in value over the past couple of weeks. Before we get into what this means for Celsius, we first must understand stETH.

Ethereum is currently working on changing its consensus mechanism (ie: how it validates transactions on its blockchain) from Proof-of-Work to Proof-of-Stake. Without getting too in the weeds on the differences, Proof-of-Work relies on computational power to operate and secure the network whereas Proof-of-Stake relies on network participants locking up a portion of their ETH (aka “Staking”) to validate transactions. In prep for this transition, Ethereum developers created a separate chain called the Beacon Chain which runs parallel to the main Ethereum blockchain and will eventually combine with the Ethereum mainnet during the merge.

Users can start staking their ETH today on the Beacon Chain to earn staking fees (ie: earn more ETH) similar to how miners contribute computing power to earn BTC. However, any assets held on the Ethereum Beacon Chain are locked up until after the merge. In return, users receive Staked ETH (stETH), which they can later redeem for ETH. In theory, stETH should trade at a 1-to-1 ratio to ETH. However, it’s not officially pegged to ETH, meaning it doesn’t HAVE to trade 1-to-1. With the recent turbulence, stETH has begun trading well below ETH which brings us back to the problems at Celsius.

For ETH deposits, Celsius promises up to 8% in interest, with a lot of that yield generated from staking on the Ethereum Beacon chain. In fact, Celsius was one of the biggest holders of stETH. 73% of its ETH holdings are tied up in staking on the Beacon Chain meaning all those assets are illiquid. As the price of stETh began to fell and unable to redeem their stETH, Celsius now owed its users more than the value of the Staked ETH they were holding. Essentially, Celsius is functionally insolvent on their ETH position.

As concerns about Celsius began to increase, that loss in confidence led to more and more users attempting to withdraw their assets further exacerbating the problem. On June 13th, Celsius halted all withdrawals on their platform causing even more panic. The company has since asked its users to give it more time to stabilize liquidity and hired lawyers to help with a possible restructure. There are also reports that Goldman Sachs is looking to raise $2 billion to buy Celsius’s distressed assets.

My heart goes out to anyone who put their money with Celsius expecting it to be safe and are now wondering if they’ll ever get their money back. I hope Celsius can find a cash infusion so that anyone who has assets locked up gets them back. However, let’s be clear about one thing, Celsius is not Decentralized Finance (DeFi).

Celsius is a centralized entity that custodies and manages crypto on behalf of its users. Like a traditional bank, it takes control of your deposit, uses your assets to generate a profit, and promises you a fixed interest rate in return. The only difference was Celsius was taking cryptoassets and depositing those assets on chain.

But here is the thing, Celsius never disclosed to its customers what parts of the crypto market it was engaging in. Much of Celsius’s marketing and the info it shared with customers was, at best, opaque. There is no way for users to easily assess the risks of using Celsius and instead, they must be savvy enough to use on-chain analytics platforms like Nansen to track the company’s deposits in various protocols. In fact, questions around the company have persisted for years with numerous warnings from the crypto community dating back to 2020 (here, here, here) as well as cease-and-desist letters sent by four different states.

This isn’t to say that DeFi is perfect, but Celsius highlights the opportunity for fundamental improvement over traditional finance because on-chain transparency keeps DeFi fair and honest. In DeFi, every deposit and every loan is clearly posted on the blockchain so we can monitor the risk and solvency of a platform 24/7/365 in real-time. We can see exactly how much exposure a platform such as Aave has to stETH, at what prices these positions would be liquidated, and how much liquidity is available to service them. Compound Finance, one of the largest DeFi protocols, shows daily updates for the total deposited and the total borrowed in each asset it supports right on its website. As a result of this transparency, users can more easily make informed decisions.

In the case of Celsius and other centralized platforms, we don’t have nearly the same level of insights and are forced to trust entities who are incentivized to hide any vulnerabilities they may have. In fact, it’s only through DeFi’s radical transparency and on-chain monitoring that we are able to figure out what caused Celsius’s insolvency. The truth is DeFi markets are fair and efficient, albeit sometimes brutally so. Despite the volatility in the markets, no major DeFi app has paused trading, halted withdrawals, or required emergency financing. There are no bailouts and when those taking risky positions are wiped out it is contained to that entity.

DeFi still has a long way to go, especially with regards to education and making it simple for crypto novices to participate. Today, the technical expertise needed is too high of a barrier for most people to do it themselves. However, in time, that will get solved and when it does, individuals will have greater transparency of risk, more control over their finances, and access to the same opportunities as institutional players.

In Other News

Members of Congress wrote a letter to the EPA detailing the benefits of Bitcoin mining.

Crypto exchange Crypto.com and lending platform BlockFi plan to cut a total of more than 400 jobs while Coinbase will lay off around 1,100 employees as part of a cost cutting plan.

New research shows that “bitcoin consumes 56 times less energy than the classical [financial] system.”

Multi-billion dollar crypto fund Three Arrows Capital (3AC) has reportedly failed to meet margin calls from its lenders, raising suspicion of insolvency after the market’s downturn triggered unforeseen liquidations for the Singapore-based company.

Both Genesis and BlockFi confirmed it liquidated a “large client’s” position after 3AC failed to meet a margin call.

BlockFi secured a $250 million credit facility from crypto exchange FTX and will be used to fulfill client balances across all accounts.

A class action lawsuit accuses Do Kwon, Terraform Labs (TFL) and others of selling unregistered securities and making false statements about the stability of the TerraUSD (UST) stablecoin and related token Luna to induce investors to purchase them.

“Mr. Wonderful” Kevin O’Leary is buying the crypto dip, including Bitcoin, Ether, and Web3 projects.

ProShares, an exchange-traded fund (ETF) provider, announced an ETF that will give investors an opportunity to short bitcoin.

A Bank of International Settlements report reveals that over 90% of central banks worldwide are researching the feasibility of adopting central bank digital currencies.

Binance.US will start implementing zero trading fees on bitcoin transactions.

Coinbase rolls out Polygon support for transfers of ETH and USDC.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS