Multi-Strategy Fund Performance

After a strong start to the year in Q1, the Fund saw a significant pullback in April as a combination of macro forces drove prices down across the crypto ecosystem. While bitcoin and Ethereum were down 15 and 17% respectively, the majority of the rest of the crypto market saw drops of 30-50%. These pullbacks are common within a larger bull run and based on the on-chain metrics we track, we expect the market to recover to new highs later this year.

| Multi-Strategy Fund | Bitcoin | |

| April Gross Performance | -26.4% | -14.8% |

Market Commentary

After back to back stellar months, a combination of macro forces resulted in a much more challenging landscape for the crypto ecosystem in April. Worse-than-expected inflation data, GDP growth slowdown, escalating tensions in the Middle East, the U.S. tax filing deadline which often coincides with a crypto selloff as many traders need cash to pay their tax bills, and over $2 billion worth of liquidations in the bitcoin futures market all combined to cause bitcoin’s price to crash down to below $60k (-15%) by the end of the month.

April was also a busy month on the regulatory front as the SEC turned its sights towards DeFI, non-custodial infrastructure and the Ethereum ecosystem. On April 10, the Securities and Exchange Commission (SEC) sent Wells Notices to Uniswap and Consensys. We covered why these actions likely have very little legal merit behind them but they did undoubtedly contribute to the selloff we saw across the crypto ecosystem. Ethereum (-17%), Solana (-37%), Layer 2 Networks (-33%), DeFi (-38%), and more were down significantly in April. Regulatory clarity will ultimately be reached in the long run but the recent actions are causing increased uncertainty in the short term.

Despite the brutal price action this month, there is a lot of historical precedent to remain optimistic for the rest of the year.

First, nothing in the adoption of bitcoin or crypto industry writ large has changed. We can see that the number of on-chain wallet addresses with at least 0.1 bitcoin increased in the month of April which suggests more and more people are acquiring and using bitcoin. Hashrate on the network continues to grow and the number of transactions on-chain is increasing. It was revealed this past month that over 100 institutions, such as BNY Mellon, have purchased bitcoin through an ETF signifying the growing acceptance of bitcoin by TradFi institutions. Morgan Stanley announced they will soon allow its 15,000 brokers to provide bitcoin exposure to their clients and also filed to broaden access to BTC ETFs by expanding it to 12 more funds. Regardless of intra-month price movements, people and institutions around the world continue to find value in bitcoin’s peer-to-peer system which historically bodes well for the long term appreciation of bitcoin’s price.

Second, April marked a historic event for Bitcoin. On April 19th, bitcoin experienced its fourth Halving which reduced bitcoin’s annual inflation rate to 0.85%, making it even scarcer than gold. Historically, bitcoin has traded flat to down in the initial weeks following each of the previous three Halving events but on average, bitcoin has risen 3,224% in the year following the Halving compared to 185% on average in the year preceding it. It takes a few weeks or months to see the supply change impact the market but if history is any indication, over the coming months, we should see bitcoin’s price continue to rise aggressively.

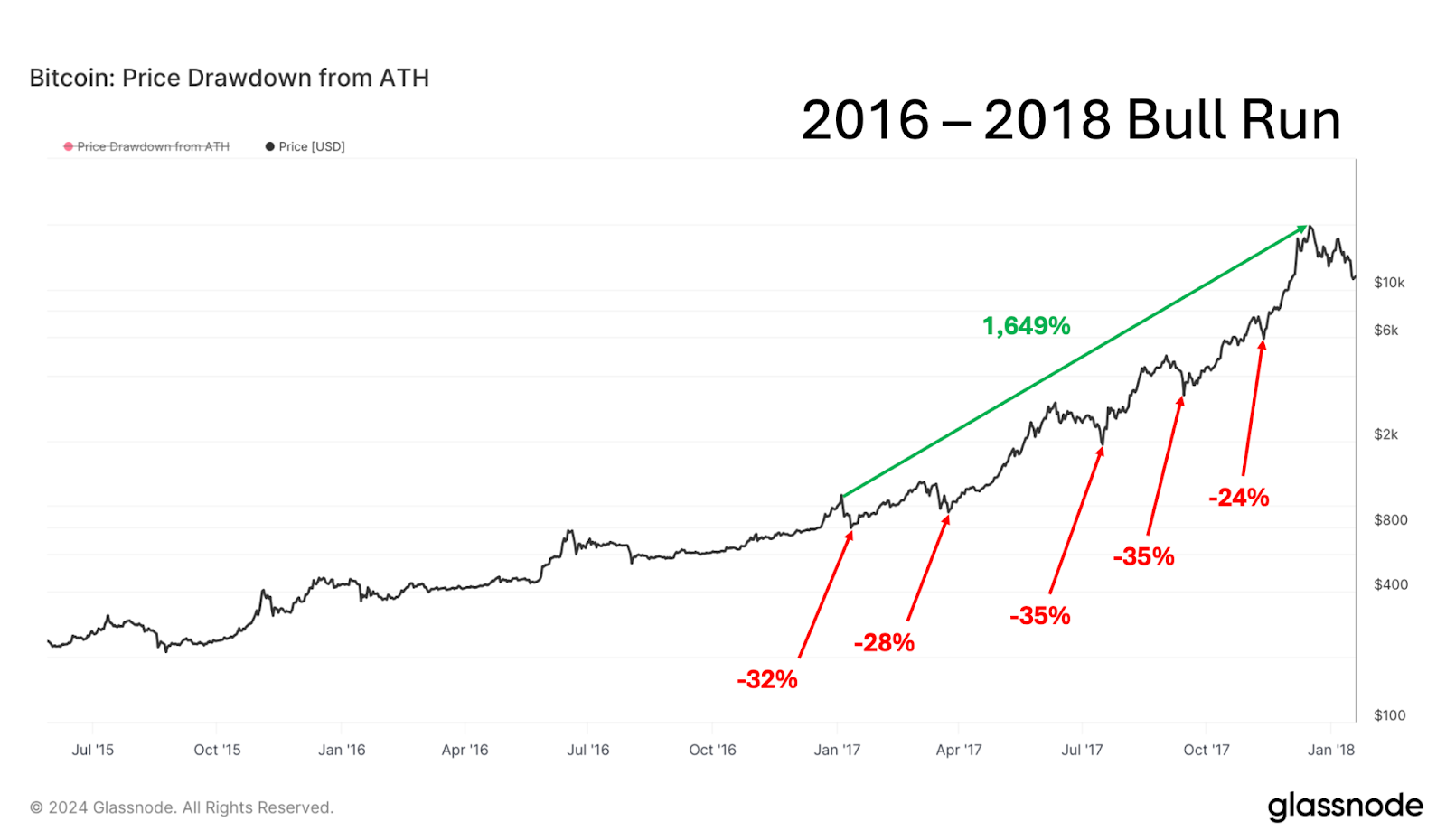

Third, pullbacks of this magnitude are very common within a larger upward trend. In the 2016 – 2018 run up to $20,000, bitcoin experienced 5 pullbacks of 24% or greater after breaking new all time highs. Despite those periods, bitcoin’s total price appreciation over that same period was 1,649%.

In the 2020 – 2022 bull market, bitcoin also had 5 pullbacks of 24% or greater on its way to a market top of $69,000.

April’s pullback is completely within historical norms. If this cycle is anything like previous ones, we should expect multiple 20%+ drops along the way to hundreds of percent gain during this expansion period. In short, patience is often rewarded during this part of the cycle. It’s worth remembering that nothing about the investment thesis has changed. Supply continues to become increasingly scarce and demand, as measured by on-chain metrics and the buying of the ETF, continues to grow. Over the long run, that should result in massive price appreciation for those who stay disciplined and make informed decisions based on data, not emotions.

The Blockforce Team

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS