By Brett Munster

A store of value is an asset, commodity, or currency that maintains its worth and therefore can be exchanged in the future without deteriorating in value. I start with the definition because I want to be clear that the parameters in which we evaluate a store of value asset on has to do with its future value and not the ability to conduct transactions today. In other words, I am not concerned with Bitcoin as a medium of exchange for the purposes of this post.

Viewed in this light, it’s pretty clear that all fiat currencies are horrible store of value assets. Cash is useful to transact with in present day and valuable to keep for short term liquidity. However, as a store of value over a longer period of time, its track record is terrible. According to the work of economist Steven Hanke, more than 50 hyperinflation episodes of fiat monetary systems have taken place around the world in the past century. While the US has yet to experience hyperinflation, if you think being the world’s largest economy or the world’s reserve currency protects the dollar from being devalued, think again. According to The Fed’s Consumer Price Index, $1 in 1913 (the year The Federal Reserve was established) would buy you roughly what would require $26.15 in 2020. That is a cumulative loss of a little over 96% in purchasing power from the most dependable fiat currency in the world during that time span. Ironically, an original stack of Monopoly game money from 1935 is worth roughly $40-$60 on eBay today as a collectible item, meaning “Monopoly Money” has held its value better than real money over the last 85 years.

The root cause of this decline in value is inflation. The US Federal Reserve controls the money supply in the US and uses monetary policy to achieve its target rate of 2% inflation per year. The Fed’s stated goal is to use the tools available to them in an effort to maximize employment and price stability. By debasing the currency a modest amount every year, The Fed hopes to incentivize people to either spend or invest their capital, both of which will hopefully stimulate economic growth and in turn maximize employment. By keeping this inflation to only 2%, the belief is this also keeps prices relatively stable.

Managing an economy is extraordinarily complex and difficult and those entrusted to do so are motivated to grow the economy in the short term, not protect the value of the currency over the long run. There are powerful incentives and political motivations to debase the currency over time. In the US, the amount of money printed has accelerated since 2008 and especially so in 2020, as The Fed has routinely increased the money supply through Quantitative Easing and direct stimulus. M2, a measure of money that includes cash, bank accounts (including savings deposits) and money market mutual funds has been growing at a year-on-year rate above 20%, compared with an average of 5.9% since 1982. Since September 2019, the Federal Reserve has pumped over $9 trillion into the economy and in 2020 alone, the U.S. has created 22% of all the US dollars issued since the birth of the nation.

Regardless of whether you agree with these practices or not, the fact remains that over time, fiat will never be a good place to store one’s wealth. This is why the wealthier one is, the smaller the percent of their net worth they typically store in cash. Those that can afford to, invest their wealth into assets such as stocks, bonds, real estate, private companies, collectibles, and other hard assets. They put that wealth into assets that are likely to appreciate, or at the very least maintain, their value.

Investing in stocks, bonds, and real estate tends to be the most common. However, as we have seen, real estate markets and financial markets have their boom and bust cycles. Making matters worse, these asset classes are becoming more correlated with each other over time. Thus, a portion of a well-diversified portfolio should also include a “store of value” asset that is not correlated with stocks, bonds or real estate in order to help offset their cyclical nature.

In this category of store of value assets, gold has been the “gold standard” (sorry, couldn’t resist). Gold has been a store of wealth for thousands of years and has outlasted the currencies of various empires and nation-states that have come and gone. Many currencies, including the dollar, were pegged directly to gold. However, this limited government’s ability to provide financial aid (aka, print more money) and in 1971, the gold standard was abandoned by the US. Since then, the value of a dollar has steadily declined while gold has risen from $35 per ounce to over $1,800 today.

I think it’s also worth noting that gold was not a global monetary standard that was chosen by any one person or entity. Governments only recognized gold as a monetary value once the market had adopted it. By end of 19th century, gold emerged as clear, universal monetary medium used around the world due to a number of intrinsic properties.

That is until now.

By every measure other than adoption (for now), Bitcoin is a better store of value than gold. Let’s go through these one by one.

Scarcity

While there are a number of characteristics needed in an ideal store of value asset, scarcity is the most important of them all. In order to be a store of value, the good cannot be abundant, easy to obtain or easy to produce in quantity otherwise it would be trivial to increase the supply of the good. As basic economics have taught us, when the supply increases by more than demand, the price falls making it a poor store of value. However, when supply is limited, any increase in demand increases the price of the good helping retain its value.

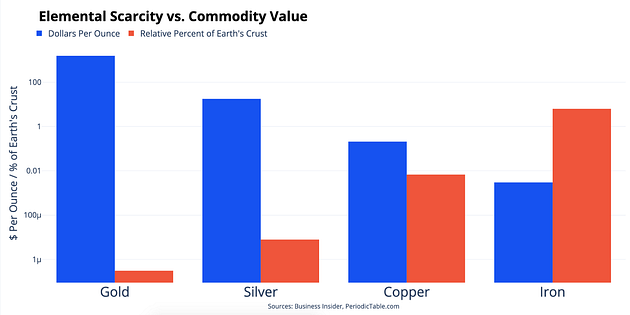

Gold happens to be one of the rarest naturally occurring metals on Earth. It is difficult, costly and labor intensive to dig out of ground. As a result, the supply of gold is not easily increased nor is it abundant relative to other metals. This is a key property that made gold successful as store of value, because when demand increases and prices rise, it’s a non-trivial endeavor to produce more gold which means it’s difficult to flood the market with new supply. This is the reason there is an inverse relationship between value of a metal and the scarcity of that metal. Compared to copper or silver, which are much easier to produce, gold had a distinct advantage of being scarcer and thus became the dominant form of store of value and money.

However, whereas gold has relative scarcity, Bitcoin has absolute scarcity. There will only ever be 21 million Bitcoin in existence and after 2140, no more will ever be created. Gold has been mined for thousands of years and new gold will likely still be mined for the indefinite future. Once the last Bitcoin is mined, there will never be any more.

Thus, Bitcoin is the only liquid asset in the world that has a fixed supply. That makes Bitcoin the scarcest asset in the world. With a fixed supply, any increase in demand means the value goes up over time making it an ideal store of value asset.

Constant and Predictable Supply Schedule

In addition to overall scarcity, a constant or predictable supply schedule is desirable. Consistency and predictability increase confidence in an asset.

Gold has been relatively consistent. New gold gets introduced every year at roughly 1–3% of existing supply. However, as demand starts to rise and price increases, gold mines become more profitable and thus more gold gets mined and the supply schedule increases. It’s harder and more expensive to increase the supply schedule of gold compared to other metals, but it’s still possible. In fact, it is even possible to artificially create gold. The process requires nuclear reactions and is so expensive that one cannot currently make money from doing so but the fact remains that it is physically possible. If gold were to appreciate enough and the cost of producing artificial gold were to fall substantially, gold would lose this inelastic supply feature.

Bitcoin not only has a fixed supply, but its supply schedule is also pre-determined which means we know in advance exactly what the supply schedule will always be. Furthermore, Bitcoin’s supply schedule is disinflationary, meaning the amount that gets mined per block decreases by half every four years. This event is called The Halving and as a result of this event, Bitcoin becomes scarcer over time, regardless of demand or price increases. Like Bitcoins fixed supply, it’s supply schedule can never be altered.

Not only that, but it’s also harder to mine bitcoin than gold. As previously mentioned, it is possible to increase production of gold by increasing investment in mining activities. However, with Bitcoin, there is an ever-adjusting mining difficulty built into the system. This means that regardless of the amount of additional computing power you put into the Bitcoin network (ie: increase in “mining” investment) the output of number of Bitcoin mined per block remains constant. The same number of Bitcoin will be produced tomorrow regardless of whether there are 10 computers mining or 10 million. The supply of new Bitcoin entering the market is more reliable, more predictable and more consistent than gold.

Durable

In order to retain its value well into the future, the asset must not be perishable or easily destroyed. Food, while very valuable to our health, is a poor store of value because it goes bad after a period of time.

Gold on the other hand, is very durable. It is the most corrosion-proof and oxidation-resistant metal and therefore it will not tarnish or rust. Thus, a gold coin or bar can be left for thousands of years in a vault without having to worry about it breaking down. However, it is a very soft metal which means repeated use can wear down the metal over time. While gold has the ability to be durable over a long period of time, there is a limit, and that length of time is impacted by its use.

Assuming computing standards don’t change in a way that make it hard to use Bitcoin or diminish its usefulness, it will not degrade over time. It doesn’t erode, wear down or break apart due to time or use. Any bitcoin will still be just as useable in the indefinite future as it is today.

Fungible

A store of value needs to be mutually interchangeable and uniform. The ability to replace one good with another identical good simplifies the exchange processes, as fungibility implies equal value between the assets. Therefore, fungibility allows the exchange of goods in multiple locations and markets. This is important for a store of value because the holder of the asset knows they can easily sell the good in the future to wide range of buyers, the good is more likely to hold its value.

For example, diamonds are not fungible. Diamonds are irregular in shape, size and quality and thus each diamond has slightly different value. This makes the exchange of value much more difficult. Cars and houses are also examples of non-fungible assets as each unit of good has unique qualities that impact the value.

Gold, on the other hand, is generally considered fungible as one gold ounce is equivalent to another gold ounce. However, there are instances when gold is not fungible. If gold has some impurities in it, it’s not worth the same as pure gold. Also, some gold bars are imprinted with serial numbers and are considered “allocated.” While owners of allocated gold bars generally receive some additional legal protections, the particular bars of gold are not considered to be fungible goods.

One Bitcoin is always exactly the same as another Bitcoin. Because it’s software, Bitcoin isn’t mined with any impurities. One Bitcoin will forever remain identical to every other Bitcoin ever created. As a result, Bitcoin is more fungible than gold.

Verifiable

A store of value asset is ideally easy to identify and simple to verify. It would also be very difficult, if not impossible, to counterfeit. Easy verification simplifies the exchange process thus increasing confidence in the holder that they will have no issue in receiving value in the future. Knowing that the good cannot be counterfeited ensures the market will not be flooded with fake goods and also increases confidence levels in future transactions.

Gold can be tricky to verify. While there are some at home tests one can run, they often require special equipment (ie: rare earth magnets) or specific knowledge about key characteristics of gold. These methods are useful but not totally full proof. The only way to know for certain is to take the gold to a third-party specialist in order to get it certified.

In contrast, Bitcoin is simple to verify. Not only is it easy, the Bitcoin Blockchain is constantly validating and verifying each block of transactions it receives to ensure that everything in that block is fully valid, allowing anyone to trust the block without having to trust the miner who created it. Furthermore, the ledger is transparent and immutable so that anyone can verify the validity of any coin or any transaction at any time.

Bitcoin also has never been counterfeited. In fact, because Bitcoin can only be created from mining, and thus no way to create a fake bitcoin, and no way to make a duplicate of an existing Bitcoin, it’s theoretically impossible to counterfeit Bitcoin. In contrast, counterfeit gold coins routinely make their way into the circulating supply. This makes Bitcoin more easily verifiable than gold.

Storable

Because a store of value asset is meant to be held onto well into the future, there must be a secure method of storing this asset so that it can be retrieved at a later date.

Gold is rather difficult and expensive to store. You either need to store it yourself or have someone store it for you. While a couple gold bars can be stored in a home safe, larger values require significant space to store. As such, most gold is stored in large vaults such as Fort Knox, private banks, or with private gold storage firms. However, storing gold with a third party comes with fees which can range from 0.3% — 1.25% per year depending on the account value. These annual fees diminish the future value of your holdings in gold.

By comparison, Bitcoin is much easier to store and can be done for free. Bitcoin is digital and therefore does not require a large vault or safe. Anyone can self-custody any amount on their own using a digital wallet that is either web based, or hardware based. The wallet can also reside on a mobile device, on a computer desktop, a hard drive or kept safe by printing the private keys and addresses on paper. There is a little bit of a learning curve on how to safely store bitcoin for anyone new to the space but once understood, there is no scaling or cost limitations to storing Bitcoin.

Portable

A store of value asset ideally is easy to transport, making it simple to access regardless of where you are. This feature also facilitates long-distance trade.

Gold is heavy and very inconvenient to carry with you. In fact, this was gold’s biggest drawback and the reason we moved from carrying gold coins to using bank notes that represented a claim on gold. It’s also expensive and slow to transport which is why it is done so infrequently. In fact, when Germany repatriated gold bars worth nearly $31 billion from storage locations in New York and Paris in 2017, it took over four years and cost $9.1 million to ship all that metal to Frankfurt.

However, portability is not an issue with Bitcoin. It can be stored on a thumb drive or accessed anywhere in the world that has an internet connection meaning that you can “take it with you” wherever you go. This is incredibly important for refugees who historically would have to flee with only what they could carry. Now they have a way to store and take whatever wealth they have with them.

It also takes a fraction of the time and cost to transfer value of that size. On April 10, 2020, a bitcoin account transferred $1 billion worth of Bitcoin that cost the sender a grand total of $0.68 in total transaction fees. That’s a transaction fee of 0.000000068%. And since new blocks get recorded on average every ten minutes, the transaction occurred in minutes, not years.

Divisible

A store of asset good should also be easy to divide into smaller units. Similar to fungibility, divisibility allows for precise transfer of value.

Divisibility is another drawback to gold. It’s a pretty dense metal so even a small amount of it represents a relatively large amount of value. Thus, it’s hard to transfer small amounts of value even with small coins. In fact, part of the reason silver and copper were often used as money along with gold was these metals were less valuable than gold and therefore could be used in smaller transactions or represent smaller amounts. This problem only gets exacerbated as gold increases in value. This was another reason we moved to paper money, it made gold more divisible and easier to represent smaller units of value. However, by 1971, this paper money was no longer backed by gold so today, gold once again has a divisibility problem.

Bitcoin, by contrast, is essentially infinitely divisible. In fact, 1 millionth of 1 Bitcoin is known as a “Sat” (short for Satoshi, the creator of Bitcoin). Even as Bitcoin increases in value, it’s still possible to transact in Bitcoin given this infinite divisibility.

Adoption

Widespread adoption is crucial for a store of value because the longer the good is perceived to have been valuable by society, the greater its appeal as a store of value. In other words, a store of value is subject to the Lindy Effect.

Gold has been used for thousands of years and is widely accepted around the world. In this respect, Gold is currently superior to Bitcoin. Bitcoin has only been around for a little more than a decade and while it has garnered an impressive level of global adoption during that time, it pales in comparison to gold’s long-standing history. Gold’s current market cap is estimated to be around $9-$11 trillion whereas Bitcoin’s market cap is $500 million as of writing this. There is no argument that as gold is much more widely adopted.

However, Bitcoin is gaining ground quickly. Not only is the value of Bitcoin going up, it’s beginning to eat into gold’s market share as more and more people are selling their gold in favor of Bitcoin. According to a recent report from CoinShares, gold saw a record $9.2 billion outflows during a four week period in November and December of 2020. In the same period, Bitcoin funds experienced an inflow of $1.4 billion.

These recent trends suggest that in time, there is a strong possibility that Bitcoin will overtake gold with regards to adoption and the one advantage gold currently has will be gone.

Provable

One thing we have never been able to do with physical assets is precisely measure the exact amount of existing supply. No one actually knows the exact total or circulating supply of either fiat currencies or gold. We have estimates and ranges, but it’s impossible to measure with 100% certainty. If you ask ten different economists to come up with those numbers, you are likely to get 10 different answers.

However, with Bitcoin we can do exactly that. Because every Bitcoin in existence and every transaction is immutability recorded on the blockchain, we can measure with 100% accuracy and 100% certainty the total supply, the circulating supply, transaction volume, and velocity of Bitcoin. We even know that 63% of Bitcoin have not moved in at least one year. What would you have more confidence in, an opaque asset or one that is completely provable? This kind of granularity and transparency creates greater trust in Bitcoin as a store of value asset.

Non-sovereign and seizure resistant

Bitcoin is not controlled by governments and is resistant to forceful seizure. In other words, Bitcoin makes it difficult for an external party such as a corporation or government to prevent the owner of the Bitcoin from keeping and using it. This feature is becoming increasingly important in our modern, digital lives in which corporations and governments can more easily invade our privacies.

This is a feature that gold has never had. In his book, “The Bitcoin Standard”, Saifedean Ammous describes how one of gold’s biggest failures is that it needs a central settlement system. As previously explained, the divisibility and transportation limitations of gold led us to centrally storing it in large government vaults. This means we have to rely on governments who store the gold to keep accurate records of who actually owns it. This gives governments power and ability to seize value from people if they so choose.

Gold can and has been seized in the past, even in America. In 1933, for example, the United States banned the private ownership of gold, a ban that persisted for more than 40 years.

And it’s not just gold. There are recent examples of fiat money being confiscated by governments around the world. In 2016, the Government of India announced the demonetization of all ₹500 and ₹1,000 banknotes, which many critics considered confiscation of property without due process. In 2019, HSBC seized the funds of individuals affiliated with the Hong Kong protests in order to support Beijing’s national security law that in turn is expected to give the bank “greater profit potential in China in the medium to longer term.”

Bitcoin offers a potential solution to the forceful seizure of wealth. First, Bitcoin is completely decentralized which means settlement happens on a network that no government or single entity controls. Thus, so long as you own your own private keys (self-custody), Bitcoin can’t be taken from you or confiscated by state actors.

Knowing that regardless of the future political climate, you will always own your asset is critical for a store of value good for if you no longer own your asset, you no longer have the wealth you stored in it. This is an assurance that gold cannot make but Bitcoin can.

Criticisms of Bitcoin as a Store of Value Asset

Despite all these inherent properties that make Bitcoin the best store of value asset in the world, there are a few concerns people tend to raise. I wanted to address the three biggest concerns I hear as to why Bitcoin is a poor store of value. They are, in no particular order, Bitcoin is too volatile, Bitcoin is not “backed” by anything, and Bitcoin is not accepted anywhere. Let’s unpack each of these three critiques.

Volatility

The most common argument against Bitcoin as a store of value is that it’s “too volatile.” Historically, Bitcoin has been more volatile than gold. However, I think this critique is rather superficial.

Bitcoin is much younger and has a much smaller market cap to compared to gold. As such, we should expect higher volatility for Bitcoin when compared to gold. This volatility makes Bitcoin difficult to transact with on a daily basis. However, remember the key here is future value, not the value today. Thus, it’s much more important to look at Bitcoin’s volatility over a longer period of time rather than point to short term fluctuations.

When viewed in this light, Bitcoin looks incredibly promising. For example, while Bitcoin has had numerous decreases of value over 30% in its history, it’s also true that every year but one since 2012 the lowest price of one bitcoin for that year has always been higher than the lowest price of one Bitcoin in the previous year. More impressively, as of writing this, anyone who had bought Bitcoin, at any price, and held for at least three years, would have seen the value of that Bitcoin increase. Think about that for a second. It literally didn’t matter what price you bought in at, so long as you held for at least three years, it would be worth more any time after that three-year period that it was when you bought it.

This means Bitcoin, over any three-year period or greater, has only ever been a net positive volatile asset. Gold can’t make that claim.

Volatility is a bigger issue with short term holdings and when the asset is used for daily transactions. The longer the time horizon you look at, the less the short-term volatility is an issue.

You know what else has a lot of short-term volatility? Amazon stock. It’s also one of the best performing stocks of the past two decades. However, many people do not realize that every year, Amazon has had at least one double digit decline in value, including an 83% drop in 2000. The average intra-year price decline for Amazon stock is roughly 35%. Amazon has been a volatile stock for more than 20 years, yet no one would have complained about owning Amazon during that period of time.

What people who make this argument about Bitcoin being too volatile fail to recognize is that an asset needs some volatility in order to grow and you need the asset to increase in value over time to overcome value relative to the dollar and its inflation. If you want no volatility, buy Treasury Bills. You will have no volatility but you will also lose value because inflation will outpace any return. That’s a bad strategy for storing your wealth.

But Bitcoin won’t remain highly volatile forever. In fact, Bitcoin’s volatility has been steadily decreasing over time. Bitcoin is less volatile than a good percentage of the stocks in the S&P 500. As Bitcoin’s market cap has grown, the volatility has decreased and will likely continue to do so as market cap continues to grow.

Bitcoin is not “backed” by anything

Gold is tangible. It is used in jewelry and is also a highly efficient conductor of electricity. It is used in most electronic devices, including cell phones and computers. Gold alloys are used for fillings, crowns, bridges, and orthodontic appliances. Therefore, the argument goes, that gold has intrinsic value other than as an investment or medium of exchange because it can used in other applications should the value of gold drop. This in turn, helps retain gold’s value.

Bitcoin, by contrast, is digital. It can’t be worn as jewelry or used in making electronic components. You can’t eat Bitcoin, decorate with it, or use it in medical applications. Its only use is to store value and facilitate peer to peer exchange. Thus, a common criticism of Bitcoin is the idea that sound money must be backed by something real, hard, and independently valuable and Bitcoin doesn’t meet these criteria.

I disagree with this critique. In addition to being a store of value, Bitcoin also is a payment system. Jeffery Tucker, the Editorial Director for the American Institute for Economic Research, argues that in fact this “payment system is the source of value, while the accounting unit merely expresses that value in terms of price.”

Jeffery Tucker points out that we are used to thinking of currency and payment systems as separate things because this is historically how commerce has worked. If I want a cup of coffee and go to a café, hand them cash in exchange for coffee, there is no third party. However, the moment we want to transact without being physically present, we have always had to rely on third party payment systems. Thus, money has come to rely on third party service providers. “There is the dollar and there are credit cards. There is the euro and there is PayPal. There is the yen and there are wire services.”

For the first time in history, Bitcoin “weaves together the currency feature with a payment system. The two are utterly interlinked in the structure of the code itself.” The real value of Bitcoin lies in the ability to transfer value in a peer-to-peer manner, without the need for a third party and without either party having to take counter-party risk. The value is in the payment network and the coin is merely an expression of that value. It also happens to be that this coin is portable, divisible, fungible, durable, verifiable, easily stored, and, most importantly, scarce.

Bitcoin is not accepted anywhere

The final common critique I hear is that Bitcoin is not accepted by most merchants. If you want to buy a cup of coffee or groceries, most stores still do not accept Bitcoin.

This is true. However, this critique conflates store of value with medium of exchange. While it is yet to be determined if over time Bitcoin can become a medium of exchange, as of today, there are better alternatives than using Bitcoin to buy your groceries. But gold isn’t a viable medium of exchange for everyday transactions either. I’m sure if you tried to purchase your groceries with a bar of gold you would get some confused looks at the checkout counter.

Being a poor medium of exchange does not mean the asset is a poor store of value. Real Estate is widely used as an investment and store of value but is a terrible medium of exchange. Yet, I have yet to hear this criticism of real estate and gold.

There is another reason this argument holds very little weight. As Murad Mahnudov so acutely pointed out, a common misconception about Bitcoin is that it is not competing at the payment layer and therefore not competing with Paypal, Visa or Venmo. Rather, Bitcoin is competing on an international settlement layer and thus Bitcoin’s true competition is with international settlement systems such as SWIFT. Earlier in this post I highlighted the example of how it is far cheaper, faster and more secure to send $1 billion worth in bitcoin than gold or fiat currency. Nic Carter has a useful analogy that Bitcoin transactions are more akin to shipping containers that can move large amounts of value efficiently rather than individual packages at a store. A $5 cup of coffee probably does not need the same security level as a $100m transaction and thus Bitcoin is currently not a good candidate for smaller transactions. Thus, it currently does not matter if Bitcoin is accepted by your local merchant as that is not what Bitcoin is best used for.

It also remains to be seen if this will always be the case. In the future, Bitcoin could develop into a medium of exchange with layer 2 or layer 3 technology. As the market cap grows and price stability increases, it becomes a more attractive medium of exchange. So, it’s possible that Bitcoin might become a viable medium of exchange in the future. However, it doesn’t need merchant acceptance in order to be a store of value today.

Conclusion

Both gold and Bitcoin are hedges against the fiat system that is rapidly printing money and debasing the currency. Gold bugs and Bitcoiners have much more in common than they have differences. Gold was the soundest on a relative basis for thousands of years. I suspect both will likely perform well over the coming years. However, gold is the analog version of sound money while Bitcoin is the digital version. In time, everything is moving digital, including the primary store of value. This is why, in the long run, most of the wealth that is stored in gold will find its way over to Bitcoin. It is the best safe haven asset and best store of value that currently exists.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS