TLDR

In the wake of a recent 26% dip in bitcoin’s price, Blockforce emphasizes that such pullbacks are historically common and often precede significant gains. Drawing parallels to the March 2020 COVID-19 crash, where bitcoin plummeted but subsequently soared by over 1,200%, the article highlights those current economic conditions, including panic selling in traditional markets and geopolitical tensions, are contributing to the volatility just as they did in March 2020. However, bitcoin’s fundamentals remain strong, with decreasing supply on exchanges, growing adoption, and supportive political sentiment, making this dip a strategic buying opportunity amidst an ongoing bull cycle.

Seizing the Moment: Why Bitcoin’s Recent Dip Signals a Strategic Investing Opportunity

In our March edition of The Node Ahead newsletter, when bitcoin first broke its previous all-time high of $69,210, we highlighted that this moment has historically marked an increase in volatility in the following months. Although the subsequent 12-18 months have typically seen the largest gains, they have also come with numerous double-digit drawdowns. This past Monday, we experienced another one of these pullbacks within a larger upward trend. For newer investors, such moments can be nerve-wracking. However, for those of us who have been investing in the asset class for a decade and seen this pattern play out numerous times, these dips are buying opportunities. Let’s examine why we at Blockforce have so much conviction despite the recent price drop and why we believe it’s a great opportunity to double down.

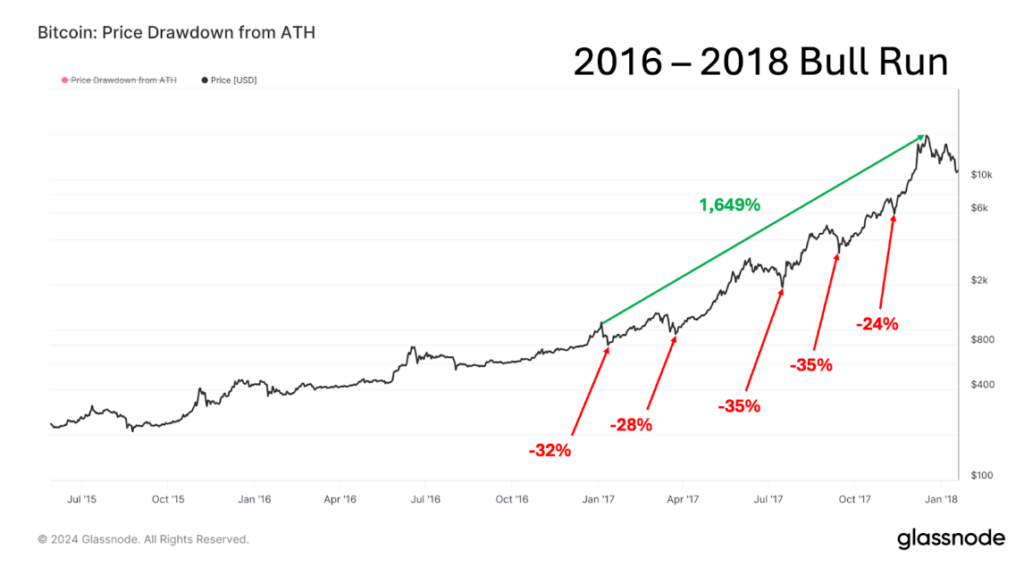

Pullbacks of this magnitude are historically common within a larger upward trend. During the 2016-2018 run-up to $20,000, bitcoin experienced five pullbacks of 24% or greater after breaking new all-time highs. Despite these periods of volatility, bitcoin’s total price appreciation over that period was 1,649%.

Source: Glassnode

Similarly, in the 2020-2022 bull market, Bitcoin had five pullbacks of 24% or greater on its way to a market top of $69,000, resulting in a 570% return over that timeframe.

Source: Glassnode

As we predicted in March, we have seen multiple pullbacks so far this cycle, with Monday being the third 20% or greater pullback of this cycle. Despite Monday’s drop, bitcoin is still up 240% since our article on January 1, 2023, calling the bottom of the cycle. All data points tracked by Blockfroce indicate that we are likely mid-way through this larger bull cycle, suggesting that bigger gains are likely later this year, along with a few more significant pullbacks. It’s worth reiterating that Monday’s drop was well within historical norms and to be expected in this part of the cycle.

Source: Glassnode

In addition to comparing to historical norms, understanding why the drop happened is crucial. If the reasons and data for the pull back invalidate our core thesis, we would need to reexamine our portfolio construction. However, if the data does not invalidate our thesis and the dip in price was caused by other forces, then it’s an opportunity to get aggressive when prices are low.

Several factors likely contributed to the recent pullback in crypto prices. Last week, the government released a weaker-than-expected jobs report just days after Fed Chair Jerome Powell spoke of a still-robust labor market. This contradictory data caused a wave of panic-selling in the stock market over sudden recession concerns, evaporating hopes for a soft landing. This panic spread to Asia, leading to a rapid unwind of the yen carry trade (a strategy aimed at exploiting interest-rate differentials between currencies) as the Nikkei 225 dropped 12.5% on Monday, the sharpest daily drop since Black Monday in 1987. Rising geopolitical risks in the Middle East, a stronger Japanese yen, and rumors of market maker Jump Trading liquidating its crypto business further exacerbated the situation. Consequently, the S&P 500 saw its biggest single day drop since September 2022, the Dow shed more than 1,000 points, the Nasdaq 100 erased almost $1 billion in market value, and the VIX, Wall Street’s Fear Gauge, hit levels only seen during the 2008 Financial Crisis and the 2020 pandemic.

When there is this type of fear in the market, all assets tend to become highly correlated for a short period of time as investors look for liquidity wherever they can find it and thus the broad market sell-off dragged crypto down with it.

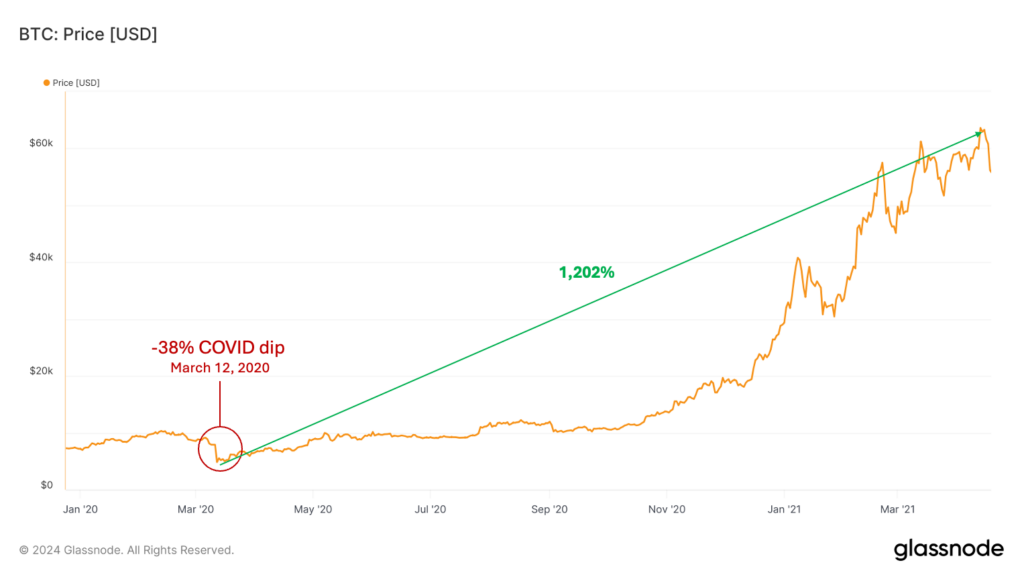

The last time the market melted down like this was on March 12, 2020, when the impacts of COVID-19 were first realized. The Dow Jones Industrial Average had its worst day since 1987, tech stocks were in free fall, and bitcoin crashed 38%. Critics claimed bitcoin had failed its test as a store of value asset (quick hint, it hadn’t).

As governments stepped in to stabilize the economy by cutting interest rates and printing large amounts of money, bitcoin bounced back better and faster than any other asset. A year later, it was up more than 1,200%. In retrospect, March 12, 2020, wasn’t a time to panic—it was the best buying opportunity for bitcoin in a decade.

Source: Glassnode

Nothing fundamental had changed about bitcoin because of COVID-19. There were still only ever going to be 21 million bitcoin. The adoption and usage of bitcoin around the world was still growing. The fixed supply, increasing demand thesis had not changed.

In fact, COVID-19 supercharged the value proposition of a currency with a fixed supply and a predictable supply issuance schedule that can’t be changed. It showed that central banks would bail out the economy at the first sign of trouble, demonstrating the limitations of centralized institutions.

The current situation feels similar to March 2020. The Fed Fund futures markets are already pricing in an aggressive response. A week ago, Federal Reserve Chair Jerome Powell was talking down the need for interest rate cuts this year, with the market assigning just an 11% chance of a 50 bps rate cut by the Fed’s September meeting. Today, the market has increased those odds to a 98% chance, with some even calling for an “emergency rate cut” before the September meeting. The US government debt is structurally guaranteed to grow and the only way to continue financing its operations is to further debase the currency. Financial easing and an increase in global liquidity is likely coming just like it did in 2020.

Recent events do not invalidate any of our core thesis about Bitcoin, Ethereum, Solana, or other crypto networks. These networks continue to process transactions, global adoption continues to grow, and pullbacks like the one we saw on Monday are within historical norms. In fact, the crypto markets have already started to recover, and bitcoin seems to have stabilized around $55k price range. The fact that the recovery was underpinned by exceptionally strong volumes is also encouraging. Bitcoin was created exactly to fix the types of cracks in our current monetary architecture that events like this expose.

The difference this time compared to 2020 is that there is less available supply to be traded (bitcoin held on exchanges is at historic lows relative to price), access is easier than ever with Bitcoin and Ethereum ETFs (potentially leading to greater demand than in 2020), and we have two Presidential candidates (including the current frontrunner) and a sitting U.S. Senator who have publicly expressed the inevitability of bitcoin as a global reserve asset and proposed steps for the U.S. government to accumulate its own stockpile. Microstrategy will not be the last corporate to buy BTC, El Salvador will not be the last nation state to buy BTC, Wisconsin and Michigan will not be the last pension funds to buy BTC.

This setup is incredibly bullish for the rest of the year. Excuse me while I go look under my couch cushion for some spare change.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS