By Brett Munster

Regardless of whether the Fed does to interest rates, it’s good for bitcoin long term

Earlier this month, Federal Reserve chair Jerome Powell announced interest rates would remain unchanged. The Fed’s decision on what to do with interest rates has major ramifications for every asset class, economy and individual throughout the world. It impacts mortgages, auto loans, the stock market, the bond market, businesses, consumer spending and more.

The problem is not a single individual knows what the Fed is going to do over the course of the next 6 months, let alone the next several years. The overwhelming consensus at the start of 2024 was that the Fed would drop interest rates 6 times over the course of this year. Now many believe there might only be one or two interest rate cuts this year, while others believe there won’t be any cuts and there is even a 22% chance that the Fed might raise interest rates in the near future.

This isn’t the first time the Fed has said one thing only to do the opposite. A year ago, we covered (43) how in 2020 the Fed’s publicly stated position was that they would not raise interest rates until after 2023 and then proceeded with the fastest rate hike in history in 2022. That sudden change in policy was the root cause behind the banking crisis that resulted in 3 of the 4 largest bank failures in U.S. history. It’s a perfect example of why I have argued that its problematic to have the entire global financial industry not just impacted, but utterly dependent on the opaque actions of a small number of unelected bureaucrats making decisions behind closed doors. It’s impossible to have a stable, well-functioning global economy when the foundation for all commerce is this unpredictable. If only we had a monetary system that had a consistent, predictable monetary policy that wasn’t subject to the political whims of a small few…but I digress.

So why doesn’t the Fed just lay out a plan for interest rates and stick to it? Because unfortunately, the Fed is in a no-win scenario right now.

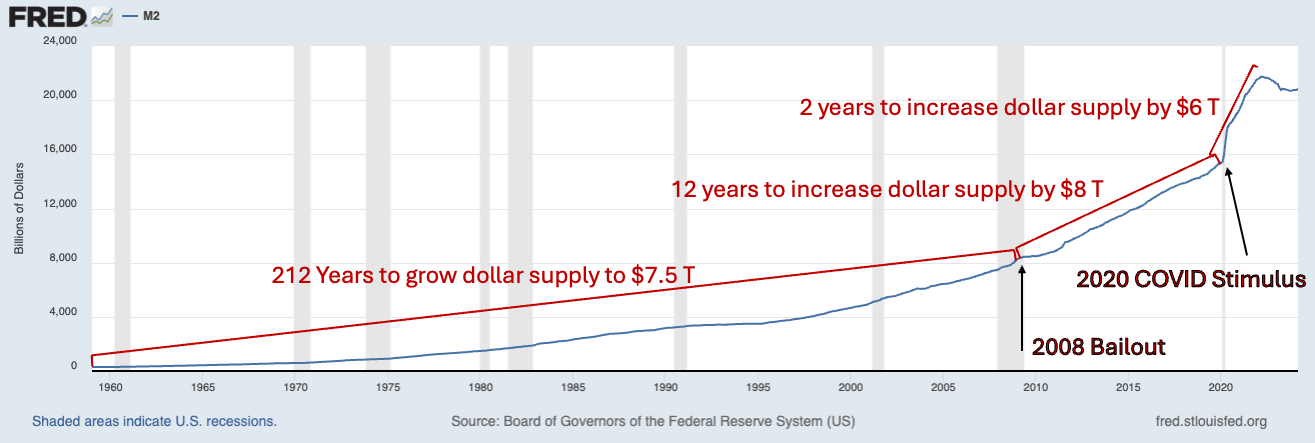

The 2020 COVID stimulus led to the largest increase in money supply (aka currency debasement) in U.S. history, dwarfing even that of the 2008 bailout. That growth in the money supply is largely responsible for the rising inflation we have all experienced in the last couple of years.

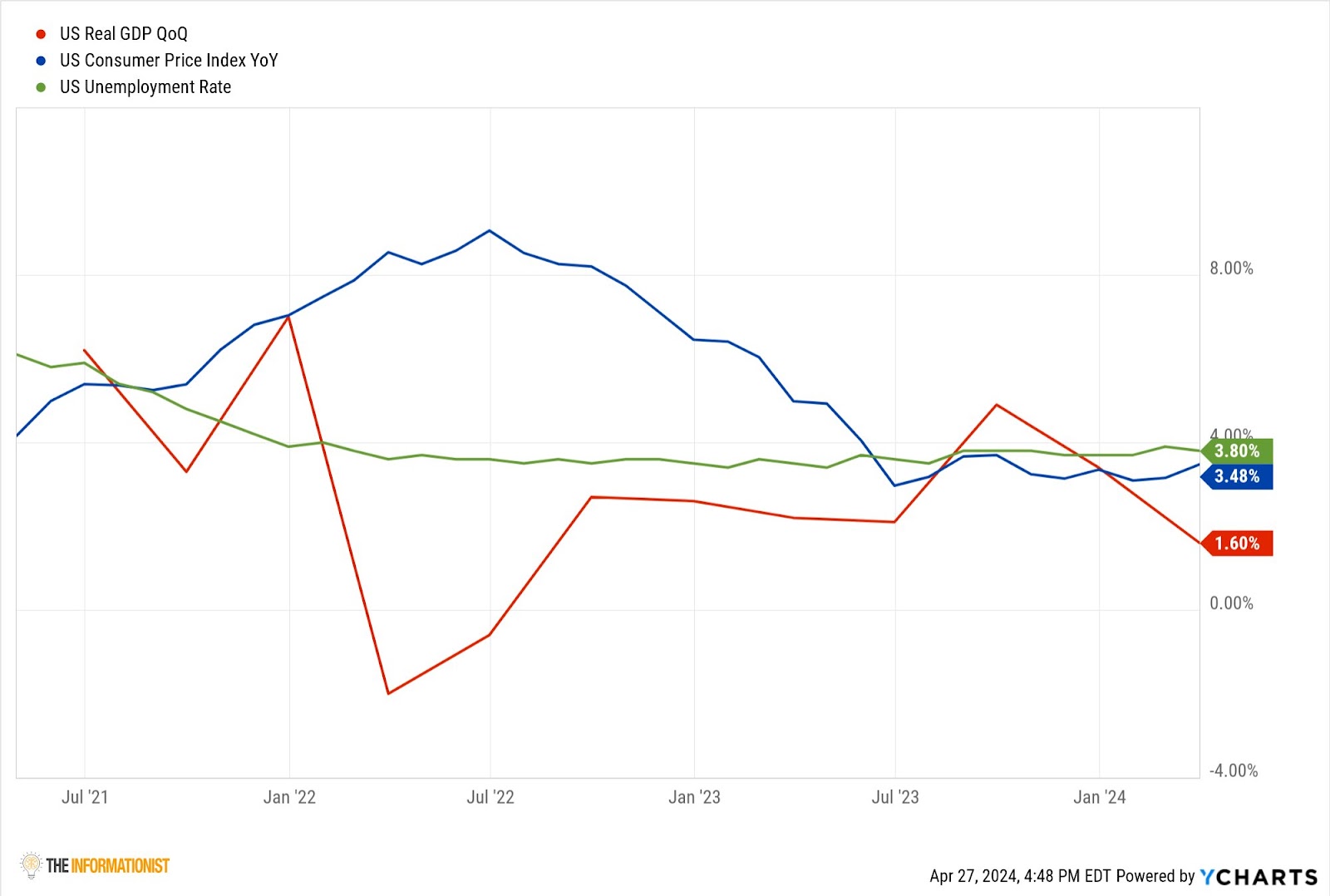

In an effort to fight that inflation, the Fed aggressively raised interest rates in 2022. In response, inflation growth did slow down, though let’s be perfectly clear about what it means when the Fed says CPI is down. Prices are still rising, just not as fast as they were in 2022. So, we are stuck with permanently higher prices. Currency debasement inevitably leads to decreased purchasing power.

But here is the problem for the Fed, inflation never came down as much as they needed it to. The Fed’s stated target is 2% but CPI has yet to fall below 3%. Making matters worse, the most recent numbers suggest that inflation might be back on the rise. CPI came in at 3.5% in March (a 0.4% month-over-month increase), which was higher than expected and signaled a renewed acceleration in inflation which is why the Fed has yet to cut interest rates.

At the same time, the latest data shows that the economy appears to be slowing. GDP growth slid to an almost two-year low in Q1. The most recent jobs report revealed a disappointing labor market as unemployment rose to 3.9%. All else being equal, as the economy starts to slow the Fed would typically prefer to lower interest rates in order to help stimulate the economy.

So, the Fed is stuck between a rock and a hard place. Lower interest rates to combat a slowing economy and the Fed risks inflation growing rapidly again. Raise interest rates to combat inflation and the Fed risks sending the economy into a recession. Keep them where they are, and the Fed risks the worst of both worlds. As James Lavish pointed out, inflation has stalled above 3% and is starting to rise again (blue line in the graph below) while GDP has fallen significantly over the last two quarters (red line) so, if unemployment (green line) were to increase in the coming months, we likely could enter into a period of stagflation.

The point is, it’s impossible to know what the Fed will do because they are caught in a lose-lose situation. But there is a silver lining for investors trying to navigate the economic uncertainty. Unlike any other asset, bitcoin is poised to benefit regardless of whether the Fed decides to decrease or increase interest rates.

Let’s start with the more well understood scenario, the Fed decides to lower interest rates. Lower interest rates means lower returns on bonds and other debt instruments. Thus, investors start to move capital to other asset classes in search of higher returns. Don’t be surprised if the demand for the bitcoin ETFs, along with other stocks, takes off if the Fed lowers interest rates.

But it’s much more than just that. Lowering interest rates makes borrowing money cheaper which encourages consumers and businesses to borrow more. This increased demand for credit can cause the money supply to grow over time as evidenced by the rapid growth of M2 during the years when interest rates were near zero. And as we have seen, when the money supply is increased, bitcoin’s hard money characteristics make it a very attractive investment and historically has performed very well.

Should the Fed decide to cut interest rates multiple times, that would likely create a favorable environment for bitcoin’s price. In the short term, it’s likely that lower rates will help all “risk-on” assets, including bitcoin. In the long term, as central banks continue to show a propensity to reduce rates and let the money supply inflate at the first sign of economic trouble, it would further highlight the benefits of a scarce, distributed money compared to that of an arbitrary, centrally planned approach.

I honestly do not think many people would disagree with the prediction that bitcoin’s price would rise if the Fed lowered interest rates. The counterintuitive argument that I think far less people understand, is that bitcoin’s price is also likely to rise if the Fed raises interest rates.

Raising interest rates means that borrowing is more expensive. Consumers therefore either don’t borrow as much as they otherwise would (which reduces spending) or they pay higher interest rates which lowers their disposable income (which also reduces spending). When the cost of capital is high, businesses also borrow and invest less into their operations thus reducing growth at the same time consumers are likely to buy less of their products thus impacting their bottom line. Historically speaking, raising interest rates lowers liquidity causing contractions in the economy and stock prices typically go down. Conventional wisdom would therefore dictate that stocks and bitcoin would perform poorly in this scenario.

However, there is an important factor that is substantially different today than in the past and completely changes the equation. When Paul Volcker raised interest rates in the 70s and 80s, it was very effective at curbing inflation and had all the impacts on the economy one would expect. The difference between then and now is that in the 70s, debt to GDP was 30%, the lowest level it’s been in the last 60 years (and likely longer than that, I just couldn’t find the data from before 1960). Today, debt to GDP is near an all-time high of 120%.

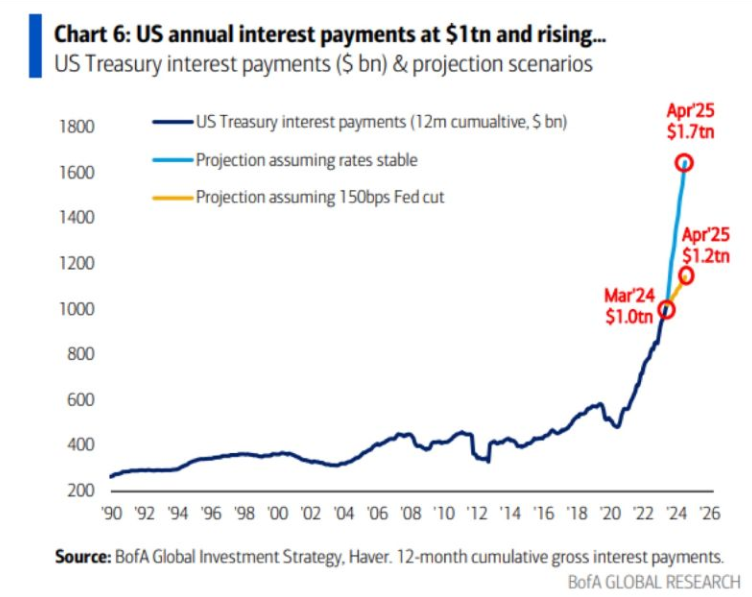

The fact that our debt is larger than our economic output completely changes the impact of raising interest rates. In the 70s, Volcker could aggressively raise interest rates because the U.S. government could afford to pay the increased interest rate payments. Today, the U.S. government is already structurally guaranteed to operate at a deficit which forces the government to borrow more in order to keep operating which only further exacerbates the problem. It’s called a debt spiral and we have covered it in this newsletter a couple times (here (44) and here (56)).

Even if rates stay the same over the next year (let alone increase), the interest payment will grow exponentially to $1.7 trillion on a twelve-month basis. The Congressional Budget Office’s own projections estimate interest expense to be nearly 40% of the entire federal budget by 2050 making it by far the single largest expense item. That’s not assuming an increase in interest rates. If the Fed decides to increase interest rates, that annual payment goes parabolic. As Lyn Alden described, “Raising interest rates when federal debt is over 100% of GDP substantially increases the government’s deficits at an equal or faster pace than it reduces loan creation in the private sector. So as the Federal Reserve raises rates, federal interest expense increases, and the federal deficit widens ironically at a time when deficits were the primary cause of inflation in the first place. It risks being akin to trying to put out a kitchen grease fire with water, which makes intuitive sense but doesn’t work as expected.”

The ONLY practical solution to keep the lights on for the U.S. government at this point is to aggressively print money and further debase the currency (I do not consider a default or complete restructuring of entitlement spending a realistic scenario). That’s BEFORE raising interest rates any further. If the Fed were to raise interest rates, the annual interest payments would explode at the same time tax revenue would drop due to a slowdown in the economy. The annual deficit would grow even faster forcing the U.S. government to borrow more than they already do. That would cause the interest rate payments to grow even faster, and the deficit to accelerate. At that point, it’s possible the credit worthiness of the U.S. government could be thrown into question (it already has been) and there would be less demand for U.S. bonds (which is already waning) forcing the government to buy its own debt (ie: print even more money).

If the Fed raised interest rates, in the short term, there likely would be an initial sell-off of bitcoin just because that is what most traditional investors are conditioned to do. But in the long run, because the U.S. government is already $34 trillion in debt and is already borrowing at higher interest rates than recent years, raising interest rates further would result in the money supply drastically increasing over time just to finance government spending. Perhaps even more so than it did in 2020. In that scenario, bitcoin’s value proposition of a scarce asset with a predictable, ever decreasing inflation rate looks awfully attractive.

To recap, if the Fed lowers interest rates that will lead to increased borrowing and spending which will ultimately lead to further debasement of the dollar and likely higher inflation. If the Fed increases interest rates, the annual deficit will grow substantially (mostly due to increased interest expense) forcing the U.S. government to print record levels of money thereby debasing the currency and likely lead to higher inflation. Bitcoin is going to benefit in the long run regardless of whether rates go up or down.

Inflation remains elevated and appears to be accelerating month-over-month. Interest expense is growing at an exponential rate driving fiscal deficits and national debt higher year over year. Demand for government bonds is deteriorating forcing the government to buy its own debt more and more. The U.S. dollar will continue to be debased and U.S. citizens will continue losing purchasing power in the coming years.

Bitcoin, with its combination of programmatic scarcity, decentralized network and ever-growing global adoption, continues to be one of the best ways to provide economic protection in uncertain times. The asset is up more than 120% over the last 12 months and up 1,100% since March 2020. Regardless of whether the Fed decides to raise or lower interest rates this year, bitcoin is poised to grow in value over the long run.

In Other News

SEC Chief Gensler accused of misleading congress on Ethereum.

Tokenization company Securitize raises $47M led by BlackRock.

BlackRock sees sovereign wealth funds and pensions investing in the bitcoin ETFs.

The Bitcoin network surpasses one billion on chain transactions.

U.S. crypto super PACs have raised more than $100 million, with more than half of that from Coinbase and Ripple.

A new survey found one-in-five voters think crypto is a key issue in U.S. elections this November.

House passes measure to overturn SAB 121.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS