By Brett Munster

Putting into perspective just how scarce bitcoin is

On April 19th, Bitcoin went through its fourth Halving event. In past issues we have discussed what the Halving is and the price appreciation that has historically followed. But as a quick refresher, bitcoin’s supply issuance schedule is constant and predictable. This is because the protocol adjusts the difficulty of the mining process such that no matter how few, or how many miners are active, a new block is mined every 10 minutes on average (aka the Difficulty Adjustment). Every 210,000 blocks, which equates to roughly a 4-year time period due to the consistency imposed by the Difficulty Adjustment, the amount of newly minted bitcoin issued every block is cut in half. This most recent Halving event reduced the block subsidy from 6.25 BTC to 3.125 BTC per block.

Prior to this Halving event, there was an average of 900 new BTC produced per day which works out to an annual inflation rate of 1.7%. That put bitcoin on par with gold in terms of annual supply growth per year. Since 1995, gold’s average annual inflation rate has been 1.8%. The fact that gold’s inflation is so low and consistent relative to all other commodities is arguably the number one reason why gold has historically been used as money throughout most of human history. And for the past four years, bitcoin and gold had a similar issuance scarcity.

One major difference between bitcoin and gold is that gold has had a steady inflation rate for decades whereas bitcoin’s supply issuance is programmatically designed to decrease over time. On April 19th, the Halving reduced bitcoin’s annual inflation rate down to 0.85%, squarely below that of gold’s. For the first time in history, bitcoin’s issuance is now scarcer than gold.

And if at this point you are thinking to yourself, “isn’t the inflation rate of the dollar 2-3% per year on average?” Not quite. That 2-3% figure is CPI which is a metric for tracking price increase for consumers, not the debasement rate of the dollar. Since 1960, the average annual growth of the dollar supply has been 7% per year. You read that correctly. On average, there are 7% more dollars in circulation every year which I would argue is a much more accurate representation of the real inflation rate compared to CPI which is a flawed and manipulated metric (but that’s a post for another time).

Another way of comparing the supply growth between bitcoin and gold is to look at the Stock to Flow Ratio. The Stock to Flow Ratio is a metric that quantifies the scarcity of a commodity. It compares the current circulating supply of a commodity to the annual flow of new production (aka supply issuance) of that commodity. Commodities that are consumed at a high rate (ie: have low stock) or are easy to produce (ie: have high flow) have a low Stock-to-Flow Ratio. A higher Stock-to-Flow Ratio indicates higher scarcity. In 2023, gold’s stock to flow ratio was 58.3. In other words, gold’s total circulating supply is on pace to double every 58 years.

That is relatively good compared to all other commodities. Silver has a stock to flow ratio of 22 and metals like palladium and platinum have a ratio of around 1, as existing stock is usually equal to or lower than yearly production. In comparison, gold has historically been much scarcer than all other commodities. But not anymore.

With recent halving bitcoin’s stock to flow ratio is 120. Bitcoin is officially now more scarce than gold both in terms of total supply and net new issuance.

A few days after the Halving, I was trying to rock my 3-week-old daughter back to sleep at 2 am and got to thinking about just how scarce bitcoin is. More specifically, how many people will ever own a full bitcoin? If you work through this thought experiment, you come to realize that owning one bitcoin will be extremely rare.

Let’s start with the fact that there will only ever be 21 million bitcoin to ever exist. Even if bitcoin were perfectly distributed only as whole coins, that means the theoretical maximum number of people who could own a full bitcoin is 21 million people. There are currently 8.1 billion people in the world which means the theoretical maximum percentage of the world’s population that could own a full bitcoin is 0.26%.

But we know bitcoin isn’t distributed evenly in this fashion. First of all, although there are 21 million bitcoin in existence, in practice there are less than that actually available. For example, there are a fair number of “lost” bitcoin. These bitcoin, though they still exist, are technically inaccessible due to forgotten passwords, discarded hardware, or other unfortunate circumstances. When someone loses access to their bitcoin, it becomes irretrievable. While it’s impossible to know for certain exactly how many have been “lost”, based on on-chain analytics, there is an estimated 6-8 million bitcoins that are likely to never be retrieved. In addition, there are 1.1 million bitcoin owned by the creator of bitcoin, Satoshi Nakamoto. These coins have never moved and likely never will.

Now back to our thought experiment. If somewhere between 7-9 million bitcoin are inaccessible, that puts the total available supply that is actually available somewhere around 12-14 million bitcoin. That means that the theoretical maximum percentage of the world’s population that could own a full bitcoin really is 0.14% – 0.17%.

But that’s assuming the only owners of bitcoin own a full bitcoin and no bitcoin holder owns more than 1 BTC. In reality, some people own tens, hundreds, or even thousands of bitcoin. Far greater number of people own less than a full bitcoin. In fact, a satoshi is the atomic unit of bitcoin (usually referred to as sats) and each bitcoin is divisible into 100,000,000 sats. We therefore know bitcoin isn’t evenly distributed which means the real percentage of people that will ever own a full bitcoin is significantly less than 0.1% of the world’s population.

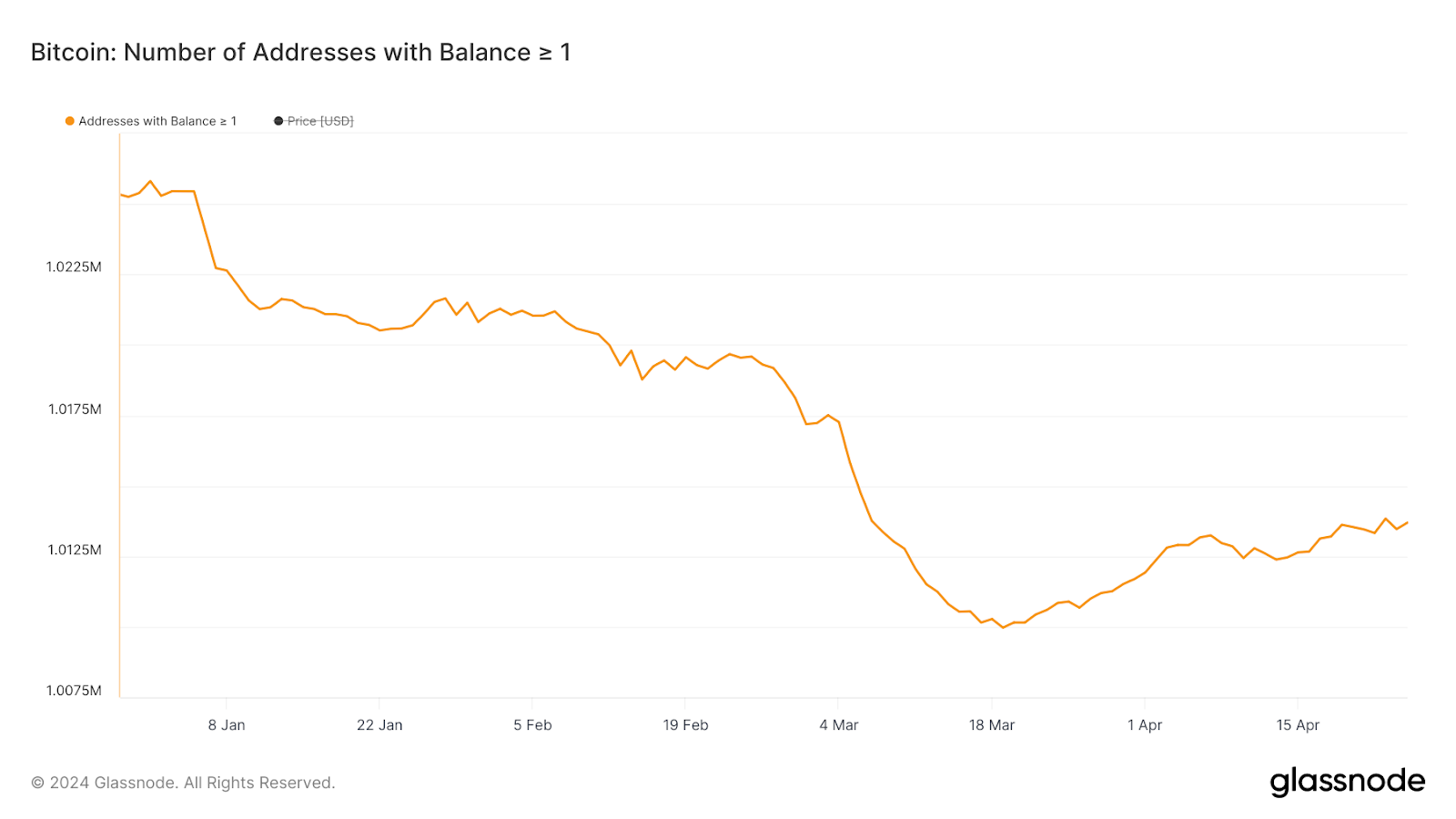

That back of the napkin math highlights how rare it is to own a full bitcoin but we can get more precise than that. Using on-chain analytics, we know there are only 1,013,693 unique addresses holding at least 1 BTC as of writing this article. Quick caveat, addresses aren’t one for one with people who own bitcoin as one person could own multiple addresses, or an address could hold bitcoin for numerous people (an exchange like Coinbase might have an address that holds bitcoin for millions of users). However, it does give us a rough approximation for purposes of this thought experiment which means that today, roughly 0.01% of the world’s population owns a full bitcoin. Even more astonishing is the number of addresses with at least 1 BTC has been falling since the start of the year as bitcoin is becoming more widely distributed so it’s possible that percentage could be even smaller in the future.

To put that number in perspective, there are an estimated 59 million millionaires in the world. That means there are currently 59x more people whose net worth is greater than $1 million than there are people in the world who own at least 1 bitcoin.

Think of it this way. If there are 59 million millionaires in the world and only 21 million bitcoin, that means at most, less than half of all millionaires today will ever own 1 BTC. But as we previously pointed out, due to lost bitcoin and not being evenly distributed, the maximum percentage of today’s millionaires that will ever own at least 1 BTC is closer to 25%. In reality, it is likely to be considerably less than that.

Think about that for a second, less than a quarter of the wealthiest people in the world today will ever own a full bitcoin. Those people you think are rich today, may not be the “rich” ones in the future. In time, being a “wholecoiner” is going to be an extremely exclusive list.

The SEC declares war on DeFI

Uniswap is one of the largest decentralized exchanges (DEXs) in the world and allows users to buy and sell a wide range of cryptoassets without an intermediary. Because the exchange runs purely on smart contracts built on top of the Ethereum blockchain, it can provide users with the same functionality as Coinbase or Binance without a centralized company operating the exchange. Instead of order books, which match bids and asks on a centralized exchange like Coinbase, Uniswap pioneered the Automated Market Maker model in which users deposit tokens to “liquidity pools” and algorithms set market prices based on supply and demand. By supplying tokens to Uniswap liquidity pools, users can earn rewards while enabling peer-to-peer trading in a completely decentralized fashion.

Launched in 2018, Uniswap Labs is a software company headquartered in New York City that built the Uniswap Exchange. The Uniswap Exchange is one of the original, largest and longest running DeFI applications having processed over $2 trillion in volume over the course of its lifetime without any instance of a hack. It is integrated into thousands of applications built by teams around the world and is the most copied open-source smart contract protocol. Any legal ruling, either positive or negative, regarding Uniswap Labs or Uniswap Exchange would have serious ramifications for the entire DeFI industry. Which is why if the SEC decides to bring enforcement action against Uniswap, that decision would not just impact this one protocol, it would be a de facto attack on the entire DeFI space.

On Wednesday April 10, the SEC issued a Wells Notice to Uniswap Labs. As you may remember from our coverage of the Wells Notice the SEC issued to Coinbase back in March 2023, a Wells Notice is simply a formal communication from the SEC that the agency believes there could be a violation of the law. It is not an enforcement action but rather, an opportunity for the target of the investigation to explain why the SEC’s view on the matter is incorrect and why they should not move forward with an enforcement action. It’s like when you were young, and your mom was threatening you in the car that you are going to be in big trouble when you get home but she hasn’t actually grounded you yet. However, the SEC under Gensler has yet to engage in any good faith process so it’s likely the SEC will move forward with enforcement action at some point in the future just like they did with Coinbase.

When will that enforcement action actually be issued? I have no idea. But if and when it does, Uniswap’s founder has already announced they are ready to fight back.

And Uniswap Labs should fight back because the law is on their side. If the SEC were to bring enforcement action and this case were to go to court, the SEC would be on very shaky legal grounds and would likely have an extraordinarily hard time winning this case.

Based on public statements from Uniswap’s founder as well as their head legal counsel, the SEC is considering bringing three distinct charges against Uniswap Labs. In no particular order the SEC believes that Uniswap’s wallet is a broker, the UNI token is an unregistered security, and the Uniswap protocol is an unregistered securities exchange. Let’s examine each of these claims.

1. The Uniswap wallet is a broker and therefore Uniswap Labs is guilty of operating without a broker’s license.

The problem with this rationale is that the SEC has already lost this argument in court. The SEC made the same claim against Coinbase’s wallet in its lawsuit against the company and Judge Failla found this claim to be so ludicrous that she dismissed it outright before it even went to discovery. And for good reason.

A crypto wallet is nothing more than a piece of software code that allows users to store cryptoassets, send and receive cryptoassets and discover prices of various cryptoassets on decentralized exchanges. The user of that wallet can then decide for themselves if they want to execute a transaction. At no point is the wallet or Uniswap Labs managing customer funds because the wallet is non-custodial. At no point is the wallet making decisions on behalf of users whether or not to execute transactions. Uniswap Labs has no decision authority over the funds in the wallet. Thus, by the very definition, the wallet cannot be a broker. Coinbase’s wallet was ruled not a broker, and neither is Uniswap’s.

2. Uniswap’s native token UNI is a security and therefore Uniswap Labs is guilty of issuing an unregistered security.

In order for an asset to be a security, by law there has to be an investment contract. Here is the thing, Uniswap never sold the token to any investor. Uniswap Labs originally distributed the UNI token via an airdrop to its users after the protocol had already been operating for some time. Those users who received that initial distribution did so for free. While the UNI token is traded on exchanges such as Coinbase, Binance, Uniswap and others, there was never anyone who ever purchased any UNI tokens from Uniswap Labs.

If no one purchased any UNI tokens from Uniswap Labs, then no one ever entrusted their money with Uniswap Labs on the promise of post distribution efforts to increase the value of the token. Thus, by definition, there is no investment contract. And if there is no investment contract, the law states that UNI can’t be considered a security.

No investment of money = no investment contract = not a security. Plain and simple.

3. Uniswap Labs is guilty of operating an unregistered securities exchange.

The Uniswap Exchange is a fully decentralized service which means Uniswap Labs DOES NOT operate the Uniswap Exchange.

Uniswap Labs built the code, released it, and due to the power of self-executing smart contracts built on top of a blockchain that validates transactions in a peer-to-peer manner, the exchange now just runs on its own indefinitely. If the entire Uniswap Labs team died in a plane crash tomorrow, the Uniswap Exchange would continue to operate uninterrupted forever.

That’s the power of an immutable smart contract protocol that continues to operate exactly as designed indefinitely with no active management by the team that built it. The exchange is purely peer to peer with the pools being funded by users, not Uniswap Labs. I will say it again; Uniswap Labs is NOT the operator of the protocol. And if you aren’t the operator, you can’t be guilty of operating an unregistered securities exchange regardless if there are unregistered securities being traded on it or not.

Is this Wells Notice and potential enforcement action a giant waste of taxpayer dollars? Absolutely. Is it yet another example of a gross overreach of power by the SEC? Yes. Does it encourage entrepreneurs to leave the U.S. and build their companies in more friendly jurisdictions? Definitely, and if you talk to any VC in the crypto industry this is already happening at an alarming rate. Does this continued antagonistic approach by the SEC risk the U.S.’s position as the global technology leader and hurt the U.S. economy? It’s very possible that it could. Does this do anything to protect U.S. consumers? No and in fact, potentially harms consumers who may be forced to use products built outside of the U.S. (FTX, cough cough). But unfortunately, that has been the SEC’s approach under Gary Gensler.

That’s the bad news should the SEC decide to pursue this enforcement action against Uniswap Labs. It will take time to sort out and cost tens, if not hundreds, of millions of dollars to do so. The good news however is the law is on Uniswap’s side and the courts have routinely struck down the SEC’s bogus legal claims in court.

In Other News

Blockchain Association and crypto activist group sue the SEC over “Dealer Rule.”

The DeFi Education Fund and Texas apparel company Beba are suing the SEC over APA violations.

BlackRock’s spot bitcoin ETF reached 70 consecutive days of net inflows, ranking it among the top ETFs.

Two SEC lawyers were forced to resign after “gross abuse of power” in the Debt Box case.

Hong Kong Bitcoin and Ether ETFs officially approved to start trading on April 30.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS