By Brett Munster

Texas breaks new ground with landmark bitcoin reserve law

In a landmark development for both public finance and digital asset adoption, Texas has officially become the third U.S. state to establish a strategic bitcoin reserve. On June 21, Governor Greg Abbott signed Senate Bill 21 (SB21) into law, granting the state comptroller broad authority to buy, sell, hold, and manage digital assets on behalf of the state. While the legislation allows for the inclusion of any cryptoasset with a market capitalization exceeding $500 billion, bitcoin is currently the only asset that qualifies—effectively making this a de facto Strategic Bitcoin Reserve for the time being.

The primary objective of the reserve, as outlined in the legislation, is to bolster Texas’s financial stability and provide a hedge against inflation. In a period marked by persistent fiscal uncertainty and ever changing monetary policy, the move underscores a growing willingness among government entities to view bitcoin not merely as a speculative asset but as a credible store of value with potential macroeconomic benefits. Importantly, these holdings will be managed independently of the state’s general treasury, signaling a deliberate separation of bitcoin from Texas’s traditional cash, equity, and bond reserves. This distinction positions bitcoin as a new and distinct asset class within the state’s financial portfolio.

Texas’s decision elevates the conversation around governmental adoption of digital assets in ways not previously seen in the U.S. While states such as New Hampshire and Arizona were the first to pass a strategic bitcoin reserve, their efforts have been comparatively narrow. New Hampshire permitted public investment in bitcoin but maintained these holdings within its broader treasury, lacking both a dedicated reserve structure and long-term legal safeguards. Arizona, meanwhile, created a framework to manage unclaimed crypto assets but stopped short of deploying public funds into active crypto investments.

In contrast, Texas has taken a far more ambitious and structured approach. SB21 not only commits public capital to digital assets but also establishes a distinct legal and operational framework to govern these holdings. Notably, the law includes strong legal protections designed to shield the reserve from future political shifts, making it far more durable than earlier state-level initiatives. This ensures that the reserve remains intact even as administrations and legislative priorities change, providing a long-term foundation for bitcoin’s role in Texas’s finances.

The potential scale of Texas’s bitcoin reserve is equally significant. With an economy that would rank among the world’s top ten if it were an independent nation, Texas has the fiscal capacity to make impactful digital asset allocations. Although the initial funding allocation is set at $10 million, the legislation authorizes investments of up to $2 billion over time. This positions Texas not only as an early mover in sovereign bitcoin adoption but as a potential global leader in public-sector digital asset management.

The passage of SB21 marks more than a standalone financial experiment—it signifies meaningful progress in integrating digital assets into government finance. As global markets contend with inflationary pressures, currency volatility, and geopolitical instability, Texas’s move may serve as a catalyst for other jurisdictions—both domestic and international—to consider similar policies.

What was once dismissed as a speculative and volatile technology is now steadily becoming a component of long-term financial planning by governments. Texas’s commitment to maintaining a bitcoin reserve may emerge as a blueprint for other public institutions aiming to diversify assets and guard against federal currency devaluation. If successful, this initiative could mark a pivotal step toward further embedding digital assets into the mainstream financial system, fundamentally reshaping how governments approach sovereign asset management in the digital age.

Fannie and Freddie get orange pilled

Buying and owning a house has long been the cornerstone of the American dream – but for Millennials and Gen Z, it’s increasingly out of reach. Compared to the Baby Boomer generation, younger Americans face a dramatically different housing landscape. In 1970, the median home price was about $17,000 and the median household income was $9,870, putting the price-to-income ratio at just 1.7x. Today, that ratio has exploded: with median home prices nearing $419,000 and median incomes around $67,000, homes now cost over 6.25x annual earnings. That’s nearly four times the affordability ratio Boomers faced.

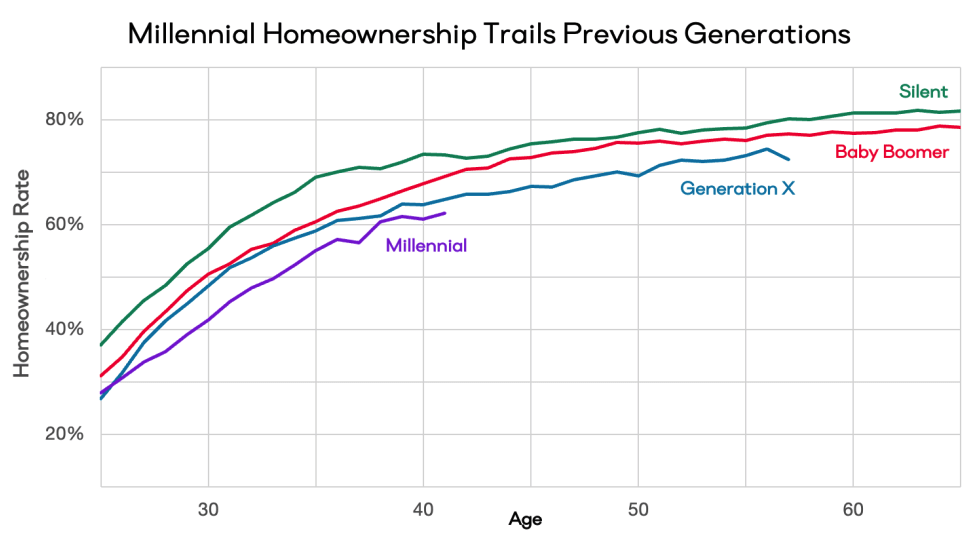

Homeownership rates reflect this reality. At every age milestone, younger generations have lagged behind their predecessors. By age 30, only 42% of Millennials owned homes, compared to 48% of Gen X, 51% of Boomers, and nearly 60% of the Silent Generation. This gap persists into their 30s and early 40s, as delayed ownership becomes more common.

One of the underlying causes of this growing affordability crisis is the gradual debasement of the U.S. dollar. Inflation, fueled by persistent monetary expansion, pushes prices higher over time. But more subtly—and perhaps more significantly—the erosion of fiat purchasing power drives investors into scarce assets like real estate. Real estate has long served as a hedge against inflation, and in high-demand areas with strict zoning laws, its scarcity becomes even more pronounced. Wealthy investors often acquire multiple properties as stores of value or income-generating assets, bidding up prices and crowding out primary homebuyers in the process.

To illustrate the extent of this distortion, consider that the $17,000 median home price in 1970 would be about $137,000 today after adjusting for inflation. Yet the actual median price now exceeds $419,000—a 3x premium above inflation. That $282,000 gap reflects not just housing demand, but a monetary premium—a cost imposed by the inability to reliably preserve value in fiat currency over time.

This leads to a provocative thought experiment: what if, instead of saving in dollars, people had saved in bitcoin? While Bitcoin didn’t exist in 1970, we can look at the last decade. In 2015, the median U.S. home cost roughly $277,000. Today, that figure is $419,000—an 51% increase. But in bitcoin terms, the change is staggering. In 2015, it took about 1,100 BTC to buy the median home. Today, just 4 BTC will do. That’s a 99.5% drop in housing cost, denominated in bitcoin. Put differently, if you had purchased 4 BTC in 2015 for around $1,000 total, that amount would be enough to buy a median-priced home today. Over time, real estate becomes less affordable in dollars—but more affordable in bitcoin.

Which makes last week’s policy development all the more significant.

On June 25, the Federal Housing Finance Agency (FHFA) announced a landmark shift: Fannie Mae and Freddie Mac will now begin recognizing crypto assets—held on U.S.-regulated exchanges—as eligible reserves in mortgage risk assessments. This move, directed by FHFA head William J. Pulte, marks the first time crypto holdings are being formally integrated into mainstream mortgage underwriting.

In practice, mortgage lenders assess reserves—liquid assets a borrower can draw upon in case of income disruption—as part of overall risk evaluation. Traditionally, this has included cash, stocks, and bonds. But until now, crypto assets were excluded. Borrowers were forced to liquidate their holdings, often triggering capital gains taxes, just to have those assets counted. Now, those days are over. Under the new FHFA directive, borrowers can simply present their verified crypto balances—no liquidation required.

This change allows crypto holders to bolster their mortgage applications without selling their assets. Crypto can now help improve a borrower’s credit profile, increase down payment credibility, and potentially lower interest rates. For younger Americans—who disproportionately own crypto—this could be a game-changer. With over 50 million U.S. crypto users, many of them under 40, this move could meaningfully reduce the home affordability gap by unlocking dormant financial resources that previously went unrecognized in the mortgage process.

More broadly, this is part of a growing trend: crypto is steadily becoming a recognized balance sheet asset. From corporate treasuries to sovereign investment funds and now mortgage underwriting, digital assets are being integrated into traditional financial frameworks. The FHFA’s move signals more than just a nod to innovation—it’s a policy shift that could democratize access to homeownership while nudging the U.S. mortgage system into the digital age.

In Other News

Bitcoin and digital asset clarity is essential for our financial future.

SoFi, the fintech company and largest online lender in the US, will relaunch spot trading for BTC and ETH later this year after pausing its crypto services in 2023.

Crypto tax changes didn’t make It into the Senate’s One Big Beautiful Bill.

The Senate recently passed a version of the “One Big Beautiful Bill” is projected to add $4 trillion to the national debt over the next decade.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS