By Brett Munster

5 tailwinds heading into Q4

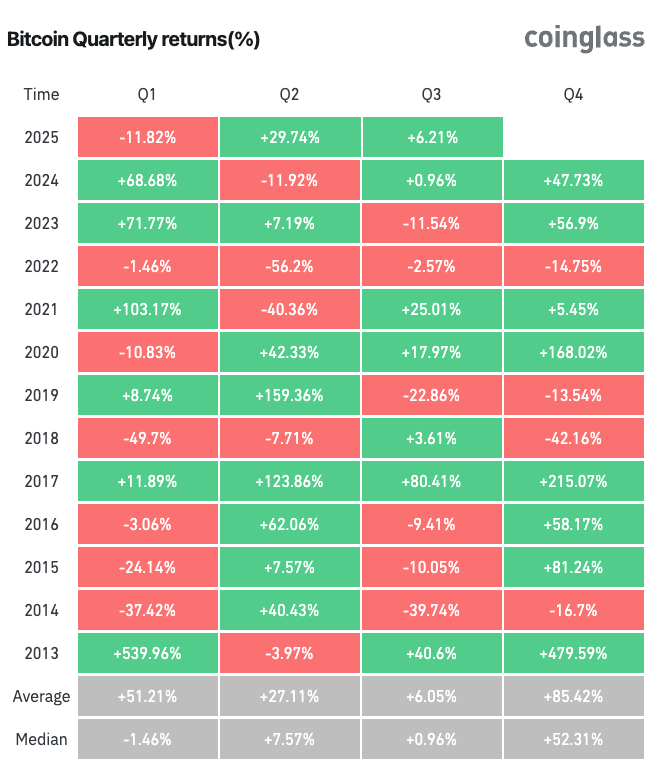

Historically, Q4 has been bitcoin’s strongest period of the year. Since 2013, data from CoinGlass shows Q4 has delivered average gains of more than 80%, far outpacing every other quarter. That surge doesn’t stop at bitcoin either: when the market leader rallies, the momentum typically cascades across the entire crypto ecosystem, lifting altcoins and strengthening market sentiment.

Of course, past performance doesn’t guarantee the future. Each cycle is shaped by its own set of drivers—whether it’s macroeconomic policy shifts, liquidity conditions, regulatory developments, or structural changes in how capital flows into crypto. The tailwinds that fueled rallies in previous years won’t always repeat in the same form. History should be treated as a compass, not a map.

That said, the setup heading into Q4 2025 appears uniquely favorable for crypto markets. Increasing regulatory clarity is reducing compliance uncertainty, which in turn is bolstering institutional confidence. This confidence is laying the groundwork for more sustained and sizable capital inflows, a critical driver of long-term price appreciation. Multiple structural tailwinds are converging at once including expanding global liquidity conditions, interest rate cuts, consistent ETF demand, growing corporate treasury participation, and the long-awaited opening of U.S. retirement channels such as 401(k) plans. The convergence of these inflows represents an uncommon alignment of macroeconomic, institutional, and structural drivers—potentially amplifying market growth heading into the end of the year.

Let’s break down the key drivers that could have history repeating itself this Q4.

Global liquidity at all time high and rising

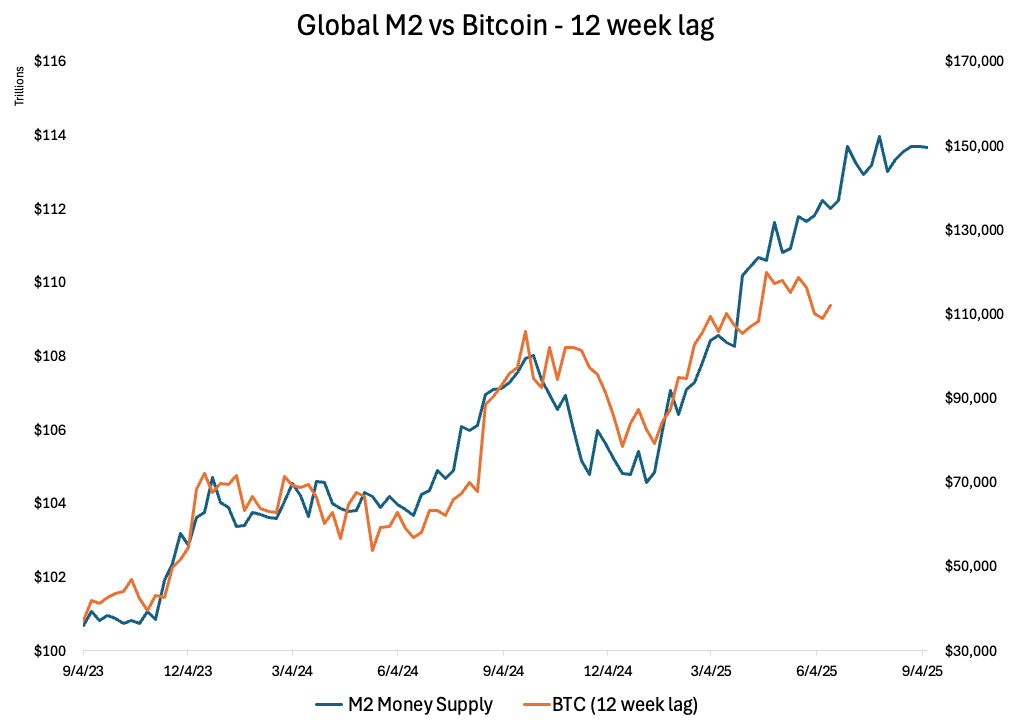

Nearly a year ago, we published research examining the link between bitcoin and global liquidity. Our argument was straightforward: bitcoin’s monetary framework is the opposite of fiat currencies. Fiat supply is unlimited, while bitcoin’s is capped; fiat issuance tends to accelerate, while bitcoin’s issuance halves over time; fiat monetary policy is discretionary and often opaque, while bitcoin’s is immutable and fully transparent.

Because of these contrasts, bitcoin’s investment case strengthens when fiat liquidity expands and purchasing power erodes. Historical patterns reinforce this: periods of rapid money supply growth have often coincided with surges in bitcoin as investors turn to scarce, non-sovereign assets to preserve value.

At the time of that report, bitcoin was trading below $70,000. Just two months later, it broke through the $100,000 mark in lockstep with a sharp acceleration in global liquidity. Since then, global M2 has continued to climb, surpassing $113 trillion, with more than $8 trillion added since the start of the year.

Historically, bitcoin tends to respond to liquidity expansions with a lag of roughly 10–12 weeks. With major central banks already pivoting toward easier policy, that expansion looks set to persist into year-end. If the established relationship between global liquidity and bitcoin holds—and there is little reason to think otherwise—then bitcoin appears well positioned for another significant leg higher in the coming months.

Interest Rate Cuts

On September 17, the Federal Reserve lowered interest rates by 25 basis points to a target range of 4.00–4.25%, its first reduction since December 2024. Both market pricing and the Fed’s own Summary of Economic Projections (SEP) indicate a clear path toward additional easing: the median “dot plot” suggests two further 25-bp cuts before year-end 2025, with another reduction likely in early 2026. While debate remains over the Fed’s approach, the fact is that rate cuts have resumed and based on current guidance, are expected to continue through year-end and into early 2026.

Easier monetary policy typically injects liquidity into the financial system, creating an environment where capital is more likely to flow into risk assets. Bitcoin, with its fixed supply, stands out in contrast to fiat currencies that can be expanded at will. In this way, looser policy not only makes traditional safe havens like government bonds less rewarding but also strengthens the relative appeal of scarce digital assets.

More importantly, lower interest rates erode the appeal of fixed-income assets such as Treasuries, certificates of deposit, and commercial paper. Amid the Fed’s aggressive rate hikes in 2022 and 2023, investors funneled record amounts into money market funds, drawn by the unusually attractive yields these traditionally low-risk vehicles offered in a high-rate environment. As a result, assets in U.S. money market mutual funds surged to an unprecedented $7.4 trillion. However, as the Fed shifts into an easing cycle, those yields will begin to compress, leaving trillions of dollars in capital earning less than before. When returns on cash-like instruments fall below investor expectations, that money rarely sits idle. Instead, it seeks higher returns in risk assets, setting the stage for a powerful reallocation into equities, real estate, and increasingly, bitcoin and other digital assets.

In short, with liquidity returning to markets, yields on cash instruments declining, and trillions of dollars sitting on the sidelines in money market funds, conditions are aligning for a potential flow of capital into crypto. If history is any guide, rate cuts that push investors out of cash and into risk assets could provide the fuel for crypto’s next major leg higher in Q4.

ETF Momentum

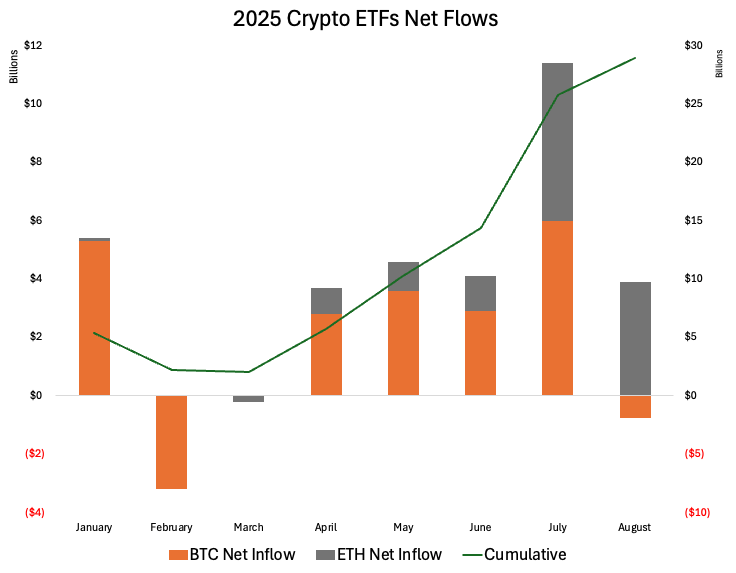

Last year, bitcoin ETFs rewrote the history books, drawing in over $35 billion in aggregate net inflows in 2024—a figure more than ten times larger than the previous all-time record for ETF launches. That unprecedented wave of demand was not isolated to bitcoin: Ethereum ETFs pulled in an additional $8.7 billion, cementing crypto as the most successful ETF category launch ever.

What makes this cycle even more compelling is that inflows into ETFs typically accelerate in their second year as investors grow more comfortable with the asset. At the start of 2025, we highlighted this dynamic and projected that total net inflows into crypto ETFs could surpass $50 billion this year. With nearly $30 billion already allocated as of early September, that forecast is well within reach—and possibly conservative.

More importantly, the trajectory of flows tells an even stronger story than the totals themselves. After tariff-related uncertainty dampened Q1 activity, inflows have surged through Q2 and Q3, culminating in a record-breaking July. This acceleration signals growing institutional confidence in crypto as an asset class.

While bitcoin ETFs continue to grow, it is the rapid rise in Ethereum ETF adoption that has fueled much of the recent momentum. The willingness of institutions to look beyond bitcoin marks a critical inflection point: once capital begins to diversify across multiple tokens, overall allocations to the sector tend to grow substantially. This trend is expected to accelerate, with the SEC not only anticipated to approve new spot ETFs tied to tokens like Solana (SOL), Ripple (XRP), and Litecoin (LTC) before year-end, but also recently introducing listing standards designed to fast-track dozens of additional crypto ETFs. ETF analyst Eric Balchunas noted, “The last time they rolled out generic listing standards for stock and bond ETFs, the number of launches tripled. There’s a good chance we’ll see more than 100 crypto ETFs hit the market in the next 12 months.”

Taken together, these factors point toward a powerful continuation of inflows into Q4. Institutional capital is not only entering at record levels, but doing so at an accelerating pace, across a widening set of assets. If the pattern holds—and history suggests it will—crypto ETFs are on track to attract well over $50 billion by year’s end, setting the stage for significant upward pressure on crypto prices in the months ahead.

Crypto in 401ks

On August 7th, President Donald Trump signed a landmark executive order permitting cryptoassets such as bitcoin to be included in 401(k) retirement accounts.

The order, titled Democratizing Access to Alternative Assets for 401(k) Investors, instructs federal regulators to remove longstanding barriers that prevented retirement plans from offering exposure to non-traditional assets—including digital assets, gold, real estate, and private equity.

Until now, regulatory guidance discouraged plan sponsors from including crypto, citing risks around volatility, custody, valuation, and liquidity. By rescinding these restrictions, the order immediately opens the door for trillions in retirement savings to access bitcoin and other digital assets. The U.S. 401(k) system alone represents roughly $12.4 trillion in assets, with $50 billion in fresh contributions flowing in every two weeks. Unlocking even a fraction of that pool for crypto could create sustained demand that rivals—and likely exceeds—the impact of spot ETFs.

The implications are profound. Even a 1% allocation of total 401(k) assets would translate to $120 billion in recurring inflows, fed automatically by payroll deductions and investment defaults. Unlike speculative trading, 401(k) contributions are systematic, sticky, and long-term. Most participants rarely adjust their allocations once set, meaning capital directed into crypto would accumulate steadily over years rather than exiting at the first sign of volatility.

Importantly, Millennials and Gen Z—who make up the majority of new and current 401(k) contributors—are already far more open to crypto adoption than the older generations nearing or in retirement. Consequently, many financial experts anticipate that a growing share of 401(k) plans will incorporate crypto options in the years ahead. Speaking personally as a Millennial, I can assure you mine will be among them.

This executive order is more than symbolic validation—it’s a structural catalyst. By channeling a portion of one of America’s largest and most stable capital bases into crypto, it introduces a new wave of long-duration demand that could transform the market. For Q4 and beyond, this policy shift is poised to act as one of the strongest tailwinds the crypto sector has ever seen, accelerating both adoption and price discovery.

DATs

One of the defining narratives in crypto throughout 2025 has been the rise of digital asset treasury companies (DATs)—publicly listed firms whose core strategy is to hold cryptoassets like bitcoin, Ethereum, and Solana on their balance sheets. This phenomenon traces back to 2020, when MicroStrategy (now rebranded to Strategy) broke new ground by converting corporate cash into bitcoin. Michael Saylor, its outspoken executive chairman, not only pioneered the idea but also built a financing playbook to scale it—using equity offerings, convertible notes, and even perpetual preferred equity to steadily expand Strategy’s bitcoin holdings. For a few years, imitators were limited with Japan’s Metaplanet the most prominent. But 2025 has been the year the idea exploded into a mainstream corporate strategy.

At the beginning of the year, only a handful of public companies could be called digital asset treasuries. By late summer, however, the Financial Times reported that 154 U.S.-listed companies had raised roughly $98.4 billion for crypto purchases in 2025, compared to just $33.6 billion raised by 10 companies prior to this year. What began as a bitcoin-only phenomenon has rapidly diversified. Firms are now raising capital to accumulate Ethereum, Solana, and other assets, in effect creating publicly traded vehicles that give investors indirect exposure to a broadening basket of cryptoassets.

The most important point, however, is not whether these companies’ strategies will stand the test of time, but the timing of capital flows. A significant portion of the money raised by these digital asset treasury firms has not yet been deployed. Many of the transactions underpinning their plans are subject to shareholder approvals, SPAC closings, or regulatory sign-offs, meaning the funds are currently sitting on the sidelines.

The examples highlight the scale of this pending demand. Parataxis Holdings is finalizing a $640 million SPAC merger to fund its bitcoin treasury strategy, yet has not deployed any of that capital into bitcoin. Asset Entities has raised $750 million but awaits shareholder approval before it can purchase any BTC. Twenty One Capital, led by Jack Mallers and backed by Tether, SoftBank, and Bitfinex, already counts more than 43,000 BTC contributed by its founding partners, but its additional $585 million PIPE financing is still awaiting SEC approval. Forward Industries has announced plans to raise $4 billion to build the largest Solana treasury company, but has yet to purchase any SOL with that new capital. These are just the headline examples; across the sector, the majority of capital raised in 2025 is still waiting in the wings.

This backlog of dry powder is a structural tailwind heading into Q4. As deals close and approvals come through, billions in fresh capital will move from intention to execution, translating into direct purchases of bitcoin, Ethereum, Solana, and beyond. Unlike the fragmented flows of retail investors, these treasury allocations are large, deliberate, and concentrated, creating step-function increases in demand. The effect is not only supportive for prices but also for institutional confidence, as public companies demonstrate willingness to treat digital assets as a legitimate treasury reserve.

Public companies are thus emerging as one of crypto’s most reliable and predictable sources of demand. With tens of billions of dollars poised to move from balance sheet commitments into actual on-chain deployment, the digital asset treasury trend represents a powerful catalyst for capital inflows. If 2025 was the year the movement took off, Q4 may well be when its impact is truly felt across crypto markets.

In Other News

Solana hits 7-month high price as Bitwise exec foresees “epic end-of-year run.”

Nasdaq seeks SEC nod to trade tokenized securities.

Blockchain lender Figure goes public at $5.3 billion valuation.

The U.S. House Appropriations Committee introduced a spending bill directing the Treasury Department to assess the feasibility and security of a Strategic Bitcoin Reserve.

Gemini, the Winklevoss’ crypto exchange, pops more than 14% in Nasdaq debut.

DeFi TVL grows to $170 billion.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS