Myth: Bitcoin is bad for the environment

Truth: While it’s true bitcoin does use a lot of electricity to power and secure the network, the source of the power generation is what determines the impact on the environment, not the total amount of electricity consumed. Bitcoin miners are increasingly using clean and renewable energy sources and leveraging unused energy that would be generated regardless. Thus, in many instances, bitcoin mining does not add any additional environmental impact that wouldn’t occur anyways. There are even instances, such as redirecting methane gas flaring, where bitcoin mining is a net positive for the environment. Because miners are economically incentivized to find the lowest cost energy, which is often excess or renewable energy sources, many believe that bitcoin will be a catalyst for increasing adoption of clean energy.

——————————

It is true that Bitcoin does consume a large amount of electricity to power the network. This makes for great headlines such as “Bitcoin uses more electricity than Argentina” or “Bitcoin will increase global warming.” However, superficial headlines like these do not provide the proper context nor are they based on a fundamental understanding of how Bitcoin’s technology actually works. If we are to have a productive discourse on Bitcoin’s true environmental impact and whether or not it’s worth the tradeoff, it’s imperative that we understand what causes energy consumption to increase, where this power comes from, what we get in exchange for this power consumption, and how Bitcoin’s energy consumption compares to other systems.

How does computing power scale on Bitcoin’s network?

There have been a number of articles written that spell doom and gloom based on Bitcoin’s projected environmental impact. While these articles make for catchy headlines, they tend to misrepresent what drives the increase in computing power on the network.

For example, a common critique is to take Bitcoin’s current energy use and extrapolate the CO2 emissions should it reach the size of Visa or Mastercard’s payment network. The argument uses the following line of logic. Measure the amount of energy consumed by the Bitcoin network today and divide by the number of transactions Bitcoin settles per day (~300,000) to arrive at a “per transaction energy cost.” Next, extrapolate that figure to account for all of the world’s daily transactions on the Visa or Mastercard network. When you do this, the result is an eye-popping amount of electricity consumption.

However, there is a giant flaw to this line of reasoning – energy consumption is not based individual transactions.

Let’s start with the simple fact that Bitcoin’s base layer isn’t capable, nor ever will be capable, of handling anywhere close to that many transactions. Today, Bitcoin is much more suited to become a final settlement layer akin to SWFIT or ACH, not Visa and Mastercard. Should Bitcoin ever become a medium of exchange, it will have to leverage solutions built on top of the Bitcoin blockchain. These layer 2 and layer 3 networks would have to be, by necessity, far more energy efficient than Bitcoin’s base layer blockchain in order to process that volume of transactions. Thus, the extrapolation of Bitcoin’s per transaction cost isn’t applicable because the payment layer, where the vast majority of transactions would occur, would use a fraction of the energy as Bitcoin’s base layer.

Second, metrics like the “per transaction energy cost” are misleading because transactions themselves do not cost energy, nor does Bitcoin’s CO2 footprint scale with transaction count.

To be clear, having the network accept a transaction costs it virtually no energy. What takes energy is the computational power to “mine” blocks which are a collection of transactions. Regardless of whether a block has very few transactions in it or is full of transactions, the power intensity required to mine that block is the same at that moment in time. Thus, in theory, the number of transactions validated could increase or decrease without the computing power of the network ever changing and vice versa. There is simply no relationship between number of transactions and computing power.

So why does computing power of the network keep increasing? Well, because when the price of Bitcoin goes up it makes mining more profitable. As mining gets more profitable, more operations enter the market and the computational power (and security) of the network increases. Eventually, an equilibrium is found in which only the miners with the most cost-effective power sources (most often the miners with unused energies or renewable energies) are left. Bitcoin’s price and the availability of cheap power drive the amount of computational power on the network, not the number of transactions.

If that’s the case, wouldn’t Bitcoin’s computational power just increase forever as long as BTC’s price continues to appreciate? Not quite. Today, the vast majority of revenue earned by miners (greater than 80%) comes from the Bitcoin they are rewarded for supplying computational power to the network. However, Bitcoin’s supply issuance gets cut in half every four years thus naturally decreasing the amount of mining revenue.

“…the issuance component of miner revenue is structurally decaying over time. Unless you believe that the price of bitcoin is going to literally double in real terms every four years until 2140, that expenditure (and hence energy usage) is going to decline.”

- Nic Carter, Coindesk Article

Thus, over time, transaction fees will have to grow to account for a much larger portion of miner revenue. Keep in mind that as of writing this (Q3 2021), we’ve already mined 18.7 million of the 21 million Bitcoin that there will ever be. As miners become more reliant on fees over time, there will be a limit to how much they are willing to invest in new computing power as there is a limit to how much in fees users will be willing to pay. If fees become too high, users will look to other blockchains or solutions built on top of those blockchains. Thus, there is a natural limit to how much power will ultimately be consumed by the Bitcoin network.

Unfortunately, this misunderstanding of how blockchain technology works has led publications such as this often cited paper claiming Bitcoin could increase global warming by 2 degrees despite the fact that no less than three separate academic articles have debunked this paper (here, here, and here).

And there is historical precedent for predictions like these to miss the mark. During the height of the dot-com boom in 1999, a Forbes article was published that claimed that it was “reasonable to project that half of the electric grid will be powering the digital-Internet economy within the next decade.” The piece accused the internet and hardware companies of “burning up an awful lot of fossil fuels” and setting the world on a dangerous trajectory of energy usage.

Turns out those projections too were based on inaccurate assumptions and a misunderstanding of how technology works. It’s no surprise that a decade later these projections proved to be off by orders of magnitude.

Don’t get me wrong, the Bitcoin Blockchain will still be by far the largest computing network on the planet and will require a lot of computational power, but nowhere near the amount some journalists have reported it would grow to.

Where does the energy comes from?

Not all methods power generation have the same impact on the environment. A common mistake many people make is to assume that all of Bitcoin’s energy consumption has equivalent CO2 emissions without taking into account the type of energy source being used to generate electricity. For example, one unit of hydro energy will have much less environmental impact than the same unit of coal-powered energy.

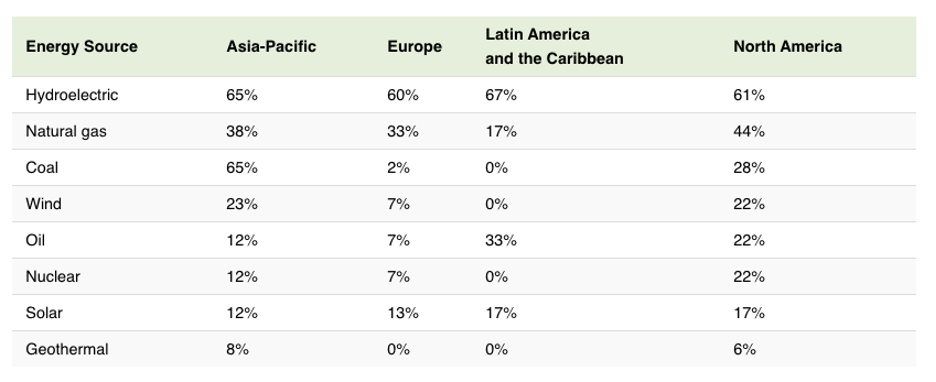

In a 2020 report by the University of Cambridge, researchers found that 76% of crypto miners rely on some degree of renewable energy to power their operations. Another report in 2019 suggested that 73% of Bitcoin’s energy consumption was carbon neutral, largely due to the abundance of hydro power in major mining hubs such as Southwest China and Scandinavia. In fact, hydroelectric energy is the most commonly used energy source globally, and it gets used by at least 60% of crypto miners across all four regions. Here is a breakdown of the types of power sources various crypto miners use by the percent surveyed who use that power source (note that miners often use multiple sources).

This brings us to another false claim made by several critics, that Bitcoin “hogs” the energy in the grid. The truth is Bitcoin mining is best suited to take advantage exactly where there is excess energy that would otherwise go to waste. Let’s take a look at China given that most of the critics point to the Chinese grid as being the most carbon dependent. Turns out all three of the provinces that contain the majority of the Bitcoin hashpwer are located in areas that are sparsely populated (collectively, only 12.7% of the population of China lives in them), thus much of their energy production would otherwise never be used. It’s no surprise that the majority of Bitcoin mining operations in China have sprung forth within these provinces. The fact is most of China’s energy consumption from mining Bitcoin is not depriving anyone of energy. There are simply regions in which energy is wildly overabundant and Bitcoin miners are incentivized to find locations that have excess, unused energy.

One reason energy is overabundant in certain areas is because electricity does not travel efficiently over long distances. In fact, over 8% of the worlds electric power is lost in transmission. To put that in context, the amount of electricity lost in transmission and distribution is 19.4x more than the annual power consumption of the entire Bitcoin network. However, with Bitcoin, we can store that energy in a valuable asset and transport it much more efficiently thus helping to smooth out global energy markets.

In fact, there is precedent for doing exactly this in other industries. Both Nick Grossman of Union Square Ventures and Nic Carter of Castle Island Ventures have pointed out that aluminum has served this purpose in the past. “A huge fraction of aluminum’s embodied cost is the cost of electricity involved in smelting bauxite ore. Because Iceland boasts cheap and abundant energy, in particular in the form of hydro and geothermal, smelting bauxite was a natural move. The ore was shipped from Australia or China, smelted in Iceland and shipped back to places like China for construction.” Assets such as aluminum produced in Iceland, can be moved, transferred and transformed much more efficiently than electricity can thus converting stranded renewable energy into value. Icelandic economists even touted the fact that Iceland “export[s] energy in the form of aluminum.”

Bitcoin does the same thing. It takes excess energy, converts it to value in the form of a cryptoasset, and allows that value to be moved throughout the world much more efficiently.

It turns out that there’s a tremendous amount of excess energy available throughout the world. This includes both excess capacity from on-grid energy and energy generated off-grid that never makes it to the grid in the first place. A growing trend is to leverage excess natural gas from oil fields to power Bitcoin mining operations. Rather than venting or flaring the excess gas, the oil field operators are using that excess capacity to convert to electricity and power Bitcoin mining servers. Methane is about 25x worse than CO2 and flaring doesn’t always burn it all off (especially on windy days). However, when these energy companies instead funnel this methane to a generator and use it to power Bitcoin mining rigs, they can eliminate the risk of methane making it into the atmosphere and thereby reducing the emissions. Not only are they putting to use gas that would otherwise go to waste, it’s actually a net positive for the environment and more environmentally ethical for oil companies. Furthermore, because these operations tend to be based in areas where there are sparse populations this is energy that would have never made it to the grid anyways. Thus, it does not compete with energy needed by households or businesses.

What do you get in exchange for this power?

Part of what makes Bitcoin so attractive is the security and reliability of the protocol. Bitcoin’s security comes from its consensus algorithm called “proof-of-work.”

The simplified explanation of proof-of-work is that Bitcoin miners compete to solve computationally difficult mathematical equations that lead to the creation of a new block. In exchange, miners are rewarded with newly issued Bitcoin every time a new block is “mined.” Thus, miners are incentivized to grow the amount of computational power they contribute to the network because increasing the amount of computational power increases the odds that a miner will be rewarded Bitcoin. Since this process consumes energy, which has a real-world cost in the form of computers and electricity, the Bitcoin blockchain makes it extremely difficult and cost prohibitive for an attacker to overwhelm the network.

As we can see, the energy used in securing the Bitcoin blockchain is not “wasted,” as it is sometimes described in the media. It makes counterfeiting and record tampering prohibitively costly and impractical. Once you understand the rationale for why proof-of-work was designed the way it was, it becomes clear that Bitcoin’s energy consumption is a security feature, not a bug of the system.

Bitcoin is the greatest store of value asset and international settlement system in existence today. The network is fully decentralized, censorship resistant and non-sovereign. Bitcoin has properties no other asset has and many of those properties are becoming increasingly valuable in today’s world. The power that goes into operating that system ensures the security, stability and reliability of the network.

How does Bitcoin compare to other systems?

Depending on the report you read (here or here), the Bitcoin network uses roughly 110 – 150 terawatts hours (TWh) per year. On the surface that sounds like a lot of energy and honestly, it is. However, it’s helpful to put this energy use in context.

Since Bitcoin is most often compared to gold, let’s start there. A recent study from Galaxy Digital estimates that mining gold consumes 240 TWh per year. The report arrived at this figure by converting estimated greenhouse gas emissions from the gold industry and converting it to a TWh figure using a converter provided by the International Energy Agency. A different study using a different methodology estimated that gold mining accounts for 132 TWh per year. Thus, mining gold takes somewhere between the same amount of energy as Bitcoin to as much as 2x the amount of energy and that’s not taking into account the energy consumed to transport gold once its mined.

However, where Bitcoin is digital and therefore its environmental impact stops at its energy consumption, mining gold has additional negative impacts on the environment. In addition to the energy used to mine gold, modern industrial gold mining destroys landscapes and creates huge quantities of toxic waste.

Let’s do another comparison, this time to the legacy financial system. That same Galaxy Digital report estimates that banking industry, which consists of banking data centers, bank branches, ATMs, and card networks, uses approximately 263 TWh of energy each year. That’s roughly double the amount of energy the Bitcoin network consumes.

Turns out we can find numerous use cases that consume more electricity on an annual basis than Bitcoin. The global consumption of YouTube videos accounts for 243 TWh per year. The amount of electricity consumed every year by always-on but inactive home devices in the USA is nearly 214 TWh per year. Clothes dryers in the US use roughly 93TWh per year and that’s not even accounting for the rest of the world.

It’s pretty disingenuous to criticize Bitcoin’s energy consumption without applying the same level of criticism towards the energy consumption of other systems. When compared side by side, Bitcoin’s total energy consumption doesn’t look nearly as harmful as the legacy financial infrastructure. It’s just that Bitcoin is easier to measure and much more transparent about its energy consumption which makes it easy for critics and journalists to attack.

BTC may actually be a driver of renewable energy

The dominant narrative today is that due to Bitcoin’s level of energy consumption, it’s therefore bad for the environment. However, as this piece hopefully illustrates, that’s not exactly true. In fact, in time I believe the sentiment will shift as crypto mining proves to be a driving force in the energy transition from fossil fuels to clean energy.

The fact of the matter is Bitcoin miners are constantly seeking the lowest marginal cost of electricity, because the Bitcoin mining industry is highly competitive. The cost of electricity is the single largest input in the business model thus in order to attain the highest levels of profitability, Bitcoin miners are constantly searching for cheap power. That usually results in the miners consuming unused and renewable power, which is historically the lowest cost power available. Flared gas in North Dakota and Texas is used to power Bitcoin mining rigs, helping to reduce methane emissions. In China, where the wet season generates an oversupply of hydroelectric power, surplus energy is converted into a Bitcoin. Adding Bitcoin mining to natural gas and renewable energy operations makes them more profitable thus making the transition away from fossil fuels easier and faster.

Bitcoin is actually driving innovation in renewable and surplus energy as miners look to hydroelectric, geo-thermal , and excess natural gas. Case in point is Greenidge’s Bitcoin mining operation in New York, which is a converted coal plant that now runs on natural gas and is expected to be carbon-neutral by June 1st of this year.

A recent whitepaper put forth by Square and ARK Invest argues that Bitcoin mining presents an opportunity to accelerate the global energy transition to renewables by serving as a complementary technology for clean energy production and storage. “Solar and wind are now the least expensive energy sources in the world but are hitting deployment bottlenecks primarily because of their intermittent power supply and grid congestion. Bitcoin miners as a flexible load option could potentially help solve much of these intermittency and congestion problems, allowing grids to deploy substantially more renewable energy. By deploying more solar and wind, these generation technologies will likely fall even further down their respective cost curves, bringing them closer to zero marginal cost energy production.”

Conclusion

Hopefully, this article has shown that although Bitcoin does use a lot of energy it’s still less than legacy systems. The energy it does consume is increasingly coming from clean sources and its precisely this energy that provides security to the network. Bitcoin incentivizes miners to gravitate towards cheaper energy sources thus spurring adoption and innovation within the renewable energy sector. Much of the doom and gloom projections about Bitcoin’s usage are based on a misunderstanding of how the technology works.

That being said, Bitcoin does have some level of impact on the climate. However, at the end of the day, we must decide whether the benefits of having a digital asset based on sound money principles that is also non-sovereign and censorship resistant is worth the environmental impact it does have. In order to make that decision, it’s imperative we understand the true impact it has, how we can lower that impact moving forward, and how those tradeoffs compare to the tradeoffs we make every day using the legacy system. I think Nic Carter summed it up best. “If you believe that Bitcoin offers no utility beyond serving as a ponzi scheme or a device for money laundering, then it would only be logical to conclude that consuming any amount of energy is wasteful. If you are one of the tens of millions of individuals worldwide using it as a tool to escape monetary repression, inflation, or capital controls, you most likely think that the energy is extremely well spent. Whether you feel Bitcoin has a valid claim on society’s resources boils down to how much value you think Bitcoin creates for society.”

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS