By Brett Munster

Historically, bitcoin and the rest of the crypto market has followed a pattern of extreme growth over a period of a couple years followed by an inevitable crash as price gets ahead of fundamental adoption metrics. That crash culminates in a new floor price which has historically always been substantially higher than the bottom of the previous cycle. In other words, bitcoin has made higher lows every subsequent cycle. That period of consolidation at new floor prices sets the foundation for the next period of extreme growth. In January, we published an article arguing that the on-chain data indicated that November 2022 was the bottom of this cycle and thus far that thesis has proven correct. Assuming the thesis continues to hold true, we are likely only 6 months into a multi-year growth period for the crypto markets. However, there is an important dynamic that makes this upcoming cycle structurally different from every previous bull market in crypto’s history.

Source: Glassnode

For the first eleven years of bitcoin’s existence, the number of available coins to be traded on exchanges steadily increased. This makes sense as the number of new coins released per block was the largest early in bitcoin’s lifecycle. Miners, needing to pay for operations and equipment would sell those coins on the open market thus distributing the coins to other participants. Many early adopters of bitcoin ended up selling some or all of their positions, having made a substantial economic profit, which further increased the number of bitcoin in circulation through bitcoin’s first few cycles.

However, that trend saw a stark reversal beginning in March 2020. It’s worth pointing out that this reversal coincided with the COIVID relief stimulus which saw record levels of money printing from the U.S. government. The data shows that starting in March 2020, more and more people began taking their bitcoin off exchanges and storing them offline. This very well could just be a coincidence (correlation does not imply causation) but it is possible that bitcoin’s narrative as a hedge against fiat monetary debasement really began to take hold at this time.

Source: Glassnode

That trend, which started in March 2020, was accelerated in 2022 with the collapse of crypto lending companies and FTX. Rather than keeping their bitcoin on exchanges, more and more bitcoin owners have turned to cold storage custody solutions. Coins stored offline can’t be traded until those coins are transferred back to the exchange. This is one reason why the number of available bitcoin that is available to be traded has been steadily falling. As of writing this, only 11.9% of all bitcoin in existence are currently available to be bought and sold on the open market.

This phenomenon is a very different dynamic than previous bull markets. During the large run ups of 2010, 2013, and 2017, the supply on exchanges was increasing. Even during the last big bull market of 2021, the reversal was still very new and the number of bitcoin held on exchanges was still near all-time highs. Today is a very different dynamic. We are currently at levels not seen since 2018. The difference is it was growing back then whereas today its falling. The next few years will be the first full bull market in which this supply decrease is noticeably prevalent.

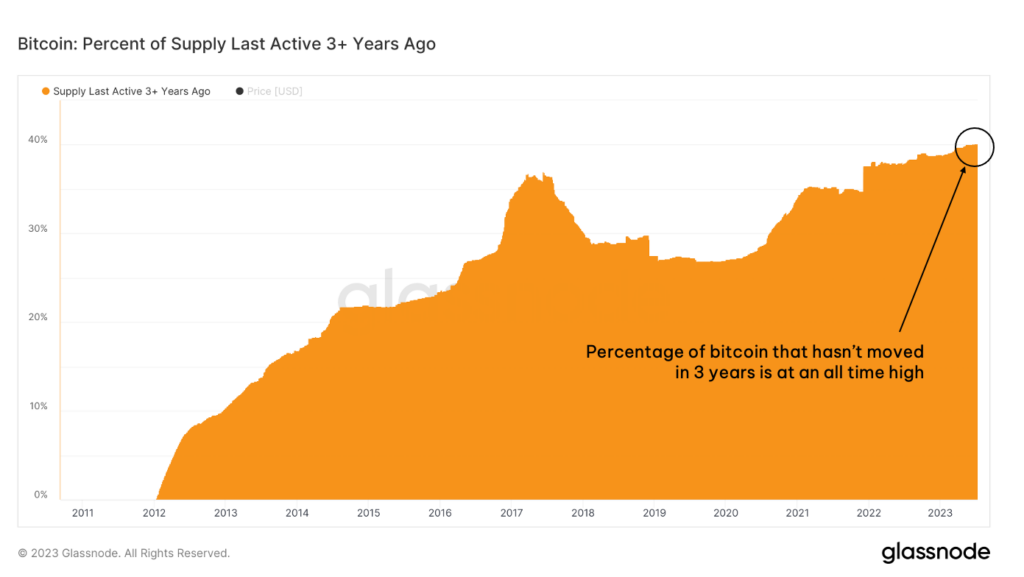

There are three good reasons to believe this trend of dwindling supply of tradeable bitcoin will continue. First, the long-term conviction in this asset class is growing, which is leading to more long-term holders of bitcoin. As of writing this, 69% of all bitcoin currently in existence has not moved in over a year. Think about that for a second. Bitcoin’s price fell by as much as 76% off the all-time-high set in November 2021. Since May of last year, the industry has experienced multiple multi-billion-dollar collapses, numerous bankruptcies, and outright fraud in the case of FTX and Three Arrows Capital. The result has been wide-scale, massive deleveraging in the system and significant credit contraction. And yet, nearly 70% of all bitcoin in existence just held steady through it all. In fact, the percentage has been continually setting new all-time highs throughout 2022 and 2023 with no sign of it slowing down.

Source: Glassnode

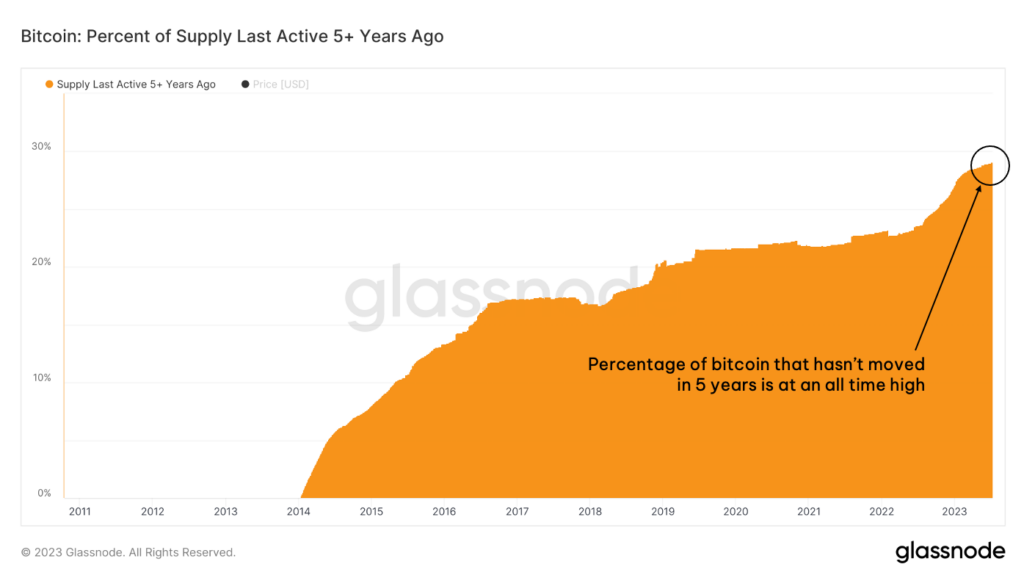

The same phenomenon can be seen in longer hold durations as well. The number of bitcoin that hasn’t moved in over 3 years (40%) and in over 5 years (29%) are also at all-time highs.

Source: Glassnode

The bottom line is an increasing number of market participants are taking a longer-term outlook with this asset class and in doing so, simply aren’t selling their bitcoin regardless of volatility. Having held through all the turmoil of the last two years, it’s unlikely these holders will change their behavior now. Hence, it’s reasonable to assume that we are unlikely to see a large influx of supply coming out of cold storage in the near future.

The second reason supply is likely to continue to decrease has to do with miners. In July of last year we highlighted the stress bitcoin miners were under due to the confluence of increased hash power on the network, lower bitcoin prices, and rising energy costs. As a result of the economic stress, most mining operations were forced to sell a significant portion of their bitcoin holdings (if not all) to help cover ongoing operational expenses. At the time, BTC was around $20,000 which was a crucial threshold for many miners operating in the space. Today, BTC is trading around $30,000 and while many bitcoin miners aren’t fully out of the woods yet, they also aren’t nearly in as dire of a position as they were a year ago.

Should bitcoin’s price continue to appreciate, miners will become more profitable and will need to sell fewer of the bitcoin they earn to meet their expenditures. Whereas many miners were recently forced to sell close to all (if not 100%) of their block rewards, should bitcoin hit $50,000, they are likely to sell only 20-30% of that inventory. As price increases, less and less new supply gets released onto exchanges from miners, adding more tailwinds to this trend.

Lastly, there is the upcoming Halving. Every 210,000 blocks (which equates to roughly every 4 years) the supply of new bitcoin issued per block gets cut in half. In other words, after the next Halving, there will be 50% fewer new bitcoin issued every day than there currently is. The next Halving will occur in April of 2024, roughly 9 months from the time this paper is authored. The Halving is likely to further contribute to less supply being available for trade.

The fact is, we are currently sitting on the lowest supply of available bitcoin to buy in over five years and it’s continuing to decrease. The holding behavior of market participants, miners selling less bitcoin as price rises, and the Halving will all further intensify this trend over the next year. In stark contrast to every prior bull market in which supply was increasing, this upcoming cycle may take place with one of the largest supply squeezes in bitcoin’s history.

While a supply squeeze can positively impact the price of bitcoin, the sustainability of the next market cycle still depends on the influx of new demand entering the market. In our year-end review, we highlighted numerous data points showing how bitcoin adoption grew among citizens, financial firms, corporations, and even governments across the globe in 2022 despite the significant drop in price. It was one reason we argued that when bitcoin fell below $20,000 it represented one of the best risk-adjusted opportunities to buy in bitcoin’s history. Then last month, we got news that may prove to be one of the biggest demand drivers in bitcoin’s history.

On June 15th, Blackrock filed an application for a spot bitcoin ETF. There have been over 40 spot bitcoin ETF applications filed since 2017, all of which have been denied by the SEC. However, the success of spot ETFs in other jurisdictions, the Grayscale lawsuit against the SEC, and mounting political pressure on the SEC might be signaling a change in the landscape. It’s also worth noting that this is Blackrock’s first attempt at a bitcoin ETF and Blackrock carries far more weight than any previous applicant. Blackrock is the largest ETF manager in the world and the firm has a 575-1 record when it comes to ETF approvals. Even that one denial they later got approved so history would suggest that the odds they receive approval here are strong. Furthermore, this is the first spot bitcoin ETF application with a surveillance sharing agreement which mitigates a lot of the SEC’s concerns with previous applications. Thus, many believe the probability that a spot bitcoin ETF will be approved in the near future is fairly high.

If that were to happen, that would likely open up a wave of new capital into the asset class. Larry Fink, CEO of Blackrock and one of the most influential and authoritative figures in TradFi, went on TV claiming that bitcoin could “revolutionize finance”, that it is a hedge against monetary debasement, that it is fit for retirement accounts, and that holding BTC is prudent. JP Morgan called a bitcoin ETF the “holy grail for owners and investors” because it would provide easier access to bitcoin (especially through brokerage accounts), increase liquidity in the market, and come with greater protection such as insurance via SIPC. It’s why gold prices saw a huge surge after the launch of SPDR Gold Shares.

The amount of capital that could potentially flow into bitcoin once an ETF is approved is staggering. Blackrock alone manages over $9 trillion dollars. Just for context, that is 15x the size of bitcoin’s total market cap today. Now of course not all, not even a majority, of that $9 trillion will flow into bitcoin. But even if a small percentage does, it could substantially impact the price. And it’s also not just Blackrock we are talking about either.

Days after Blackrock filed, Fidelity, WisdomTree, Invesco and Valkyrie also filed for spot Bitcoin ETFs. Ark Invest already had an application pending which they have revised to include the surveillance sharing agreement like Blackrock. Many of the largest financial institutions in the US are actively working to provide access to Bitcoin. Just looking at the firms with recent announcements, they collectively manage over $27 trillion.

Blackrock’s ETF hasn’t even been approved yet, but just its public foray into digital assets has already fueled a resurgence in digital assets interest. Shortly after their announcement, crypto investment products saw the largest week of inflows in over a year. That trend of new capital coming into the market continued for several weeks. To put the potential of this ETF into context, Grayscales Bitcoin Fund (GBTC) is the largest in the world and at its peak had $44 billion in assets under management. So even if 0.5% of the world’s investable assets went into an ETF holding bitcoin, that would be the equivalent of adding more than 10 more GBTCs to the market.

Over the next 12-24 months, we potentially have a scenario in which more money comes into the space than any time in bitcoin’s history precisely at a time when available supply is aggressively shrinking. Bitcoin has seen explosive growth in previous cycles, but it’s never had this dynamic.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

BACK TO INSIGHTS