By Brett Munster

Welcome to the Cointucky Derby

It’s been over ten years since the first ETF application was filed and rejected but on Wednesday January 10th, the SEC finally approved a spot bitcoin ETF. Actually, they approved 11 different applications which all began trading on January 11th. Since the inception of this newsletter, we have been critical of the SEC’s reluctance to approve a spot ETF and for good reason. I think SEC’s own commissioner Hester Pierce summed it up best in her statement following the ETF approval:

“Today marks the end of an unnecessary, but consequential, saga…For reasons I have explained many times before, the logic of the long string of denials is perplexing. The goalposts kept moving as the Commission slapped “DENIED” on application after application… until a court reminded us that our unexplained discounting of the obvious financial and mathematical relationship between the spot and futures markets falls short of the standard for reasoned decision making…We squandered a decade of opportunities to do our job. If we had applied the standard we use for other commodity based ETFs, we could have approved these products years ago, but we refused to do so until a court called our bluff.”

We covered that bluff last September when the court ruled in the Grayscale case the SEC’s rationale for previously denying ETF applications was “arbitrary and capricious” which forced the SEC to reverse their decade long position. We clarified why the SEC lined up numerous applications to approve all at once, explained why this is a watershed moment in bitcoin’s history and argued why the long-term implications of a bitcoin ETF are not reflected in the current price. We highlighted how January 10th was the final decision date on Ark’s ETF application making it the de facto deadline and why for the last few months, there was a 90% probability an ETF would be approved by then.

You read this newsletter, so you have known for months that it was extremely likely that the ETF was going to be approved last week. As it turns out, most people who work in the traditional financial market don’t read this newsletter (I know, I was shocked when I found out too). Prior to the ETF being approved, investment management firm Bitwise conducted a survey exploring how financial advisors, who manage roughly half of all the wealth in America, think about crypto. As of two weeks ago, only 39% of all financial advisors believed a spot bitcoin ETF would be approved in 2024. If you are a financial advisor reading this newsletter, congrats, you are better informed on the best performing asset class over the last decade than at least 61% of your peers.

But there was an even more illuminating takeaway from the survey regarding the ETF. As of Jan 1, only 19% of advisors said they had the capability of buying crypto in their clients’ accounts yet 88% of advisors said they would be interested in purchasing bitcoin once an ETF is approved. With the ETF approved, now every advisor has easy access. They won’t all come in at once because many are just now beginning to do their diligence and get approval from their compliance departments. But over the next year or two, expect more and more financial advisors, pension funds, endowments, sovereign wealth funds, and retail investors to start allocating to bitcoin. As much as we like to see the eye-popping numbers from the first day (more on that below), the ETF approval isn’t a one day or one week story. This trend will play out over the next few years.

And if the traditional financial market isn’t going to read this newsletter, Wall Street is going to make sure they know about the ETF. One unique dynamic of approving so many applications at once, is that whoever reaches scale the fastest has a competitive advantage. Many investors often will gravitate to the largest ETF simply because they see that as a signal for “best.” With numerous players all launching at the same time, the race to accumulate the most assets is incentivizing these firms to spend massive amounts of money on marketing. Some have dubbed this the “Cointucky Derby.” We are already seeing national commercials and marketing campaigns from Blackrock, Bitwise, Fidelity, Ark, VanEck, Hashdex, and others. Many of the sponsors, including Blackrock, are advertising the bitcoin ETF on the front page of their websites. The issuers have slashed their fees multiple times in order to undercut each other. After years of hating on bitcoin, Wall Street is now bitcoin’s largest marketing department.

That marketing effort seems to already be making an impact. The Wall Street Journal described the launch of the ETFs as a “monster start” while Bloomberg wrote that the new ETFs “took Wall Street by storm.” $720 million of net new capital flowed into the 10 new sponsors on the first day. After day two, that number climbed to $1.4 billion. By all metrics (volume, number of trades, flows, media coverage), the ETF was a historic event leading to Bloomberg ETF analyst Eric Balchunas declaring this was the biggest opening in ETF history. Crypto native firm Bitwise’s (BITB) low fees and commitment to donating 10% of their profits to bitcoin developers has paid off early as it leads the pack in capital after two days, beating out traditional players such as Blackrock and Fidelity.

And despite the amazing start, BTC’s price slumped a little bit following the launch of the ETFs. To understand the reason for that, we have to turn our attention to the 11th issuer, Grayscale (GBTC). As we covered last September, Grayscale winning its lawsuit against the SEC was the single biggest catalyst that enabled the ETFs to be approved after a decade of denials. At the heart of that lawsuit was the fact that Grayscale had not been allowed to convert its GBTC trust into an ETF. Unlike all the other issuers of ETFs last week who were starting from $0, GBTC already had accumulated $27 billion of capital since it launched back in 2013.

The team at Grayscale decided to take a calculated risk when the ETFs were approved. While most other issuers are offering their ETFs for low fees between 0.19% to 0.30%, Grayscale decided to set its fee at 1.5%. GBTC is the most expensive ETF on the market by a wide margin. Grayscale is hoping most of its capital will not leave despite charging ridiculously high fees because either the tax implications of moving money out is so great (if an investor had been in GBTC for years they likely have a lot of capital gains and selling GBTC would trigger a tax event) or that people are lazy and won’t go through the effort of switching. Grayscale knew it was going to lose some capital from people moving to a lower fee vehicle, it was just a matter of how much.

In the first two days, GBTC saw $579 million of outflow. All in all, not too bad for Grayscale but that did mean there was over half a billion dollars of sell pressure in the market that offset much of the new capital coming into the other 10 ETFs. GBTC dominated trading volumes over the first two days because of its size which is likely what suppressed the price of BTC.

Here is the good news. Those who were going to get out of GBTC are going to do so early which means the vast majority of that sell pressure likely goes away within the next couple of weeks.

Here is the even better news. Most advisors were not expecting this to be approved, some had no idea a bitcoin ETF was even in the works. Most advisors simply weren’t prepared to start allocating to a bitcoin ETF on day one. But they will over time. The ETF isn’t even available in most model portfolios which many advisors use to manage client funds. It will take time for advisors to do their research and for the ETF to go through compliance and get approval to be put on financial platforms that advisors use. Thankfully, we now have an army of Wall Street salespeople educating them on the advantages of adding BTC to a portfolio.

Like we said earlier, the impact of the ETF will likely take the rest of this year before its fully realized. Day one numbers are fun and the ETFs are off to a great start, but the real story will be how much is accumulated by the end of 2024. In past issues we provided the case for why we would see $10-$50 billion of inflows over the course of this year. Standard Chartered Bank thinks we are way too conservative as they put out a report that they anticipate upwards of $100 billion of inflow this year.

Last week was a major milestone for bitcoin and the crypto markets but it’s worth putting the first few days of trading in perspective given the ETF saga started over ten years ago and will continue to play out in the coming years. Once again, I think SEC commissioner Hester Pierce had a great perspective on why this approval is so historic.

“Although this is a time for reflection, it is also a time for celebration. I am not celebrating bitcoin or bitcoin-related products; what one regulator thinks about bitcoin is irrelevant. I am celebrating the right of American investors to express their thoughts on bitcoin by buying and selling spot bitcoin ETFs. And I am celebrating the perseverance of market participants in trying to bring to market a product they think investors want. I commend applicants’ decade-long persistence in the face of the Commission’s obstruction.”

Bull Case for the Ethereum Ecosystem in 2024

Coming into 2024, the excitement in the market surrounding Ethereum can at best be described as muted and even outright negative from some analysts. A large part of this is due to Ethereum’s “underperformance” in price last year (only in crypto can a 90% annual return be considered underperforming). In comparison, bitcoin was up 158% and Ethereum’s closest competitor, Solana, was up a whopping 900% in 2023. In addition, Solana’s friendlier interface and faster transaction speeds have given rise to a narrative that Ethereum is stuck in the middle between bitcoin and Solana. It’s not quite money in the way bitcoin is and it’s not as fast as Solana. The prevailing market sentiment surrounding Ethereum right now is relatively low compared to other networks. In this issue, we want to dig into the reasons why that market sentiment is a little misguided.

Ethereum’s fundamentals continue to improve

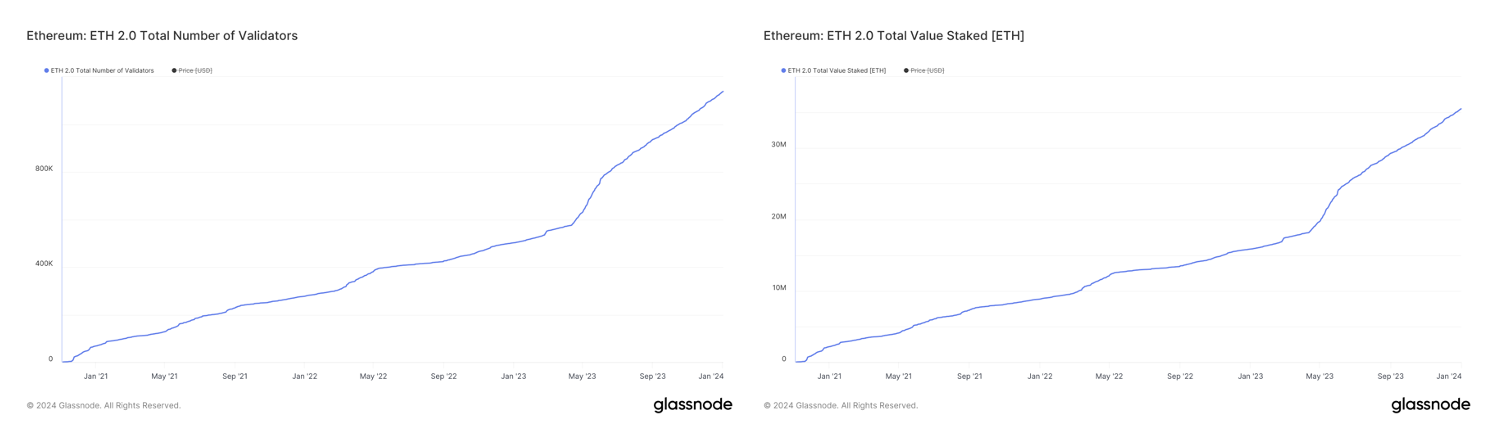

Since migrating its consensus mechanism from Proof-of-Work to Proof-of-Stake, the number of validators on the Ethereum network (ie: those that process transactions) and the amount of ETH staked on the network have grown rapidly. Ethereum is by far the largest Proof-of-Stake network and is continuing to grow at an impressive rate which bodes well for the security and health of the network long term.

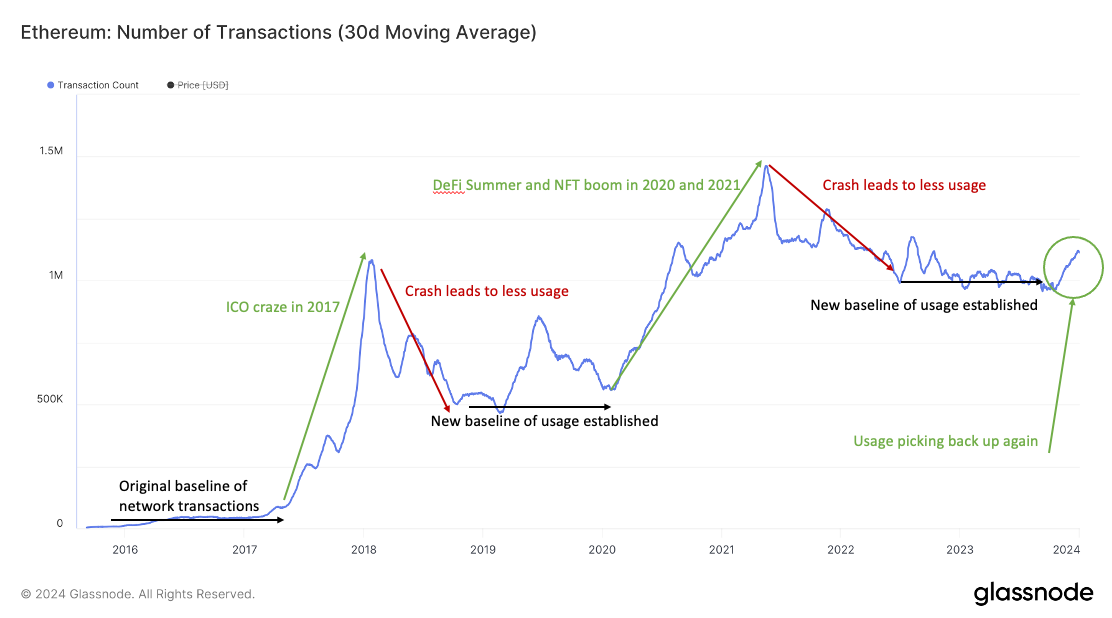

The usage on the network is also beginning to rebound. In previous cycles, new use cases have driven usage of the Ethereum network to new highs. In 2017 it was the ICO boom. In 2020 it was DeFi summer and in 2021 it was NFTs. The mania from each of these new use cases eventually causes price to reach unsustainable levels and crash back down along with usage. But each time it does, it establishes a new base floor of users that is significantly higher than the previous cycle. So far 2024, we are starting to see the number of transactions on the Ethereum network begin to pick back up again, only this time from a higher base than any time in Ethereum’s history.

And unlike some other blockchain networks, Ethereum is capturing the value of that usage. Much like your favorite mobile apps pay Amazon a monthly fee for using its computing servers (known as Amazon Web Services), decentralized applications built on Ethereum pay a fee to the Ethereum network every time their product is used. Those fees are revenue to Ethereum validators. According to a recent report by Caleb & Brown, in 2023 Ethereum surpassed $10 billion in revenue over the course of its lifetime with $2.4 billion of that coming in 2023 alone. A report put out by global asset manager VanEck last year projected Ethereum could increase its annual revenue to $51 billion by 2030.

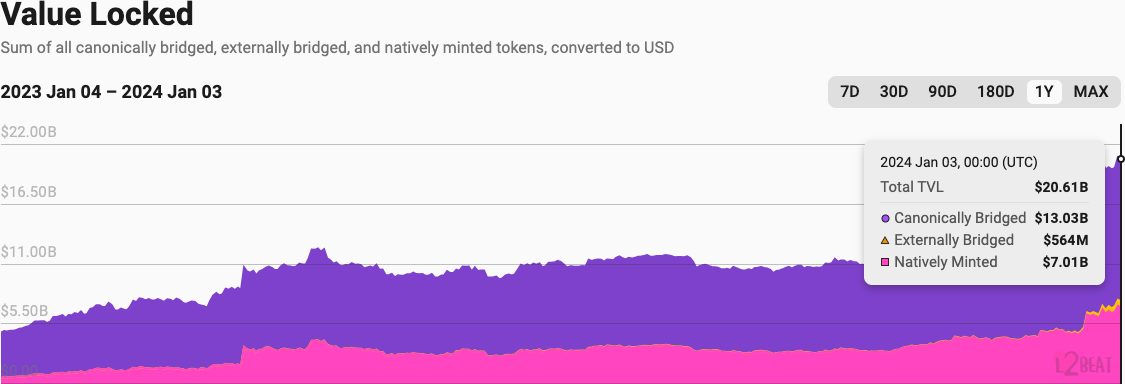

And it’s not just Ethereum’s base chain that is growing, many aspects within the Ethereum ecosystem are growing as well. Layer 2 (L2) solutions bundle multiple transactions into a single “rollup” that eventually settles on Ethereum thereby leveraging the base Ethereum blockchain as a data availability layer for settlement and security. This method has been instrumental in increasing transaction throughput and reducing average transaction fees from about $6-$10 on Ethereum to roughly 20-40 cents on L2’s like Optimism and Arbitrum. Because of the faster speeds and lower fees, growth of L2 networks has been exploding. In just the last year alone, total value locked (a measure of how much value is deposited in a protocol) on Ethereum Layer 2 networks has grown over 300% and now sits at more than $20 billion. In fact, Ethereum Layer 2 networks now have more TVL than all other smart contract base chains combined (ie: Solana, Avalanche, Cosmos, Cardano, etc…).

Source: L2beat.com

In addition to Layer 2 networks, DeFi is also seeing fresh inflows of capital. The TVL across all decentralized finance protocols on Ethereum has increased roughly 43% since mid-October and now sits at over $50 billion today. While the growth is impressive, the aggregate amount still only represents roughly 0.01% of the global financial assets meaning there is enormous growth potential for DeFi if adoption continues to grow. The majority of DeFi today still happens on Ethereum so if DeFi continues to see more capital flowing into the space, Ethereum is likely to benefit.

Despite some valid critiques, Ethereum still also boasts the largest developer base in all of crypto. Though there has been tremendous growth from other competitors (most notably Solana), the Ethereum ecosystem is still by far the largest network in several important categories including stablecoin liquidity, DeFi activity, and total fees spent by users. In addition, Ethereum has the longest track record of network reliability and a market cap that is 7x higher than the next largest smart contract network. Those network effects are not going away any time soon.

“Dencun” upgrade coming in 2024

With the rapid proliferation of L2 networks, the costs associated with storing data on-chain has emerged as a point of emphasis within the Ethereum community. This challenge is being addressed by the upcoming Dencun upgrade which introduces protodanksharding to the network.

We covered protodanksharding in detail last May but as a quick refresher, Layer 2 networks, despite being faster and cheaper to transact on than Ethereum, still must submit a significant amount of data to build consensus on Ethereum’s base chain. Moreover, it places a heavy burden on validators to download this data given an estimated 95% of the transaction fees on Layer 2s are due to costs associated with posting data to the base layer. The Dencun upgrade enables rollups to store large amounts of data on Ethereum for shorter periods at lower costs. This is expected to reduce the operational overhead for Layer 2 networks thereby increasing speed, reducing transaction costs on rollups by 90% or more, and decreasing the cost of running a node on the Ethereum network which should lead to a more robust and decentralized network. This increased speed and reduced costs will make Layer 2’s much more competitive with other high throughput chains (ie: Solana) thus alleviating many of the criticisms Ethereum is facing today.

This upgrade is slated to go live in Q2 or Q3 of this year. Look for the Dencun upgrade to be a major narrative in 2024 and potentially a catalyst for ETH’s price in the second half of 2024.

ETH as the Internet Bond

If bitcoin is digital gold because of its sound money principles, then ETH is the Internet Bond due to the yield ETH owners can earn. In a Proof of Work system such as bitcoin, miners are incentivized to contribute computing power to the network in exchange for the opportunity to earn block subsidies (aka new BTC). In a Proof of Stake system such as Ethereum, validators are incentivized to pledge their capital (aka “staking”) in exchange for the opportunity to earn a yield in the form of ETH.

In traditional finance, the bond market is the largest capital market in the world at $133 trillion. It’s significantly bigger than the stock market and is the “40” in the typical 60-40 portfolio construction. Bonds are nothing more than capital pledged from principal to an issuer (usually government or corporation) in exchange for the promise to be repaid that capital back plus interest. When viewed in this light, staking on a Proof of Stake blockchain is no different. Validators pledge capital to the Ethereum blockchain (the issuer in this case) in exchange for the promise that they can withdraw their stake at any time (aka get their money back) plus earn staking rewards (aka interest) as long as their capital remains pledged. The biggest difference is that validators don’t give their money to a government or company, they actively participate in the functioning of the blockchain. Proof of Stake systems allow, for the first time ever, anyone in the world to invest, participate, and profit off an open-sourced, decentralized digital economy.

Here’s the thing. That decentralized digital economy is outside of traditional finance. The yield validators earn is entirely dependent on supply and demand within the Ethereum ecosystem and does not change when the Fed hikes or cuts interest rates. In other words, staking yields are not correlated with the yields earned from the traditional bond market. All things equal, that lack of correlation is reason enough to buy and stake ETH because it can add diversity to the bond portion of any portfolio.

Of course, not all things are equal. Today, staking yields on Ethereum ranges between 4-6% which isn’t too far off from yields in traditional finance. But if the Fed starts cutting rates again, as it has indicated it would, it’s very possible yields from staking on Ethereum could become higher than yields investors can earn from bonds. If that happens, don’t be surprised if traditional financial players start rotating capital out of traditional bonds and into Ethereum.

Favorable Supply/Demand Dynamics

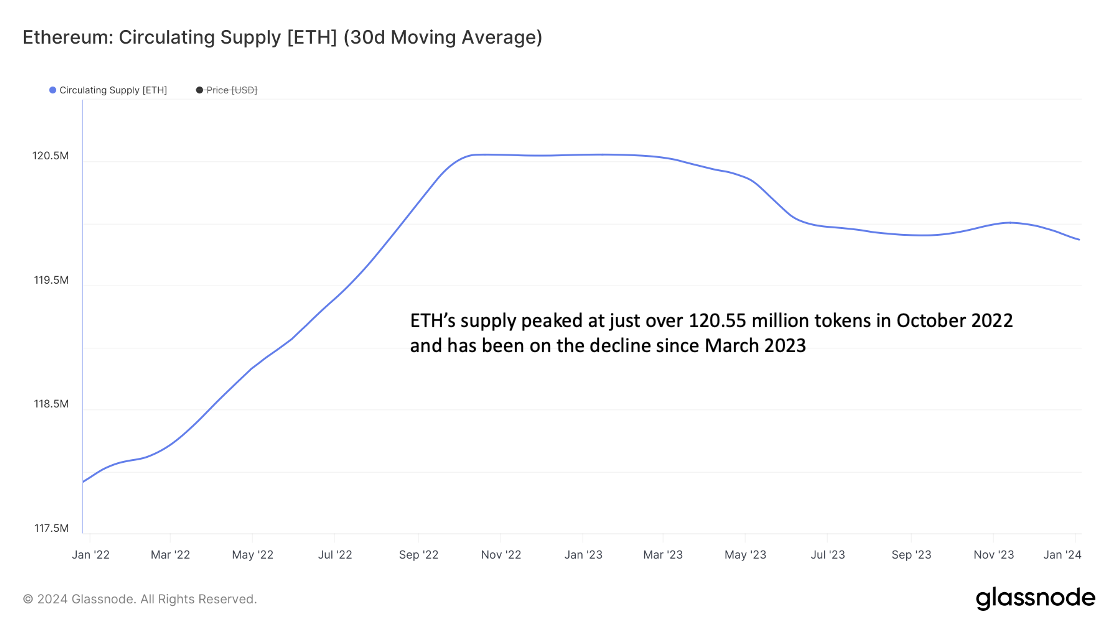

Ethereum’s supply schedule isn’t as predictable as bitcoin’s but it does have something going for it that bitcoin does not. Since August 2021, Ethereum has a burning mechanism built into its protocol that destroys ETH based on its usage. Every day, new ETH is created to incentivize validators to run and secure the network, but a portion of gas fees from users on the network is also destroyed. As a result, some days the net issuance of new ETH is positive (ie: inflationary) and some days its negative (ie: deflationary).

ETH’s total circulating supply peaked in October 2022. For a few months it held pretty constant but starting in March 2023, the total number of ETH in existence began to decline. The decrease in total ETH has intensified in recent months as activity on the network has picked up. It’s very likely ETH will continue to be deflationary throughout the year and we fully expect there to be less total ETH at the end of 2024 than there was at the start. This will be the first market cycle in which ETH has this dynamic.

But that’s just one half of the equation. On the demand side, we are already seeing transactions increase and money flowing into DeFi which, if those trends continue, would lead to increased demand for ETH. But a bigger catalyst might happen later this year. In November, Blackrock, Fidelity and six other applicants filed for an ETH ETF.

This story went under the radar due to the excitement around the bitcoin ETF but would be just as impactful for Ethereum as it would be for bitcoin. Just like bitcoin, an Ethereum ETF drastically increases access for mainstream investors because it allows ordinary investors to gain exposure to ETH in their regular brokerage accounts. Today, the only way to buy ETH is through crypto exchanges such as Coinbase. ETH isn’t available to most investors in their Charles Schwab, TD Ameritrade, Vanguard, or Fidelity accounts. There is no easy way to add ETH to your 401k account. That all changes with an ETF because it makes buying ETH like buying any other stock.

Furthermore, the move by Blackrock is a clear signal of acceptance to the entire financial world. Unlike bitcoin, which even the SEC has long said is not a security, ETH’s regulatory standing has been a little more nebulous. SEC chairman Gary Gensler has had no explanation for his inconsistency on ETH, an asset for which the SEC approved a futures ETF last fall and he has publicly called it a security but refused to answer that question directly in congressional hearings. Plus, the courts have routinely struck down Gensler’s notion that all cryptoassets are securities. An ETH ETF approval would significantly reduce the regulatory risk associated with investing in Ethereum and would likely open the floodgates for capital to come pouring into the asset, especially if investors are able earn a yield from staking.

The SEC delayed reviewing the applications until May which is a positive sign. They could have chosen to reject it outright so at least we know the SEC is taking the applications seriously. Besides, they were understandably too busy with the bitcoin ETF to deal with ETH any sooner. Last week, Bloomberg ETF analyst James Seyffart said that spot ETH ETF approval was still likely this year since the SEC had basically accepted ETH as a commodity by approving the ETH futures ETF (just like it had for bitcoin). In other words, the same reason why the judge ruled in the Grayscale case that the SEC could not deny a bitcoin spot ETF while at the same time approving a futures ETF also applies to Ethereum. That’s why Eric Balchunas (who correctly predicted the approval and timing of the bitcoin ETF last year) believes there is a 70% likelihood for the spot Ethereum ETF to be approved later this year.

If we do (granted that’s still a big unknown at this point) it’s possible ETH could see a huge influx of capital at the same time the total number of ETH is shrinking. Increasing demand, decreasing supply. Sometimes you just have to keep things simple.

Conclusion

Two years ago, ETH’s price was roughly the same as it is today. However, at that time the merge to Proof of Stake hadn’t been completed, the inflation rate of ETH was over 4%, and L2 activity was a fraction of what it is today. Now, the fundamentals behind Ethereum are improving, Layer 2 networks built on Ethereum are growing and DeFi is rebounding. The total supply of ETH is likely to decrease over the course of the year and either rate cuts or an ETF approval could drive significant amounts of net new capital into ETH. Ethereum is still by far the largest smart contract platform in crypto with much stronger network effects than any of its competitors. There are a lot of tailwinds for not just Ethereum but other networks within the Ethereum ecosystem such as Arbitrum, Optimism, Lido and other DeFi networks. While there is a lot of excitement regarding bitcoin due to the ETF (and deservedly so) and newer networks that hold great promise but are largely unproven, the market seems to be overlooking Ethereum a bit. It’s a little weird to say that the second largest crypto network is somewhat of a contrarian bet right now but that seems to be the state of crypto heading at the start of 2024.

As always, the on-chain data is provided by Glassnode. If you would like to have access to the data yourself, you can sign up here:

In Other News

The crypto industry has raised more than $78 million from 20 leading companies and voices to support bipartisan, crypto-forward candidates in 2024.

Investment management firm Bitwise has recently released the first-ever advertising for a spot Bitcoin ETF product.

Ethereum developers are targeting February for deployment of the next big upgrade.

Argentina has announced that the country legalized the use of bitcoin as currency in official contracts for settlements under a new economic decree.

Visa continues its foray into web3 as it pilots a crypto based customer loyalty program.

Why the planned fee for Grayscale’s bitcoin ETF is much higher than others.

Blockchain Association challenges Senator Warren’s crypto hiring criticism.

The number of vendors accepting bitcoin as a payment method increased by 177% in 2023, demonstrating a surge in adoption.

Circle confidentially submitted IPO papers with securities regulators, but no further details are known.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS